With all apologies, this must be brief. I am running late.

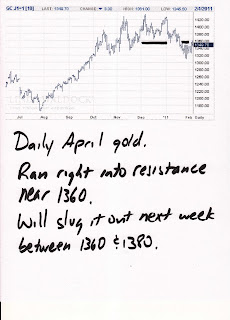

Mrs. Ferguson has granted The Turd a "hall pass" so I am headed off to Vegas for Super Bowl weekend. I will have my Macbook with me just in case I need to update but this will, most likely, be your open thread through the weekend. I'll check in after the game to comment on the Asian opening for Monday. Before I go, here are some charts that plainly show our targets for next week. First, gold:

Unless something dramatic happens in the Middle East, we will likely slug along for the next week or two as we battle it out with fierce resistance between 1360 and 1380. Once those are behind us, however, its straight to 1400 and beyond there, the old highs of 1430+.

Now, here's silver in both daily and weekly form:

You can clearly see the significance of $29.50 on both of these charts. Once that falls, its back through $30 and then the old highs of $31+.

I promised you volatility this week and you got it! Next week will still be crazy but it shouldn't be quite as dramatic. We have rebounded and Turd's Bottom is firm (for an older guy :)

If any of you find yourself in the Vegas area this weekend, look for me at Mandalay Bay. I'll be the guy at the craps table wearing the big, yellow hat!

Turd out.

Have a good one Turd. Look out for the sharks in the bay!

ReplyDeleteSilver looking good here. Physical buyers not going away...I will be releasing a short list of juniors on Sunday as well with commentary on some, and Part 4 of silver manipulation series might debut next week, as the insider info keeps rolling in . Enjoy the weekend Turd, should be a good time there....Blythe has left the office by the way

ReplyDeletePlease put 20 rapidly depreciating dollars on the team with Gold in their uniforms for me. Thanks.

ReplyDeleteIt's like the wynter_bent play over at jpig morgue yahoo board!! They hold out for fiat/FRN premiums paid at 30-40% profits to not take delivery!! Wash! Rinse and repeat the easy money take no silver delivery cycle each delivery month as in this instance March!! So with 30-40% paper fiat frn profits; they then buy physical silver with some of those profits and jump right back in to placing a crimex silver futures paper contract! There using bankster fraudster funny money profits, in being bankster bought off, to not take delivery! Using that free and clear profit to run easy money paper profit banksters funny money no delivery scam again; yet taking some of those profits for physical silver delivery on short silver bullion banks dime!! My way earlier, says you don't have to arb profits though the crimex delivery months! Join the orchestrated bankster flush at turds line of defense! Take those put option shorts on slv and use some of those profits to take delivery on physical silver! Starving the bullion banks more through there own vampire squidding ways!! Short slv under orchestrated bankster busts and buy physical silver with those put option profits on slv!! It does work as you listen to turds lines of defense blythe shall surely take!! Just draining bullion banks; subtle, but illegal loop holes to buy off exercised delivery option with paper fiat premiums!! Why not "we the people" use those bought off paper contracts in FRN premiums to buy physical silver until the fraudsters vaults are drained!! Let the stooges buy off with paper FRN premiums until they can't and all those paper profits used to buy physical silver, drain the cheating bullion bankster fraudsters world wide!! What goes around comes around! Bust the rat basturds hard! It will happen!! Bullion bankster come to a point where they doin th not pick out a corner and chit deliverable crimex silver 1000 oz bricks! It's an accelerating emptying bullion bankster vaults juggernaut of the viper squids impending doom!! The more honest money in we the people hands; the greater all of us may combine our resources in constitutional government here! Yes! Actually here in the U.S. Where unitied we stand again; against dead head fed gov goon tyranny!!

ReplyDelete@afrum,

ReplyDeleteI personally don't have the $150K it would take to stand for delivery (or payoff) of a single silver contract...but I'm willing to negotiate financing with you.

Lets know with silvers volatility you get more bang for your FRN dollar! Taking up SLV put option positions on turds line of blythe defenses, he calls quite admirably! In an orchestrated silver take down why not use the profit from those SLV put options to take more physical silver off the markets!! Use the paper ponzi chase to profit to we the peoples advantage; if you like sockin it to blythe; jpig morgue!! !!

ReplyDeleteWhat am I missing? If spot is hanging in well, why are miners slipping into the close today? Manipulation in junior stocks? I'm confused. If spot is consistently 29+ and 1345-50 over the last 2 hours, why are miner stocks dropping? Shouldn't they reflect fundamental value of the PMs? I guess volatility and I are formally introduced ... anyone have any insights?

ReplyDeletemagis00-

ReplyDeleteNeed to remember that juniors are STOCKS FIRST, and METALS RELATED SECOND. The correlations are not tick for tick perfect. And sometimes are even upside down.

Deucedude-

ReplyDeleteyour question from earlier

FWIW I use TDAmeritrade, but I just do plain vanilla stocks and ETF's, no options, futures, etc.

Well, I vote for "sucks" and say we change that. Thanks for the reply, Eric.

ReplyDeleteGenerally speaking, medium- to long-term those stocks with good underlying fundamentals should rise with the coming tide, right? It's just in a short-term day-trading view that there's crazy volatility?

"I am always ready to learn, although I do not always like being taught." ~Churchill

I'm having a great day in the Jr Miners, but a lot is due to a core position in Arian Silver which had some big buyers come in off what appears to be the end of the shakeout yesterday. Lots of green across the board in the jrs, even if it is modest. The majority of the gains came today after the bull flag in the 5 min silver chart about 1pm CT today popped upwards.

ReplyDeleteDoes not seem that more established producers did as well today as did the Jrs.

There will be earnings soon on a lot of these stocks, and a higher price of silver will certainly help! Stay thirsty my friends.

Magis00

ReplyDeleteRight.

magisoo

ReplyDeletenot just juniors either. Any kind of miners.

Generally, you'll get better correlation with a basket or ETF of miners, but still not always what you expect in the short term. With a single miner, anything can and will happen.

Badass.

ReplyDelete(My captcha was "priapi", as in permanent hard-on. But that's priapism, which makes me wonder if I had the plural -- and if so, what that portends!)

Vegas. How appropriate.

ReplyDeletemagisoo

ReplyDeletei'm not sure either, but just to be safe stay away the bay area for awhile.

Hey-O!

ReplyDeletemagisoo-

ReplyDeleteThe miners can rise with zooming metal and a slightly sucky market, or with a zooming market and slightly sucky PMs. So-so performance in both seems to leave the miners flat. The best days for the miners seem to be when the metals are rising and the market is rising as well....on days like that I just sit back, watch the big green numbers roll upward, and smile.... :-)

If I see no oversize yellow hats at the Mandalay Bay craps tables, I will be very dissapointed! ;-)

ReplyDeleteIf you are new to miners just be careful out there. There are a million things that can screw you. Cave-ins, floods, toxic leaks, strikes, nationalizations, hedge book blow ups, bad drill holes, employees stealing your ore, etc. And just about the time you think you are really going to strike it rich the company itself will do a stock offering and dilute the crap out of you. You can wake up any morning and find your stock cut in half. Don't believe me? Fine. Just don't say you weren't warned. I learned the hard way, with real money.

ReplyDeleteaka Debbie Downer

I was going back through old TF posts just now and I came across something peculiarly interesting chart.

ReplyDeleteTake a look at the silver chart on the right of the following pot and compare it to today's:

http://tfmetalsreport.blogspot.com/2010/11/top-callers-out-in-force.html

I'm not making any judgments, just very very uncanny. Please also note the close price that day. As of now I have the identical of 29.14

The biggest thing that helped my overall financial situation over the last 15 years is that I wake up every morning and tell myself "Gold is a wonderful thing, but Gold Mining is a lousy, lousy business".

ReplyDeletePick52, that is still the live silver chart, with todays action, even though it is an archived post

ReplyDeleteThere was no FUBM on 11/15..

http://www.kitco.com/scripts/hist_charts/daily_graphs.cgi

Turd,

ReplyDeleteVegas? Didn't think you were the gambling type...

daraconn,

ReplyDeleteHa! That sure explains a lot!

Slinking away in embarassment now...

Not to worry Pick52. It's Friday!

ReplyDeleteWith the help of Turd and the commenters over the past few months, I successfully bought on the dip again today; although I did miss the initial run-up in the morning but it all worked out. Purchased through gainesville again (20 roll ASE and half oz gold eagle. Running desperately low on cash so this is it for the time being.

ReplyDeleteHave a great time in Vegas Turd. I partied my as off at the Flamingo a few years back, it was a blast.

I have been in the junior miners gold, silver but sold out most of my positions a few weeks ago. Just one small holding in a junior gold miner left.

ReplyDeleteI concur that when stocks take a dump the miners will be part of it. It is then I will buy back into some juniors on the basis that gold stocks did very well during the Great Depression and that gold and silver will have a long term future as wealth insurance for the newly scared to death populace.

When the the time comes my probable targets would be mining gold stocks:

1. low geopolitical risk. That unfortunately means West Africa is out, though they are finding new deposits all the time.

2. Low debt loading, requirements and or cash in the bank.

3. Not high cost of extraction - high concentration ore bodies, and or shallow deposits and open cut mining.

4. Decent size reserves or potential reserves.

The majors may offer bargain prices for a short time if there is market dump.

'been reading inquiries RE: miners to buy. Remember we are investors not speculators/traders we want insurance, not paper... The playing field has never been level (bulls make $$, bears make $$; piigs get slaughtered). If you are fortunate enough to be a member of USAA (must be military or a familiy member of one), check out {USAGX} a PM fund, 5 star I might add. Hefty divedend and gr8 track record. Look at their 10 return and remember to add in divedends, it has followed our the twins (gold/silver). Full disclosure, I own it and have for years... Do your own due diligence, as always. BTW, I've seen the Turd at a craps table, he would make BM double down and pray for mercy, if that bitch had to step up and play for real. Packers by 10; 34-24, and turd up 10K by half time. Colonel Turd

ReplyDeleteGreat stuff, Colonel. Thanks for the vote of confidence. I'm on GB and over too

ReplyDeleteGuys, Wynter_Benton is talking about $4.5BILLION for her "team" of hedge funds. This is no small chump change. I've been researching her prior posts this evening. Some very interesting posts - my gut is to not believe her, but she references things that only those who are truly informed would know - that not even I knew until I researched what she was talking about.

ReplyDeleteDo your own DD and perhaps we will see in a few weeks if wynter_benton can deliver on what she indicated she would.

Also note, she mentioned taking FULL delivery, but the rest (that is undeliverable due to nonexistent silver) would be paid in "special fees" to her.

Also, there is another group of silver vigilantes who are going to attack on or before March 31st:

http://standfordelivery.com/stand.php

reefman, care to share any specific messages where she talks about 4.5B and other things you were able to verify that she said?

ReplyDeleteThat's an interesting site, I wonder if Max Keiser is aware of it.

flaunt,

ReplyDeletehttp://messages.finance.yahoo.com/Business_%26_Finance/Investments/Stocks_(A_to_Z)/Stocks_J/threadview?bn=10073&tid=382842&mid=383297

She said ÏF I had "$4.5B" but that is what she is insinuating... rather cryptic. Anyway, interesting read, but I am cautious...

She also references "McCruden"(spelled incorrectly on purpose for google bots). I never knew this! Really amazing story:

ReplyDeletehttp://www.scribd.com/doc/46874902/McCrudden-Complaint

Basically Mcreudden (spelled incorrectly again on purpose) threatened to assassinate the SEC, CFTC, NFA, & FINRA - past and present of all groups.

ReplyDeleteI came across the following xtranormal video. It's a great take on the Network movie with a silver twist.

ReplyDeletehttp://www.youtube.com/watch?v=h_o2fTqP--4

reefman - you spelled the name correctly in the link.

ReplyDeletextybacq,

ReplyDeleteYeah, I realize that. LOL! :)

Audio interview on silver posted today, includes Jeff Christian:

ReplyDeletehttp://www.financialsensenewshour.com/broadcast/fsn2011-0205-2.mp3

Old Chinese Gold Trader said:

ReplyDelete"Do mental calculation of how much Turd will spend at craps table. Send exact same to PM dealer today. See who is ahead on Monday!"

Obama repeals "1099 $600 reporting" from "Health" "Care" bill:

ReplyDeletehttp://www.thestreet.com/story/10986515/2/obama-short-on-specifics-small-firms-say.html

bludevil-

ReplyDeleteI agree with you about USAGX, it's been very good to me. I did step out of it for a while during the latest downswing (not soon enough, I'm still down for this year), but now I'm back in.

I just got the USAGX semiannual report, the performance commentary is pretty much a summation of what we talk about here and on zerohedge, so they obviously understand the fundamentals.

They invest in 82.2% gold stocks, 7.9% silver stocks, 5.4% platinum stocks, and 4.5 % FRNs. Mostly they invest in the senior miners.

Once we reach the "Turd Top"(am I the first poster to use that phrase?) I'll probably step out of USAGX again until we hit the next "Turd Bottom".

It looks like Egypt continues to make ripples in the world with the natural gas explosion... Up goes oil.

ReplyDeletereefman - I didn't mean to sound so harsh. It is really hard to gently say something in a comment.

ReplyDeleteAnd repealing the $600 had to happen, which meant I was sure it wouldn't. How they thought anyone could comply with that is amazing. It is actually surprisingly hard to stay under the $10K that must be reported, even for an average income household like mine.

Guys check out KWN today. Lots of great interviews with Bill Haynes, Dan Norcini, James Turk, and Ben Davies. All worth a listen!

ReplyDeletextybacq,

ReplyDeleteNo problem. I understand. :)

I agree with you re. the $600 reporting. Totally insane law.

Also Hugo Salinas Price wrote a piece about Mexico monetizing silver.

ReplyDelete"In 2001 we elaborated the text for a Congressional Bill which would establish the method for monetizing the “Libertad” silver ounce in Mexico. Today, the idea of silver money is well known among Mexicans and we believe it is only a matter of time for this Bill to be approved. It is presently awaiting a vote in the Congress."

http://www.plata.com.mx/Mplata/documentos/images/Hugo_Salinas_Price_London_2011.pdf

Another awesome weekend read; and perhaps a forward to my Ph.D Keynesian-lover brother of mine who I love but won't listen to his younger brother because I have no "degree" in economics:

ReplyDeleteGuest Post: The Great Global Debt Prison

http://www.zerohedge.com/article/guest-post-great-global-debt-prison

@Bludevil and KiwiQ, As a20+ year member, I concur wholeheartedly on USAGX a great way to ride the bull! I've held a core position for over a decade when it was in the single digits, always dollar cost averaging in on the downturns. I must admit though, their calls/management have always been so good that for the last 5 years I've been cherry picking many of their new addition companies in my IRA brokerage account (they always seem to get in very early on the gems), every once in a while finding some big gainers (Redback Mining..)In many ways I owe a lot to them for where I now am on my knowledge quest. In the news links to usagx I caught on to a story that linked to Lemetropole Cafe.com which led me to JSmineset and Kingworldnews to Harvey Organ to Zero Hedge to Turd.

ReplyDeleteTim

ReplyDeleteIt's all about the journey!

I wanted to contribute some observations regarding the movement in the US Treasury market.

ReplyDeleteNorcini posted a UST30y chart which shows the UST30y breaking through the 119 support level.

This caused me to look at the USTbond/bill numbers which show a significant trend. The UST long bonds and even now the USTBill 6 Month is showing signs of 50DMA crossing the 200DMA to the upside.

My conclusion, and I'd appreciate the input of others here is that the Fed Reserve and US Treasury have lost control of the interest rates.

US citizens will not be able to pull off refinancing of over-extended homes.

This led me to analyze Case-Shiller and other indices.

My conclusion, unlike the moronic comments from Hilda Solis and the White House, is that the US economy is ALREADY in the double dip. It's been in the double dip since the New Year.

I am seeing signs that REO's, Foreclosures, and short sales are picking up. The banks appear to be dumping properties from the Shadow Inventory into the MLS with a substantial attempt to move real estate now, as in immediately.

My view is that the following will occur in the next 4-8 weeks:

1. Interest rates for the peasants will rise substantially with many being unable to re-fi.

2. Food prices will continue to rise internationally with food commodity prices continuing to rise (10% inflation rate is my view)

3. Continuing unemployment in the Southwest USA and Rust belt in the NorthEast/Mid-West will result in continuing sagging property value.

4. Tax revenue to muni governments will continue the failing ledgers.

5. Muni defaults will become more apparent in the 3rd quarter of 2011 as major states fail to pass increasing taxes and revenue shortfalls do more damage.

6. Precious Metals market will continue to move up at 10% per year for support levels because that matches the idiots expanding M2 monetary supply by 10% per year.

7. QE3 will become priced into the market over the next 90 days.

Lastly, the comments on this blog about taking stock positions in junior miners is funny.

I'd rather take $3000 to the coin shop and buying 100 ounces of SAE's or 2 GoldAE's than get 1000 shares of a dollar stock with "deep reserves" in their dirt.

Have a nice weekend and know that your gold and silver do not reflect your self worth.

StrongSideJedi: You appear to be well informed!! As far as the feds losing control? dead head feds will dig in at higher yields on LT bonds for the next 60 days! We have learned there's double the POMO power each week for the next 8 weeks to juice all areas of the paper markets!! Only if the debt ceiling vote goes bad in March, doubtful as feds continue the status quo print to infinity, the bankster politicians may then lose control! You'll then see down moves in the USD more erratic; bond yields blowing out to the upside and rising with less sideways action!! For now, the next 8 weeks of having nearly the double POMO power each week handed off to the primary dealers to deploy as hot money speculation, will allow still measured moves in bonds/dollar! No doubt it's a time to get your arse in gear to make certain your monetary stores of value are not added up in paper fiat FRN's/assets held under counter party risk!! I can see a move coming soon, where 100% possession will be the law among the lawless banksters!!

ReplyDeleteflaunt: Hearing more stories to the "Libertad" silver effect out of Mexico also!! I think it was James Turk mentioning such in his last interview at kingworldnews! Perhaps Ben Davies!! I stay informed on physical market tightness and both these interviews, I listened to today, says we hit 50 ounce silver in the year sooner than later is my take!! I know for certain we get the 40% run up off of Turks 26.40 bottom call! The rest you may well interpret if you've a mind/time this weekend!!!! http://www.kingworldnews.com/kingworldnews/King_World_News.html

ReplyDelete@StrongSideJedi

ReplyDeleteI hesitate to respond because I know it doesn't add anything to the discussion to simply say that I pretty much agree with everything you said.

I would simply add the caveat that we should always keep in mind just who we are up against. TPTB have demonstrated the power to control, manipulate, extend & pretend, or whatever we want to call it for much longer periods of time than anybody could reasonably guess.

Thus, it could still be extraordinarily dangerous to go "all in" on any number of investment approaches based on your (and my) view.

Short bonds, short stocks, leverage into precious metals. We could have our heads handed to us in a big way if we were to go too strongly into any of these. We just need to keep our emotions and our bets under control, so as to give ourselves the greatest amount of staying power until the fundamentals fully assert themselves.

I certainly wouldn't go all in ever, with the bankster fraudster crowd in bed with lawmakers! I simply know from history when governments make monetary changes; it comes swiftly as a thief in the night! We the people losing!! Again! Action cures fear! Be prepared!! Maintain your common sense as the world goes wildly insane!! If you think someone, something is crazy like a chicken! Don't hang around simply because you need the eggs!! Waiting and not doing nothin is crazy! Especially knowing the banksters lust for power and greed currently plundering the working class people today!

ReplyDelete"There are large black swans paddling in the Middle East pond that could have a significant effect on precious metals, oil and stock markets."

ReplyDeleteBullish advice and lots of Chart Porn here:

http://www.safehaven.com/article/19892/short-term-buying-spree-in-gold

@Strongside, I understand your position on physical versus pm stocks, certainly seems the best risk/reward bet, so would I assume correctly that you'd recommend Roth/Traditional IRA holders go cash out early and go physical, at the expense of penalties/taxes?

ReplyDeleteIts not an easy choice to pull the trigger on, very much an individual scenario choice, but would you offer an opinion?

More from Gene Arensberg on backwardation in silver:

ReplyDeletehttp://www.gotgoldreport.com/2011/02/near-zero-contango-in-comex-silver-futures.html#more

afrum: Hugo in his Cheviot Sound Money Conference presentation said he thinks the legislation could get passed next presidential election, and that there were politicians' careers on the line because the people want it. Sounds like a pretty good chance it will happen. I think their next election is in 2012.

ReplyDeleteHere is a link to a video of Hugo's presentation:

http://www.cheviot.co.uk/sound-money-conference/presentations/how-to-monetize-silver-so-that-it-can-circulate-permanently-in-parallel-with-paper-and-digital-money

flaunt! Great Arsenberg commentary on silver zero cantago!! Like to see his commentary on cnbs!! hehehehehehe! Now I go to the hugo conference you posted!! Thx

ReplyDeleteAlso David Morgan's presentation is worth watching. Especially the Q&A at the end where he gets into the possibility of a currency crisis and its effect on silver:

ReplyDeletehttp://www.cheviot.co.uk/sound-money-conference/presentations/silver-monetary-and-industrial-demand

flaunt: Will listen to Morgan as well! Hugo sees silver monetization into the hands of the people clearly! Through chaos or with a 1st step country as Mexico; legislators of greater integrity than the States!! Yep! Don't need to look very far to find legislators of greater integrity outside the U.S.! Nough said! Off to Morgan!!

ReplyDeleteFlaunt, Morgan link was awesome, thanks for posting!

ReplyDeleteMorgan weasel clause for contracts paid off in cash rather than silver hilarious!! heheheheheheheh bankster weasel's got the bases covered but eventually physical trumps paper! Oh yea!!

ReplyDeleteCheck out another chart that Gene just posted. It shows a PLUNGE in contango in the silver futures market. I didn't really grasp how out of character it was until I saw this chart.

ReplyDeletehttp://www.gotgoldreport.com/2011/02/chart-shows-dramatic-plunge-of-silver-contango.html#tpe-action-posted-6a0120a6002285970c0147e255ded9970b

This comment has been removed by the author.

ReplyDeleteInteresting comment from Harvey

ReplyDelete"Forgot about the small speculators in silver. They have been wiped out long ago and have not put their toes into the hot steaming water as of yet.

This game is being played out by large resolute longs going against our 2 banker friends. March will be the ultimate battle ground and will be somebody's "Waterloo"

The total open interest declined by only 58 contracts despite the massive raids orchestrated by the banks."

http://harveyorgan.blogspot.com/

timpa,

ReplyDeleteMy take is this: Stash as much PMs as you can given your circumstances. Make sure to have enough physical food, water, survival gear, and weapons to defend your food/water/metal/family. For me, this includes plenty of food, camping gear, extra dog food, machetes, knives, guns, ammunition, other weapons, and the know-how to survive in remote locations for long periods of time.

You want enough cash on hand to handle daily affairs, maybe a few months rent/mortgage payments, some money for food, etc. I personally try to keep my bank account minimal since money there is far riskier than in hard assets.

My #s are skewed, but I have maybe 3% of my assets in cash/bank accounts. Maybe 20% in real-estate/home, and the remainder in the items listed above. I drive a 17 year old car, have a scooter to save on gas costs (and its a fun ride). My personal expenditures tend to be 70% PMs, 5% alcohol (I like beer), 25% misc.

I'm probably not a role model, but maybe this will help you figure out what others on the TF's blog are doing...

@Eric I believe it was you who inquired in another thread here about Sprott's Gold & SilverTrusts being so well known /w little talk of GTU and SVRZF (I exclude CEF here because I choose my Au/Ag ratio & it's never 50/50.) Everyone must do their own DD but I am completely satisfied that all five funds are as safe as can be.

ReplyDeleteSVRZF is a bit problematical since it trades on the grey market & is relatively thinly traded. While I get current quotes in my Scottrade account, StockBrokerPro for my Treo can't find the symbol so since its my largest holding currently, my IRA balance is constantly ~$100,000 lower in that program than in real life. Also the only way to calculate its Prem/Disc to NAV is manually since it is not published anywhere. A further factor /w SVRZF & GTU is that their NAV is based on share closing price & London Fix (I could easily be wrong but I think Sprott is based on spot at time of NYSE close - if anyone can confirm or deny this for me I'd be most grateful.)

With all that said, my strategy with these funds is when the SVRZF/PSIL +/- to NAV between the two funds diverge significantly to sell the high premium to NAV trust & buy the lower. I first sold SVRZF & bought Sprott when both were ~ +14% to NAV. Sprott stayed around there but SVRZF fell to ~ +7% so I sold Sprott & re-purchased SVRZF picking up ~ 7% more oz of Ag. This has worked for me & I think others could profit by trading the NAV disconnects (PHYS & GTU are almost always very close to each other in NAV premium/discount & unless there is a significant NAV reason to trade one for the other I stay in PHYS which *seems* to outpreform GTU.

Do your own due dilligence, IMO, HTH, YMMV

2/3/11 7:25 pm

DISCLOSURE: as of 2/3/11 7:25 pm *very* long SVRZF, long PSLV, long PHYS

@Turd: God Bless you for recommending EXK.

Re: Nickels: someone mentioned in an earlier thread here, the metal premium over 5¢ in USA nickles & that REALLY made sense to me. So aside from $100 face pre-1965 USA quarters & another 10 oz bar to kinda FYBM (I'm a gay guy so the thought is repulsive,) I've managed to accumulate almost $5,000 in $100 boxes of heavy, bulky nickels. Planning to use my tax refund to sock away $4000.00 more. Thanks to whoever offered that inspired idea.

2/3/11 7:25 pm

DISCLOSURE: as of 2/3/11 7:25 pm long USA 5¢ coins

Jai

@Jai

ReplyDeleteThanks for the comeback on GTU/SRVZF, et al. I too am quite satisfied with this family of funds, but have been scratching my head for quite a while regarding their lack of commentary on this site and others, as compared to the Sprott funds. The fact that they are relatively thinly traded probably accounts for it.

You sound like you probably already are quite knowlegeable, but for others sake I'll point out that if you are interested in SRVZF, be aware that yes it is very thinly traded and I would recommend first getting a quote on SBT.UN in Toronto, converting that from Canadian to US Dollars, and using that result as the basis for a limit order on SRVZF. This will get your SRVZF orders much closer to what is really going on in the more liquid Toronto trading. I cut my teeth on this method trading small Canadian oil and gas trusts.

Also, yes I do think they publish the premium or discount to NAV on their site.

http://www.silverbulliontrust.com/net_asset_value.htm

Though it is in Canadian $ and yes I do believe it is based on the London Fix.

GTU is currently trading quite close to it's NAV and would seem to represent a good opportunity. Either as a trading vehicle against PHYS like you describe, or simply as a good way to buy gold with an eye toward selling it later at a stiffer premium. Seems to me around a year ago GTU was regularly around an 8% premium. It fell dramatically last summer when they did an offering to raise more money, did not recover as quicky as I thought it would, and fell some more in the recent correction. But I fully expect it to go back to something like 8% at some point in the future. I own a big chunk of GTU in my Roth IRA.

Regarding liquidity, SRVZF is the only really thin one. GTU and CEF seem to trade quite easily here in the states.

@timpa

ReplyDeleteI hesitate to give out absolute numbers of ounces, both for security paranoia reasons and for the simple reason that the amount that is going to be enough is going to be different for everybody. It's all in the context of our own financial situation.

As for me, I will say that if I count actual physical Au and Ag, plus the shares of GTU in my Roth IRA, that is an amount that would fully replace the take home paychecks in our household for roughly two years. Given our other financial limitations such as debt levels and monthly cash flow needs, we really can't do any more than that right now. Is it enough? I have no idea, but it's going to have to be.

If I don't count the Roth, and just stick with actual physical ounces of gold and silver, the metric mentioned above comes out to more like 1.5 years. Roughly 2 parts gold to 1 part silver.

Also, another metric. The value of actual physical ounces is running neck and neck with total debt levels, including mortgage, a loan on a relatively new car, plus credit cards. So on the one hand I'm not comfortable going any higher than that, as in my current situation it would require more debt, but on the other hand it feels good to know that I can always make a debt payment in hard times by selling a bit of my "reserve", and could go debt free almost instantly by selling the lot.

@eric please be aware that there is nowhere I know of that publishes the +/- NAV for SVRZF. While it is true that you can get the +/- NAV for SBT.UN and SBT.U at NEITHER of those shares are the same as SVRZF (aside being managed by the same conoservative company and having the same NAV. Their prices are often very different with SVRZF usually running higher. NB the differences: last Friday SBT.UN closed +10.9 while SBT.U didn't trade at all. SVRZF, which is NOT either SBT.UN or SVRZF but an "equivalant" security that is sold on the USA OTC grey market. On Friday it closed at +12.34; the NAV of SVRZF varies often (and widely) from SBT.UN (and more from SBT.U which haredly EVER gets traded.) If SVRZF keeps it up and if Sprott Silver Trust heads down a bit, I will be dumping SVRZF for Sprott. But with silver moving up, that's an awfully big if (Sprott closed Fri at 13.75 +NAV. To do the math for any closed-end fund it is ((closing price)- NAV) / NAV) if that helps out.

ReplyDeleteBest,

Jai

@Jai

ReplyDeleteI'm sure that you and I are very much on the same page in many respects, but I guess we will need to amicably agree to disagree as to whether SBT.UN in Toronto, and SVRZF in the US are in fact the same underlying security.

IMHO, the very different prices you mention are merely the result of the difference between a Canadian stock, trading relatively actively on a Canadian exchange, versus the very same security very thinly traded here in the states, where the market makers are screwing everybody with super wide bid-ask spreads. I have not bought SVRZF, but in my experience with Canadian oil and gas trusts, it always pays to ignore the bid-ask quoted here, and instead put in a limit order based on a calculation from the action in Toronto.

In any case, this level of confusion makes a great reason for most readers of this blog to steer clear and just stick with Sprott. Which they do.

Anyway, let's keep hanging in there together. Looks to me like all things silver should be heading up shortly.

I think that the amount of physical PMs you need depends on your expected scenario of what happens when hyperinflation arrives.

ReplyDeleteIf you expect society to fall apart, resulting in an every-man-for-himself situation, with widespread pillage, rape, and robbery for an extended period of time, you certainly need more than if you think more in terms of hard times with the basic fabric of society remaining intact.

Personally, I think in terms of the latter. There are going to be hard times ahead, and silver & gold will likely be useful for barter, and will most certainly be useful as a more reliable store of value than Fiat Reserve Notes. In spite of the problems, I assume that the basic infrastructure of society will continue to function in some manner or another.

Disclosure: I live in a large European city. I don't have any special powers or own any weapons, nor do I know how to use any weapons if I had them, and I don't know any martial arts. So if the former scenario were to take place, I would probably croak (... or be forced to pay for protection out of my silver stash ... ;-).

My strategy is to allocate a large portion of my monthly savings to PM purchases.

Additional information RE: "the eve of destruction" comments. (BTW- that was a great song)... The survival gear/self defense/nourishment all with value, remember the pharmy needs. All should have a 90 day supply of meds you need to live, include OTC as well. Simple products especially if you have small children/grand children. Look in your medicine cabinet and ask your self one little question,do I feel lucky; without this stuff, well do ya?

ReplyDeleteKiwi/Tim you guys can use express scripts from tricare, stock up. BTW nice move on USAGX, tim. That 48 top in dec must have been a nice return. Hope you bought physical. col T.

Found this on the daily Paul and had to share with all the turdites. Blythe lying her ass off but revealing her end game. Looks like Ted Butler and the Turd have been right all along...

ReplyDeletehttp://www.youtube.com/watch?v=KbZNikih6yM

Listen carefully to the last answer she gives. Basically says "oh honestly little ole us can't manipulate the market....the supply/demand side always wins in commodities"

Butler reiterated that very thing in his latest newsletter and our great Turd's been saying it all along as well.

FUVMBM - Fu$& you very much Blythe masters

@Jimmy,

ReplyDeleteThanks. Blythe made a comment at the end of summer 2010 that she admitted to making a "novice mistake".

Guess her "novice mistake" was naked-shorting shorting silver with no real silver to back it up.

She has nice hair though!

ReplyDeleteNo problem. The first part of her answer is obviously total b.s., but I think she tacked the last part onto it to give the bs part weight (even if it's only given weight in HER delusional mind!)

ReplyDeleteThanks again to the grand poobaa Turd, I hope you made out like a bandit at the craps table! Hehehe

Here you go... ENJOY!:

ReplyDelete"Masters, who was named to run the business in late 2006, said the bank began dismissals on July 21, a day before the call, to trim overlap after buying parts of RBS Sempra Commodities LLP. The bank cut less than 10 percent of the combined front office, even as the oil unit lost “key people” who needed to be replaced, she said. She was discussing results with top executives after “we made a bit of a rookie error” that left the firm “vulnerable to a squeeze,” she said."

Turd, in case you haven't seen it, here's the link to a 1/6 BNN interview with CEO Bradford Cooke of Endeavour Silver:

ReplyDeletehttp://watch.bnn.ca/#clip397603

Limited physical resources; limited time left on jpig morgue naked short clock!! You do know morgue has price fixed all the commodities; oil more likely in conjunction with gov sucks GS! Away with all the bankster fraudsters to eventually be thrown to western justice!! Sharks or whales if you prefer, are exiting the states to destinations unknown with plenty real money gold/silver vaulted in Swiss accounts!! Leavin some poor madoff patsies to take the fall!!

ReplyDeleteFlaunt - thanks for that link!

ReplyDeleteafrum,

ReplyDeleteI am one that you describe in the latter part of your post. Left USA in 2009.

reefman - can you post a list of say 3-5 nation-states that are favorable for immigration?

ReplyDeleteTIM - You asked a question about 401k and IRAs.

ReplyDeleteThat question has been central to the discussion between my friends, family, and all.

Pension funds are locked up, just like the IRA's and 401k's.

The issue is really what scenarios are you insuring against. If you are a participant in the US economy and fixated on the USD-FRN, then you have little choice than to cover your disaster situations with payments to the insurance industry (i.e. life, disability, auto, and home). These payments, in my opinion, are an economic weapon against the "under class" by the "elites". TPTB want you to give them their money back. They've paid you $10.00 per hour to do something. So, the workers do it and then the bankers want the $10.00 back for a checking account. The auto insurer wants it back to cover his lousy paper. The landlord wants it back for his needs. So, everybody wants everyone else's money.

Well, there's only one way out of the debt and credit trap. You buy and hold precious metals for years.

You can buy and trade PM related contracts through the 401K and IRA.

But, for the younger generation, why?

They need the money now to survive the coming year.

This is no longer about planning for 2015 or 2020. This is about making it through March.

So, are you trying to stay put and hold your position or do you intend on using the gold/silver to just relocate family and yourself to a better situation?

I figure that you have to have insurance to cover both scenarios.

You'd have to calculate that valuation, but the 401K/IRA funds are out of the fight because "TPTB" have already stolen it. We should consider it contractually owed back now, not in 20 years.

Social security is the same way.

I'm amazed that our countrymen (USA) put up with organized crime stealing our pay each week in order to foist another lie.

There is little difference between the British Army stealing the arms from Lexington, the money from the city, and the future from our children and the actions of Blythe Masters/Jamie Dimon and their army of red coats on Wall Street.

Wall Street's valuation is no longer even human controlled. High Frequency trading is a lie that has allowed math algo's take over the self-worth of millions.

Well, that group of Egyptian pro-government people lobbing molotoff cocktails on demonstrating citizens was another example of this same fascism and neo-feudalism.

The government and bankers lob financial molotof's on our heads while they steal our productivity not only in the past, but also in the future.

Screw them. Buy silver and gold.

If Mexico monetizes silver, how might this affect Endeavour (their mines are in Mexico, right?), if at all? Would they benefit more than other companies not within Mexico's borders?

ReplyDelete@Eric -

ReplyDeleteI agree with your premise and we seem to share the same plan of action.

Some of my other friends have actually been adjusting gold and silver inventory, but I have been debating in my mind about what formula to use for such adjustment.

I think a 10% inflation rate for some commodities may exist currently. Therefore, the debt exposure of the family can actually hedge against inflation in the event that those notes are fixed and below 7%. I am assuming a 7% inflation rate as baseline and do not accept Ben Bernanke's premise of excessively low growth. From his perspective, deflationary pressures from lost paper contract valuation at the big investment banks exists. However, from my perspective in the countryside, we are seeing food and gas inflation that is outstripping liquidity. So, the small businesses are being hit hard by the fact that the big banks are siphoning liquidity and monetary supply.

Therefore, we are fighting a fight against the big banks by choice of the bankers. It is not we who chose this struggle. We would have been comfortable leaving savings/dollars in the bank. Unfortunately, it is the bankers themselves who have chosen to prey upon their own clients. Therefore, I regularly appear at Bank of America/Countrywide, HSBC, US Bank, Wells Fargo/Wachovia, and JPMC/WAMU to deposit checks and routiney withdraw in excess of $4000 per visit in cash payable in $100 bills.

They hate it and I love it.

I enjoy walking up to the teller, smiling at the blood sucking SOB, and making the bastard give me my money in $20's, $50's, and $100's. I'm thinking of going in there and asking for it in $1.00 bills next time, just to make them say... "uh, we don't have that in the bank".

LOL Bwahahahahaaaa

Yep...you bet you don't... because your bank is a blood sucking dinosaur of a business that has been outmoded by the bloggers, the precious metals market, and twitter. By the time we get done with you Blythe, you will be sitting with one foot on a declining silver inventory and another on a skyrocketing price to buy.

Nice job Blythe...hows your "unique career choices" doing?

You and the other spank monkeys in the org's like yours will have some tough days ahead.

Remember that your self worth is not tied to your account at Williams Sonoma, Tiffany's or better than that the First Class cabin for Transatlantic flights. Plus, those in-flight bars are soooo over-rated...right? I mean, who would want to sip a martini at $30,000 feet... oops...did I say $30 or $1000?

Pass me MORE JM 100 ounce silver bars...the damn things are heavy, but they make great door stops.

Anyone want to guess where the Silver and Gold price action open?

ReplyDeleteI say it opens up with buying in Asia.

With Chinese new years over and Aussie mines under water and the mining halted, there is little doubt that the general price action will move up around the planet.

What the price action does in USD is anyone's short term guess, but I'm going to guess that the Kitco chart for the next 24 hours will show silver testing $29.50 and gold testing $1355 over the next few hours.

Now, I take leave to go have some fun with my wife, ignore the SuperBowl, get some great food, shop for some Valentine's stuff, and then ready to screw the local bank branch again.

This weekend, if BM and EE suppress the price, I will order a monster box of 500 oz silver American eagles. Of course, it's kind of hard to part with $15000.00 for that box and wait ONE MONTH for delivery. LOL...I'll wait two weeks.

The local coin store runs out of silver every weekend. The poor desk clerk has to get on the phone with the wholesaler every day to figure out what to order. Then, she guesses and then the price moves and the people run in on her. It must really suck to be buying from wholesale right now. You know the EE will suppress the price by options expiration. You know the EE halts the suppression by the second week of the month.

So, like where will we close the week? I say silver back at $30.00 and gold back at $1400. Then, the EE will try to jump back into the suppression scheme in 2 weeks.

POMO will need to double to cover the bets.

QE3 anyone?

I hear that ship is already in the dry dock and floating soon.

Flu's kicking my butt, little slow here, but if Mexico monetized silver would that mean there government may try to seize all the mining operations in Mexico? In a central planners mind they would right?

ReplyDelete@SSJ,

ReplyDeleteI was a toss-up between New Zealand and Canada - but since I am a dual citizen with Canada we chose to move there.

I heard Belize is not bad I know someone who is moving there, perhaps some countries in S.America. I just wish us "libertarian/freedom" types could take over a country like Australia, or New Zealand or somewhere that we can just *live in peace* without being hassled by big government. All I want is to be LEFT ALONE!

@reefman-

ReplyDeleteI agree with you.

But, the parasites need to plug into our work in order to suck off us and our posterity.

That is why they follow us and then try to sucker our community into signing these contracts that "pull forward" future gains.

I have heard that Canadian lending does not permit Real Estate notes longer than 5 years. Is that correct?

If so, the Canadian financial system will only be as unstable as the Canadian central bank and the regional (RBC?) permitted purchasing of GS trash.

Some of the libertarian types have moved to Texas, some rural california counties, Idaho, Alaska.

AUS and NZEA are both good options. But, AUS is getting hammered right now. The Global Warming environmental thing is a factor for planning over the next 20 years.

I have also heard of people moving to Costa Rica, Panama, Brazil, Peru, and Chile.

It looks like Jim Sinclair's Tanzanian development projects would also be well positioned for future growth, even more so than China. If Tanzania moves towards republican forms of government which strengthen education, healthcare, and resource development, Tanzania could become a real continental powerhouse that fuels development for the whole continent.

Ag land is more valuable, but the arable land is going to shift with continued global warming.

As pack ice in the Artic and Antartic melts, we will see increasing rains in some areas and increasing drought in others.

My guess is that a war will start over arable land and water supply in an equatorial region.

The Iranian/ME area is the likely zone.

That same area will likely have petrochemical resources, but that will be secondary to food production and water supply.

China will need to correct it's agricultural land resource supply (desertification is a problem for PRC). The one saving thing for the USA might be wheat and ag production. Ag production would have saved California, but the idiots in government turned off the water supply to the farmers in Central California...ending the ability to produce something useful called FOOD.

@Jimmy-

ReplyDeleteThat cough 102F bug is really hitting people hard in our family and town.

It takes 3 weeks to resolve.

Regarding Mexico, I don't think they can seize a mine. The government of Mexico can't even secure Acapulco's tourist areas. There are stories about real problems in the resort areas with the physical safety of tourists. Therefore, I have no doubt of the ability of a mine to get product produced, so long as either the Catholic Church is on board or the local cartel (or both).

Strongsidejedi, Thanks for the response.. IRA's/401ks, I enjoyed reading all your posts. I've enjoyed playing with WellsFargo in the same way after they said they'd need a week or so to give me more than 10K if I chose to ask. Concur with your targets on au/ag, hui to test 560-580 by end of week as dow climbs away from 12k.

ReplyDeleteZero Contango on Silver...yes indeed, time for the explosion. Toss my salad Blythe, should freshen up your stank breath a little.

ReplyDeleteReef & StrongSide:

ReplyDeleteI've often thought about where I'd go if I left the USA, but I'm sure it will never happen. IF I had the balls and fewer family connections, I've always figured Canada would be my top choice. Cultural and language similarities. And a huge plus to me as a confirmed Peak Oiler, is that moving from an oil importer to an oil exporter constitutes a major step up. One that will pay huge dividends in overall well being in the years ahead.

Sure, it's not exactly a libertarian utopia, government-wise. But all other things being equal, oil, language, proximity, and familiarity give it strong leg up on most other choices.

If I were young and unattached, I'd learn to weld and head for Fort McMurray to work in the oil sands. I think it's the closest thing to the 1898 Klondike Gold Rush going on in the world today.

Some prices of Silver coins going nuts,should be an interesting week all round.

ReplyDeleteFor those still waiting on the Super Bowl, some good reads on FOFOA and Harvey Organs sites.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteSLW Spreadsheet

ReplyDeleteUhhm, anybody awaiting the Asia market opening with much more anticipation than the SuperBowl?

ReplyDeleteThe Silver SuperBowl; that has a nice "ring" to it.

Bit of a EUR sell-off at the open has pushed the USDX above the lofty highs of 78

ReplyDeleteI like this site on Sunday nights because it says what's going on about an hour before you see anything on kitco.

ReplyDeletehttp://www.goldpreciousmetals.com/charts.asp

Oh yeah, and GO PACKERS!

ReplyDeleteI don't care what the naysayers say about the silver shortage not being real... There are slim pickins in 100 oz bars at a lot of the online dealers. Apmex still has several hundred bars of JM but the other products have disappeared and premiums are going up:

ReplyDeletehttp://www.silverferret.com/ItemDetail.aspx?w=100.00&u=3

Here is a link to Adrian Douglas' article about silver backwardation with the charts:

https://marketforceanalysis.com/article/latest_article_02511.html

BTW said naysayers can be heard here on Jim Puplava's show:

ReplyDeletehttp://www.netcastdaily.com/broadcast/fsn2011-0205-1.mp3

This comment has been removed by the author.

ReplyDeleteGeez, it was the Declaration of Independence

ReplyDeleteoops haha - that's what I get for playing Texas HoldEm Poker while listening in!

ReplyDeleteHighlights of Adrian Douglas' latest piece:

ReplyDeleteOn September 21, 2010 I published an article entitled “More Forensic Evidence of Gold & Silver Price Manipulation”. In that article I showed how silver from 2003 to 2010 had never traded freely at all; I showed that silver was algorithmically traded with gold and there was a very clear relationship between the price of gold and the price of silver.

The stunning revelation from the data analysis was that if on any day I knew what the price of gold was I would be able to calculate the silver price from the equation of the relationship! How is that possible in a free market? It simply is not possible and so the conclusion is that silver is not in a free market but is manipulated to move algorithmically with the price of gold.

Since September 2010 silver has broken its golden shackles. The algorithmic trading that kept the price of silver subdued for seven years has been completely annihilated.

This update of my previous work adds more fuel to the fire that the dynamics of the silver market have dramatically changed. Because silver has been suppressed for so long we do not know what its free market price should be, but we are going to find out soon and I strongly suspect it will be many multiples of the current price.

https://marketforceanalysis.com/article/latest_article_02511.html

I hear someone in Vegas with a Yellow Hat bet 100 ounces of gold on the Superbowl toin coss.

ReplyDeleteWhen I first moved to USA from Germany I thought the super bowl was a type of salad. I am glad not to have tried either of those. I had Canadian Grillums for dinner tonight. No bowls for me but lots of beer.

ReplyDeleteAlso, in 1992 beer in Germany was cheaper than water.

Reefman, that's pretty funny. I probably would have thought the same. When did you move to the U.S.?

ReplyDeleteOn the 401k issue, you CAN take out a small, or large portion, and roll it into an IRA , if you have been there a while, or your plan is lienient.

ReplyDeleteMy wife had a tidy sum and we checked and we got to take out 90%, because she was over 59.5.

No penalty(10% in states) rolled into Trade IRA.

Watching closely for a move political or fiscally before rolling it into Gold, or taking the taxes hit, and just get the cash.

looks like my short-term (hourly) was off. The USD appears to have gained some strength. Was it the story about US Navy assets moving to the eastern Med Sea?

ReplyDeleteRegardless of the short-term nonsense, you can not escape the fact that the amount of silver in the USA has not expanded at the same rate as printing of US Federal Reserve Notes. Therefore, the price of silver or gold is escalating over the past 30 years due to the printing.

Anyone want to toss the coin on whether or not JPMonkeyChase is going to suppress at 9 AM EDT tomorrow morning?

About the whole SLV and GLD controversy... I don't blame anyone for being suspicious given the propensity for fraud among large banks. However, it just occurred to me after thinking about that FOFOA piece about GLD that the ETFs could actually outperform in the event of a physical shortage. If these ETFs are one of the few and cheapest ways of acquiring physical (i.e. buying baskets of shares and redeeming them), then there should be more of that activity going forward. Entities should be willing to pay a premium for the benefit of obtaining physical bullion and thus bid up the share prices while outflows skyrocket.

ReplyDeleteJust a thought.

Jedi, I always assume a morning raid. Then if it doesn't materialize it's a pleasant surprise.

ReplyDeleteJedi, there was a EUR sell off when the FX market opened. USDX rose. Since then, the EUR has pulled back and the USDX has come down

ReplyDeleteThe below story seems to have hit the new wires of late, which has probably helped the EUR

"Gonzalez-Paramo (ECB board member) was quite clear in this weekend interview that unless inflation starts easing this year, rates must go up."

I would be interested to know exactly how that's bullish for the Eurozone. The idea that the ECB can raise rates is as silly as the idea that the Fed can raise rates. Doing so would begin bankrupting governments all over again and necessitate more bailouts which is more money printing. I guess traders these days don't think past the headlines. It's like everybody piles into dollar shorts, then everybody turns around and piles into euro shorts. It's like a ship on a stormy sea rocking violently left and right. I have to say if I were ballsy enough to trade the FX market I would simply do the exact opposite of what the herd is doing at any given time.

ReplyDeleteSo tonight, I went to a bar to have a few brews and watch the big game. Generally I feel alone at bars, by myself with no one to relate to. A blind man walks in. He feels around at the bar, trying to find a seat, but they're all taken. I'm a few feet from the bar and offer him mine. He accepts saying "I'm blind, not crippled." This started an interesting converstation, I'm not going to bore you with the details, but a blind man sees the down fall of America -- yest most of America does not. We talked throughout the big game. Its still not over yet, and I honestly don't care who wins. Through our conversation, this man felt real currency. He felt real silver (which I always carry with me) and he understood, without my conversation, that America's priorities were misplaced watching American Idle and the super bowl.

ReplyDeleteThis by far was the best game i've had yet. Fuck you sports teams, I had a real conversation with a real blind American that sees cleared than you can with your visual eye sight. Thank you turd for your support through the rough and tough times. I have no fear now. I am like Evey Hammond of the fictional V for Vendetta --- I no longer have fear. Fuck you state.

I disagree with bludevil323. You need at least a 180 day supply of critical medications if you need any medications. If your drugs are volatile, then cycle through then.... if they are stable, then cycle through them. Medication is important to many people today. Talk to your Dr and make sure he's willing to prescibe enough given your outlook on the world -- If he/she doesnt, then you need a new Dr that actually trusts you. If your Doc doesn't trust you, how can you trust your doc?

ReplyDeletePackers Rule!

ReplyDeleteSheesh! I'm exhausted.

You know, the greatest thing about having some Au and Ag around, is that you've got a little something, a little savings, that's off the grid. Off the Grid. Off the Grid....

Off the Grid, bitchez.

ReplyDeleteYour money isn't in their banking system, it isn't in their currency, it isn't in their tax code, it isn't in their control whatsoever. And that's what pisses them off the most. You've gone Off the Grid.

Track COMEX inventory graphically here:

ReplyDeletehttp://www.24hgold.com/english/interactive_chart.aspx?title=COMEX%20WAREHOUSES%20REGISTERED%20SILVER&etfcode=COMEX%20WAREHOUSES%20REGISTERED&etfcodecom=SILVER

Here is what I personally think about sports. Not that there is anything wrong with sports... but just sayin':

ReplyDeletehttp://www.youtube.com/watch?v=pdbY1r0INxs

Excellent new interview of Jim Rickards here:

ReplyDeletehttp://www.24hgold.com/english/news-gold-silver-jim-rickards-on-inflation-and-currency-wars.aspx?article=3331110888G10020&redirect=false&contributor=Ron+Hera

It updates his thoughts from this presentation he did a few months ago, and you can read the new interview much quicker than the 1.5 hours it takes to watch the presentation:

http://outerdnn.outer.jhuapl.edu/rethinking/VideoArchives.aspx#rickards

For anyone out there struggling to wrap their head around how silver futures contracts work, here is a link I found that someone posted at Harvey's site titled COMEX 101:

ReplyDeletehttp://about.ag/futures.htm

Jim didn't mention the accounting change that now prevents the Fed from going bankrupt. The Treasury now gets to hold all their bad assets thereby masking the true financial situation of the Fed. Basically they unloaded everything onto the taxpayers so that the Fed never ends up in the situation of having to request a bailout. If the Fed really thought their genius plan was going to work out they wouldn't have felt the need to cook their books like this.

ReplyDeleteThe Fed will still have a problem mopping up liquidity even despite the accounting shenanigans they are pulling. When inflation is out of control and rates are going up, the value of their bonds are going down. If they sell they'll drive bonds down further and rates up higher. They could very well precipitate a currency crisis. Their only way out is to hope that their reckless monetary policy results in yet another false recovery and a recovery of the bond market. Even then, the debt bomb clock will still be ticking.

Eric, you obviously didn't watch the pre-game show. I'm glad I watched the pre-game show, I caught the piece on the Declaration of Independence. I now trust my government again to take care of me and do the right thing for our economy, country, with liberty, justice and freedom for all! The grid makes me feel warm and good all over.

ReplyDelete@ flaunt

ReplyDeleteYeah. That new Fed accounting is almost comical if not being so pathetic. Clearly they're paving the way for QE to infinity. There might be a slim chance of changing the course after 2012 election but nobody is holding breath for it.

Check out ZH this morning.

ReplyDelete"JP Morgan announced today that from now on they will accept physical gold bullion as collateral. This is a sign of gold’s further remonetisation in the global financial and monetary system. It may signal that JP Morgan is having difficulty in securing gold bullion in volume. JP Morgan is the custodian for many of the gold and silver exchange traded funds. They will not accept ETF trust gold as collateral."

Apparently even JPM admits that gold is money, and that ETF gold is crap.

I now make it a habit give a silver 1oz coin to my son (5yo) at Xmas and on his birthday. "It's real treasure," I tell him, "like pirate treasure. When you're grown up, it will be worth a lot more"

ReplyDelete"What about gold coins, Dad?"

Smart kid.

Eric: that JPM gold story is a big deal. Very important.

ReplyDeleteIncredible interview. Keep an open mind.

ReplyDeletehttp://forums.silverseek.com/showthread.php?30574-Contact-2-Is-He-in-the-Know-Is-He-Telling-the-Whole-Truth

Good Morning Turd!

ReplyDeleteHope you had a great weekend, I know we did here in CheeseHeadLand.

Yeah, that JPM thing is huge. Don't even know where to start. Hopefully we'll see some commentary in the next few days from folks way above my pay grade.

Turd, Eric,

ReplyDeleteThere are 2 companies belived to be JPM fronts in India, (Muthot Finance, and Mannapuram Finance) accepting GOLD as collateral and financing for last 2-3 years or so. So, the story may be big in US but in India they are doing it for years. Possibly the contract the poor man is signing is so twisted that whatever collateral he is submitting would be forfeited if he misses any monthly re-payment.

I am silent reader and do not trade on US markets though as it is not allowed from India. Still I have FED THE TURD as I find discussion here very enlightening. I am very curious of event happening in US and over the COMEX.

There was a question by lot of people if they can take exposure to Gold from there 401K. It is absolutely possible to take exposure to PHYS thru Vanguard or Fidelity once you roll over to IRA. My whole 401K is parked in PHYS.

Just wanted to add my $0.02.

I think the dichotomy between "Gold is good collateral" and "ETF Gold isn't" is the part that is so ripe with implications. Sort of drives a stake into the heart of the whole PM ETF concept, doesn't it? And this is coming straight from JPM, not from some fringy bank or country. This is not Latvia talking, this is friggin JPM.

ReplyDeletePat,

ReplyDeleteI'm listening to your interview post. If you haven't read "The Rise of the Fourth Reich" by Jim Marrs, I think you might enjoy it. I'd also recommend "Family of Secrets" by Russ Baker, about the Bushes.

Eric,

ReplyDeleteYes. No doubt about it.

To G and Eric-

ReplyDeleteYes, that is JPMC talking.

However, aren't we really asking which is MORE greedy and desperate at this hour?

Is CME more desperate than JPMC?

Is this why JPMC got their man into the White House as Chief of Staff?

JPMC appears to be so desperate that they are creating ways to monetize other people's gold, not fiat currency.

This is particularly revealing because not only does it split the interest of CME and JPMC, but it also suggests that JPMC(US gov't proxy) is now pleading with Asian and Pacific Rim proxies for their gold.

Was this the gold that the Asians traded US FRN's for Euro bonds for cheap gold?

Or, was this the gold that the Asians bought from the GLD inventory straight out?

Blythe and Jamie are starting to look less like bankers and more like Bonnie and Clyde.