I've received quite a few emails asking me why I seem so subdued. Many have indicated that they would expect me to be more excited by the silver market. I've asked myself these same questions. Here's the thing...

There's an old trader's adage: Never predict the end of the world because you're only going to be right once. The same holds true here...Never predict a Comex default because you'll only be right once. However, I made a promise when I started this blog that I would never be purposefully vague and that I would always tell you exactly what I think. The world is full of opinion-givers who attempt to surround every issue so that they can never be proven wrong. We don't do that here. In Turd's World, I tell you exactly what I think, win or lose. Take it for what its worth. That said..

HOLY SHIT CAN YOU BELIEVE WHAT'S GOING ON IN SILVER?!?! THIS HAS ALL THE MAKINGS OF A SHORT SQUEEZE AND A SIGNAL FAILURE!!! HAHAHAHAHA!!!!! EAT IT BLYTHE!!!!!

OK, enough of that. But, seriously, I sit here with my mouth agape just like you do. Every time silver pushes another 50 cents higher, I find myself in stunned silence by the enormity of it all. I honestly have NO IDEA of whether or not the Comex is on the verge of default. What I DO KNOW, however, is that I have never seen anything like this before. The consistent bid. The lack of offers. The record-breaking open interest. The daily 2%+ moves. Again, I've never seen anything like it.

We sit here on Monday evening, February 21, 2011. By the end of this week, anything is possible. The Comex may be on fire and silver may be at $50/ounce. Libya may be in civil war and oil may be over $100/barrel. Israel may attack the Iranian ships that will be passing through the Suez and drive oil to $150/barrel. If the silver Comex collapses, gold may be over $1500. Anything...and I mean anything...is possible. I've used the term "buckle up" quite a bit lately. I mean it. There's some crazy stuff coming over the horizon. As Fred Thompson's character said in The Hunt for Red October: "This business will get out of hand and we'll be lucky to survive it".

On the flip side, maybe we're getting overly worked up. Libya will peacefully transition to a new goverment. Iran will not attempt to utilize the Suez Canal. Silver will peak at $35 and then sharply correct back to $30. As I said anything is possible. Be prepared.

For tonight, take a look at this crude chart first. It is absolutely soaring and I hope you took the time to fill up your gas tank today as it will surely cost you about $0.20/gallon more tomorrow.

I must admit that I could stare at this next chart all night. Its a daily gold. Do you recall how, just one short month ago, every amateur, con artist chartreader was telling you that gold had formed a perfect H&S top and that the downside target was now $1***. What a bunch of crap! Do not ever listen to these morons. They are nothing but two-bit shills trying to separate you from your money. Gold will trade at $1600 by 6/10/11. (Actually, if the silver Comex fails, it'll probably trade there by 3/10/11.)

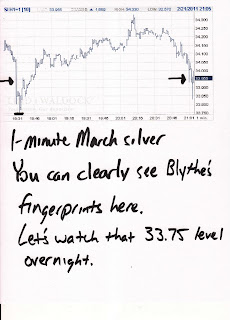

And, finally, silver. There aren't very many charts I can give you at this point as we are in unprecedented territory. This, however, is interesting. You can clearly see some EE activity. Note how in each dip, "natural" selling was taking place and then, suddenly, a massive drop gets cooked in. This is classic EE. They use their available firepower in an attempt to capitalize on the downward momentum, thereby exacerbating the selling and hoping to create a cascade effect. All of Blythe's recent attempts have been rebuffed and, as you can see quite plainly on the chart, this one was, too, at around 6:30 pm. Its happened again while I've typed. Can she be pushed back again? We'll see. Watch that area around the first low, near 33.75, for clues.

If Blythe is able to register any small victories, I'll be looking for 33.50 and then 33.25 as possibilities for sharp, FUBM turnarounds.

OK, that's it. Tomorrow is going to be absolutely crazy and volatile. A day like no other we have seen in recent memory. You might take notes, maybe keep a journal, so that you can clearly recall when it over how you felt and how you acted at various points during the day.

Get some rest. Be ready. See you in the am. TF

11:25 EST UPDATE:

An absolute classic EE beatdown tonight as Blythe tries to claw back all the gains that were made on the Globex earlier today. Take a look at this 2-minute chart for tonight's action:

This is 100%, no-doubt EE manipulation. Some may claim algo, $-related selling. Nonsense. This is exactly what I was looking for when I made that "movie" last night. Blythe likely stored up some fresh ammo by covering some shorts back on Friday. She then unleashed some new shorts on us tonight in a blatant attempt to scare some March longs into selling. So the question is...what happens next?

I doubt she's done. I would initially look for support around the 33.25 level. We struggled with that area a little this morning (remember...broken resistance becomes support and vice versa) and it served to contain last hour's attack. It may hold again but don't be surprised if, at some point overnight, silver trades all the way back down to the highs of Friday, somewhere just below $33. If I were a BoS, intent upon taking delivery and shoving my silver auger right up Blythe's patooty, I'd be waiting right there for her with giant bids. Let's hope we see one, final, massive FUBM begin there and rally us into the morning. If I were trading tonight, I'd sit, cool as a cucumber and let Blythe come to me. Here, kittykitty....come to papa...

However, I'm not trading. I'm going to bed. Good night. See you in the morning (U.S.). TF

Friends,

ReplyDeleteThanks everyone for your input on the credit cards from the earlier thread.

I guess it seems like a no brainer good idea if you think about silver going to $50 or $60 but buying now and seeing it drop down to $25 would make me sick.

Here's a slightly different question I have been struggling with.

I currently have about $10K in stocks and $30K of debt at 7%.

I can keep trading the 10K to get gains and then pay the debt.

I can keep trading the 10K then buy metals.

I can pay the debt now.

I can buy metals now.

It's really driving me crazy!

I only have about 100 oz. of silver saved right now.

At least we are in exciting times?

I for one am glad you're keeping cool.

ReplyDeleteJust picked up more silver today. Can't wait to see $50!

ReplyDeleteUgh... All this excitement is coming just as I have to sit for my State's Bar Exam tomorrow. I'm not even sure which event is the distraction!

ReplyDeleteAll I know is I'll be stuck for 6 hrs the next 3 days w/o any access to charts or my trading acct. Placed a bunch of stops... hopefully that should be enough.

Alibaba Shares Tumble After CEO Quits Amid Fraud, Rating Cuts

ReplyDelete"Feb. 22 (Bloomberg) -- Alibaba.com Ltd., China’s biggest online-commerce site, plunged in Hong Kong trading, after the company found more than 2,000 fraudulent vendors, leading its chief executive officer to quit.

...........

"The company found 1,219 of its “gold” suppliers in 2009 and 1,107 in 2010 engaged in fraud, according to the statement."

I haven't seen this much action in the overnight market, ever, that I can recall. The average is about 40-50 silver contracts per minute!

ReplyDeleteI think the mining companies are gonna open in a flurry tomorrow... with all this demand in the physical market, I would assume after a 3-day weekend for the Canadian and US Markets, there should be an ample amount of fresh market dwellers to try to buy some stocks. I am looking for an epic day tomorrow in the mining equities, especially those companies that are heavily leveraged in silver (or just a pure silver play in general).

ReplyDeleteArian Silver was apparently up 10% in london today, and I would expect to see a rather large increase in volume and profits tomorrow, as the market starts to awaken to the very real problem of discovering more ways to diversify in physical. These mining equities are still for the most part lower than 2008 highs when silver was trading at 24$. Silver has moved up to quickly in the past few months (especially 2 weeks) to really be felt in the miners. It will be quite quite quite quite quite quite quite interesting.

My personal prediction is that GGCRF takes off this week and heads back to its 2008 levels sooner than later (that is 400% from current levels). If it can top 1.10$ soon (closed near $.96, I can see this stock running in the short term). You should do diligent research though, as all investment involves risk, and you should always judge for yourself.

Remember the thing with silver miners. When silver crashed to ~$12 in 08, it really destroyed the pure silver plays. In the last 6 months, silver has gone from 18$ to a now 34$. This almost 100% base increase in the product that pure silver miners sell will come as almost all profit to silver miners, as the fixed cost to mine silver should stay relatively constant compared to the massive acceleration and demand of the product they are in business for.

Imagine once the market is in a physical shortage... I believe that we will get to a point where all companies are valued to their resource value compared to the spot price. That is only stage one, as it could even get more crazy as the speculation and lack of other sound options to put investment money from 401ks and stock market "cashouts" will flow to equities that have a major role in some sort of commodity.

This is the future of our market in my opinion...

Tomorrow I will wake up for the open...

It should be interesting to see how our miners react...

My friend was joking about how GPL will open 10-20% up from its $3.00 close. Anyone else thinking the same thoughts?

http://thehardrigthedge.com/my-investment-journal/

-

Scott J

There's still time, isn't there, for all those folks standing for delivery to be bought off?

ReplyDeleteAs promised, here’s some basics of spot PM trading. Everything that Turd has in his disclaimer at the bottom of the page applies here, too!

ReplyDeleteYou can trade PMs through almost any FX broker. You’ll need to check what’s available in your country, and whether there’s any restrictions on what individuals are allowed to trade. I’ve seen OANDA mentioned here a few times, and also the fact that you seem to be able to choose the leverage you use. If that’s the case I think you should definitely consider using them.

I use SaxoBank’s trading platform, which is offered through various brokers around the world, including two brokers that I use here in Australia. The leverage is 50 to 1 for gold and silver trades. I have heard from some people that Interactive Brokers is quite good.

First, you need to become familiar with FX trading and how it works. Instead of trading USD against JPY, for example, you can trade XAU (gold) or XAG (silver). If you are American you will probably just be satisfied with a long position in XAU/USD or XAG/USD. These positions mean you are long XAU or XAG, and are short USD.

The Kitco spot charts at the top of Turd’s blog page are actually XAU/USD and XAG/USD charts. These are the prices that the media refers to when discussing “the” price of gold or silver. But, you can also trade XAU and XAG against EUR, JPY, AUD and GBP.

The next key difference between regular FX and PMs, is that your positions are in ounces, not in dollars, etc. For example, you might buy 5,000oz of XAG/USD, which is roughly $170,000 worth of silver.

As mentioned above, you’ll need to find out what leverage your broker offers, and whether you can choose the level. 50 to 1 seems to be typical. This means for your 5,000 oz position your broker will take $8,500 of your money as margin.

Here’s where it gets exciting and scary. If silver loses 2% then you’ve lost all your $8,500. If silver gains 2%, you’ve doubled your $8,500. If the 5,000 oz of XAG/USD is your only position, you will want to have probably 4x $8,500 in your account i.e. a margin utilization of 25%.

Next, you need to be familiar with lease rates. Currencies pay an interest rate (but not so much these days, in the case of USD, JPY and EUR!). Gold and silver don’t.

Let’s look at a normal FX position, say AUD/USD. As we are speculators, we are not actually wanting to swap one currency for the other. What we want is to benefit from one rising in value compared to the other.

Continued from above:

ReplyDeleteWhat happens therefore is that each FX position is “rolled over” every night. The rolling over is actually achieved by way of closing the current position and opening another one in an identical amount. It’s referred to as “tomorrow/next” roll or “tom next” roll.

Whether you are paying a financing charge or receiving interest depends on the relative overnight interest rates of the two currencies in the FX pair that you hold. If the annual interest rate for AUD is 6%, then the overnight rate is 6%/360. Let’s say the USD rate is zero, to keep it simple.

The convention in FX is that tom next works like this:

I receive AUD overnight interest rate as I am long AUD - it's like I am depositing my AUD overnight.

I pay USD overnight interest rate as I am short USD - it's like I am borrowing USD overnight.

Because AUD interest rate is higher than USD, it's called a positive carry trade. This means that I gain the interest rate differential for as long as the position stays open. But it’s not quite as attractive as it sounds, because your broker will usually subtract say 2% from the interest rate you are receiving and add 2% to the interest rate you are paying. That’s how they make their money.

Oanda has a good explanation of the end-of-day rollover process:

http://fxtrade.oanda.com/learn/intro-to-currency-trading/conventions/rollovers

OK, that’s it for a regular FX pair. It’s different for XAG and XAU. For example, if I’m long XAU/USD:

I pay the XAU overnight lease rate (because I need my broker to borrow ("lease") XAU in order to be long).

I also pay the USD overnight interest rate as I am short USD.

All XAG and XAU spot trades are therefore negative carry trades. The extent to which they are negative is a function of the lease rates and the USD interest rates. This is where it starts to get murky, because I have never received a clear explanation from a broker of how exactly they are charging me the lease rates. They merely reference the lease rates shown on Kitco, and say that it comes from there somehow:

http://www.kitco.com/lease.chart.silv.html

As you can see, silver lease rates are on the rise, but are still quite low at an annual rate of 1.16%. Harvey recently made reference to increasing interest rates as a sign of physical shortages. I’m keeping a close eye on this.

OK, that’s some basics on the mechanics of trading. Risk management (aka not losing your money) is well covered by many authors. If people are truly interested in trading spot XAG and XAU could I suggest that you assign a fixed amount of money that you are willing to potentially lose. Think of it as your tuition fee. Get to know your broker’s trading conditions really well by asking questions, as much of what I’ve written above never seems to be well explained.

If anyone has come across a comprehensive outline of these trading mechanics I’d be eager to hear about it. I’ve combed bookshelves everyone and not found anything.

Ouch - This looks like the biggest dip since the breakout last Thursday. Does this mean the short squeeze is over? I thought that all the shorts who got caught with their pants down would keep buying as if their life depended on it.

ReplyDeleteHundreds of contracts per minute on AG & AU, selling hard right now.

ReplyDeleteScottJ,

ReplyDeleteI hope you are right about SLX. Got my fingers crossed over here.

Spot taking a beating right now. If this raid continues ..then I guess all hope for rising miners tomorrow are down the drain. ?

Wow this is entertaining stuff. WEEEEEEEEEEEE.

ReplyDeleteWendy, How about a link for that site you are watching?

ReplyDeleteToo much excitement in Turd land. Asia taking a beating, European/US stocks get beat down tomorrow while taking gold and silver along with it. FUWB tomorrow? All out attempt at a tree shake tomorrow. Can you monkeys hang on?

ReplyDeleteOK, who's buying this dip? I am.

ReplyDeleteHang on!

ReplyDeleteSilver is on sale!

ReplyDeleteSilver @ $50 or beyond?

ReplyDelete---

You got to know when to hold 'em, know when to fold 'em,

Know when to walk away and know when to run.

You never count your money when you're sittin' at the table.

There'll be time enough for countin' when the dealin's done.

ee attack!

ReplyDeletehttp://www.youtube.com/watch?v=iMDu0Tk3wH0

Thanks Turdle,

ReplyDeleteI use lind waldock but do very little futures trading as of yet. Youre info is helpful.

Butch

Turd, how did you identify the 3325 reversal point?

ReplyDeleteYou were off by 0001. Great call.

What's it tied to Fibonacci? Prior support/resistance line?

Thank you.

Looks like the tree shaking has already commenced.

ReplyDeleteWhere do you guys check the price action of silver?

ReplyDeleteHammer Time $33.32 and a first bounce. We will all find out together.

ReplyDeleteNotice:

ReplyDelete9:04pm EST MASSIVE volume on the short side

10:02 - 10:09pm EST MASSIVE volume on the short side

Hmmm.... 60 minutes time frame - could be a computer algo.

great call on the 33.25 level turd !

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks reefman :).

ReplyDeletetime to buy at $33.44?

ReplyDeleteSorry, link was missing "http://"

ReplyDeleteTry this:

http://netdania.com/Products/live-streaming-currency-exchange-rates/real-time-forex-charts/FinanceChart.aspx

Dave416 said...

ReplyDelete"Ouch - This looks like the biggest dip since the breakout last Thursday. Does this mean the short squeeze is over?"

It's because the dollar is skyrocketing, which in turn is because the euro is tanking due to turmoil in Middle East + German election result.

I use TD Ameritrade real-time futures. netdania also a good resource.

ReplyDeleteGreat new James Turk blog posted over at KWN

ReplyDeleteIt just bounced off #33.25 like a trampoline.

ReplyDeleteAnd yeah that netdania site is great I just found it an hour ago and have been watching ticks and volume instead of Hawaii Five-O.

I use FX Street:

ReplyDeletehttp://www.fxstreet.com/rates-charts/live-charts/

I have 3 tabs open usually at all times:

Xag/Usd (silver)

Xau/Usd (gold)

http://www.fxstreet.com/rates-charts/usdollar-index/

--

Live candle chart with automatic support drawn + very easy to add your own support/resistance/channels if that is your thing.

-

Which site has volume for silver/gold contracts?

I'l get more interested in the morning....right now let the dollar move define silver....in the morning the buying begins in earnest.....don't forget WB will be shorting this market too.

ReplyDeleteCan anyone give me some help on discovering which miners are hedging?

ReplyDeleteScott,

ReplyDeleteNetDania shows volume. See link above.

How do you check how many contracts are being traded on the Netdania site?

ReplyDeleteAnyone worried about a major dollar rally as the U.S. installs puppet governments in all these collapsing oil regions? And exploits all their resources?

ReplyDeleteDid this post mark "Turds Top"?!!

ReplyDeleteI wonder if your taunting of Blythe was heard...

Turd, are we seeing corrections between 1% to 3% from now on?

ReplyDelete@ Tyler,

ReplyDeleteDon't drive yourself crazy......nothing is an all or none decision. Here is what I would do....if you are successful in trading your stocks, then everytime you have a total of $1200 in net profits, pay $500 towards your credit card, buy $500 worth of metals (or set the money aside waiting for a good dip), and go about your life without flippin out dude...:-).

what about the remaining $200??.....send that to the IRS unless you have big tax deductions.

Scottj88, love the site. I hope it works in linux because kitco is a bust there.

ReplyDeleteOn netdania hit view then toggle volume.

ReplyDeleteTurd,

ReplyDeleteI liked your comment about never predicting the end of the world.

The guy I used to work for had a slightly different twist on this. He always said he looked for the trades where he was betting against the world ending. As the world has faced many problems and not ended yet, he thought he'd usually be right. If he was wrong he wouldn't be around to face the consequences anyway!

Nice call on 33.25 support level!

Arrg you need balls of silver to stay in this up/down market... just had unrealized loss of 10K in the time it took me to type that last post

ReplyDelete@Roger Knights - thanks for the explanation. I probably should be watching the news but can't take my eyes off the silver chart. I'm just watching the 180 day WMA - if I see 2 consecutive 15 minute bars below that then i'm out.

@Turd - definitely need a live chat on the new site so us dramatic types can comiserate on these dips :D Good call on the 33.25 - looks like it held nicely! back up to 33.47 now

I was serious on that email when I said Blythe was in the house. I'm going to start posting pictures of the texts I'm getting from the inside. She losing her shit over there.

ReplyDeleteI am a buyer either way tomorrow, but a nice dip will make it easier. Too much action this week to be on the sidelines.

ReplyDeleteTurdle,

ReplyDeleteThanks for posting. If you have any more information you think would be helpful on that front I'll definitely read it.

Pete

ReplyDeletethere is a volume button, along the top of the forex chart, looks like a cluster of lines.

Tyler

ReplyDeleteif you can make more than 7%, then you should trade, but otherwise you really should get rid of your debt first.

Does anyone know when Andrew McGuire us going to release his latest "news"?

ReplyDeleteQuick note to say thank you very much for all the educational posts in this thread. Us newbies really appreciate you guys sharing your mad skillz. :)

ReplyDeletextybacq, Thanks, got it.

ReplyDeletePete - I thought when I saw that interview that they were being really odd about that. They didn't ever actually say why he couldn't release the "news", and there was something a bit juvenile about it all. I found it irritating, just like the whole wikileaks thing - a tempest in a teapot. If they have something to say, say it.

ReplyDeleteWhy in my mind do I hear that clanking sound as the chains drag the rollercoaster car up the hill only to hear silence just as it falls over the edge.

ReplyDeleteThere will be heavy buying of this dip. Blythe is irrelevant now.

ReplyDeleteFor those that asked about it... I posted a 3 part post in the "Revolution at Home" thread about a friend that grew up in Ukraine during the post-Soviet collapse in the 90's and how they survived.

ReplyDeleteIt's pretty compelling stuff.

No one saw that collapse coming either, did they? ;)

Come on Laddies, These waters are not for the weak of hart If ye thinks ye be ready to sail a beauty, ye better be willin' to sink with her.AAArrrrrrhggggggh

ReplyDeleteLevito, why do you say she is irrelevant?

ReplyDelete@Tyler

ReplyDeleteI have a 5.8% mortgage and I am paying the MINIMUM each month because I am confident I can beat 5.8% with a very conservative strategy.

7% is borderline for me.

I also have a 12% credit card debt. Discover has an offer for a no fee transfer and 0% for a year. Its a no brainer. I balance transfered it. I invest the monthly payments and make profits. At the end of the year I pay it off and keep the profits.

Also, I got 0% APR credit cards (12-18 months). I accumulate all my living expenses on them for the whole year without paying. Each month, rather than paying, I invest the amount of the bill into a trading account and make profits. At the end of the year, I pay it off and keep the profits.

Also, the cards pay 3-5% cash back on living items such as gas, groceries, and restaurants. They are actually paying me to do this.

The key is you have to be disciplined. Many people have the intention to put the money aside all year, make profits, and pay after the year - but don't follow through. Every month, I figure all my bills and put the EXACT amount into a special account. That money is for paying stuff off next year and I will not spend it. Its not mine anymore. I just get to keep the profits.

Dang Dave, I hope it turns out to be a gain for you. I just don't have enough money or guts to trade in this kind of environment.

ReplyDeleteSilverGoldSilver, I didn't know you knew folks on the inside. I would like to see some of those texts! I bet Blythe is going hella insane.

That graph in silver certainly looks like a Blythe attack. How is it they have the resources to short in the Asian market though? Have they attacked in that market before like that?

Sorry, but I ALWAYS get a good laugh out of folks saying silver is down because of dollar strength! Hahhahaahah.... I know, I know, it is technically going up, but still.

I've written a late night update for you.

ReplyDeleteSGS: You're killin us!! Post the pictures!!!

ReplyDeleteDo you guys have any reputable dealers for small (under 50 oz) purchases of silver, that don't have exhorbitant shipping or obscene premiums over spot? The premiums on Lear Capital look better than most and we have a free shipping code but I don't know their reputation. Heck if anyone wants the code I'll post it. Gainesville looks OK and has good reviews. Tulving minimum order is too high, and Northwest Territorial won't ship you anything for 2 months. So just curious of any other sites to price out?

ReplyDeletextybacq and Roger

ReplyDeleteThanks for your input. I should be able to make more than 7% just by buying and holding silver, but I just absolutely hate debt.

Financial freedom must be a wonderful feeling.

Good luck to all tomorrow

Tyler

ReplyDeletewhen my hubby and I finally got debt free I was ecstatic. At least make sure you are paying it down each month - but I liked Roger's shifting to a new card with a sweet deal. That makes great sense.

"Patooty" -- What a great word!

ReplyDeleteBadu

ReplyDeleteSeems like folks here have been happy with these lately:

http://www.gainesvillecoins.com/

http://www.providentmetals.com/

http://www.monarchpreciousmetals.com/

Badu,

ReplyDeleteI have been mostly pleased with provident.com

I've never seen a raid real time before in ticks and volume, I'm showing it to the wife right now and even she is mesmerized by it...

ReplyDeleteThanks for the sites, we may pull the trigger on something tonight.

Badu

ReplyDeleteCheck out those hand poured bars at Monarch. They are so cool.

Monarch also says they are running a special on 90% coin until midnight. No idea what time zone they are talking though. Might only be another 10 minutes. Appears to be about 5% off though.

Looks like Monarch is in Oregon. That would be a couple more hours yet until midnight.

ReplyDeleteH&S target would be from the head to the neckline. That pretty much happened with the move down to 1310. Don't think you can expect more

ReplyDeletextybacq

ReplyDeleteyes I bet you were excited! that's really my goal - it's just a matter of figuring out the quickest way to get there

Badu wrote: ...Do you guys have any reputable dealers for small (under 50 oz) purchases of silver, that don't have exhorbitant shipping...

ReplyDeleteOn this site...

Gold Shark

... you can enter a hypothetical order and it returns the total price per unit from various dealers, including shipping, tax, and insurance. It also shows the BBB rating of the company.

It's fairly new, and I don't know how comprehensive its database is, but worth a shot, and at least worth bookmarking for future reference.

Click SEARCH SILVER at the bottom right to start.

night turd.. no dreaming about Suzanna Hoff.

ReplyDeletehttp://www.reuters.com/article/2011/02/22/egypt-iran-suez-idUSLDE71L01420110222

ReplyDelete@John

ReplyDelete[url]http://google.com[/url]

Question? How are you linking?

Also, very cool website on that goldshark. I just sent it to my aunt, who has been complaining about not knowing where to buy from. Thank you

-

Scott

what happened in the dxy chart atabout 11 oclock central time? seems to have been a gap up but I could not see why?

ReplyDeleteLots of action in silver over the extended weekend, even with "EE" raids tonight. Nice.

ReplyDeleteThe real story to me this weekend, however, looks to be OIL, getting poised ready for rocket ramp up. Trouble in Mideast and too much funny money printed by the crazed Bernank will make it fly like a G6. Still remember the $150 prints back in 2007, and we aren't anywhere near there yet.

Holding some SLV, PSLV, ACG, UCO - we'll see how it does tomorrow.

@Scottj88, HTML codes work in blogspot. I'ved used bold, italics, and links in other blogspot.com blogs successfuly.

ReplyDeleteITALICS test

ReplyDeleteBOLD test

link test

IMG (image tag) not allowed.

Turdlegg @ 7:03 pm

ReplyDeleteThanks so much for the explanation. It's very generous of you to share your time and your expertise, and I appreciate it!!

This sounds really interesting, and I too would love to see more of the mechanics.

Silver has been going down and the NY market isn't even open yet for Blythe to raid. Since I can't sleep, been buying on the dips. Hope we can find some support at 32.60.

ReplyDeleteWill be a rude awakening for those who wake up in the morning.

Wow! What a wild ride...hang on it's o dark thirty near the left coast and we are in for a real head banger today!

ReplyDeleteLooking forward to that OI report. Yeah that dip down to 32.80 @ midnight was like walking off a cliff. ~45 cent drop in ~10 mins.

ReplyDeleteturd,

ReplyDeletewe are now at 32.8

Starting buying back my futures i lost tonight...

FUBM ! 1.2$ down overnight. What a slaughterhouse.

BM is killing the price

ReplyDelete32.4

Holy shit! 32 cent drop in from 32.74 to 32.42 in 30 seconds! @1:15AM

ReplyDeleteThis is the time to be BUYING. Thank BM

ReplyDeleteEE taking silver to the woodshed bigtime!! - dont think this is over yet either...

ReplyDeleteBTFD

ReplyDeleteThe way this is going 31.60 is the last bastion of support....

ReplyDeleteI Think its important to see the big picture here as a war between manipulating powers....the USA and China....thats been going on for some time. being played on the currency and precious metals chess board

ReplyDeleteAlways buy when there is blood and fear...I am starting to smell fear in this board. I've bought £10k so far this morning...

ReplyDeleteOne has to decide what buying the dips means . does it mean buying at 30,or 32 ? or does it mean buying at something like a 50% fib from the low of 26.50 to the high of 34.50 which gives us a buy zone around 30.50?

ReplyDeleteor do you want to do a 50% fib from a low of last august at 18 to the high of 34 and call the buy zone .... 26? which becomes a double dip and a nice place to buy . Is that where China plans to step in and fight the next round? If you were cvhina, where would you start buying?

This comment has been removed by the author.

ReplyDeleteBlythe is ramming it up our collective arses. She is trying to intimate that she can do whatever she wants to by breathtakingly beating down the price of silver 2 dollars in the blink of an eye. Let's be clear folks: unless a SHTF/blackswan scenario unfolds--or unless those standing for delivery hold the line--she will be able to fulfill her mandate in criminally confident fashion, which is to keep us monetarily enslaved so that her worthless paper does not collapse too soon. Pray the longs remain firm.

ReplyDeletethomas,

ReplyDeleteI buy all the way down. If it breaks a support I buy.

thomas - agreed. Also depends on your timeframe.

ReplyDeleteHowever, Silver has too many reasons NOT retrace much. Take the opportunities to add at times like now...and hope for LOWER. More blood/fear, the more profits later...

This kind of takedown is typical when they are very scared, because of the time of day that it started. Had they started their attack during NY hours it would have totally failed. They always start their attacks after powerful surge in price. We had six days up in gold. That's a lot of up days and quite unusual. In the last six months we have had only 2 five day ups in a row, in September and October. I think they suspect a very powerful up day during NY hours or they would not have started this takedown so early. I cannot recall a takedown that started this early before the NY open and this vicious. This attack is likely to last at least two days since last trading day for futures and options is Wednesday. We shall see. The first five days of last month were down days the only five day down period in the last six months. Who knows when this kind of criminal activity will ever end. I suspect only when Blythe is in prison or JPM crashes. Maybe the entire monetary system has to collapse first. Had it not been for the holiday, they would have started the attack on Monday. Thus we have this very rare six up days in a row.

ReplyDeleteand now, after this raid.... what will the charts look like. Is this candlestick going to look like a pin bar? Are the engineers going to paint a frightening chart? Personally I never buy the new high breakouts for this reason. I try to buy at the lowest bottom. Yesterday I was thinking that might be around 30. But watching the power of the raiders playing their game shows us at least what they are still able to do. That tells me to stick with my charting of last week which is expecting a retest of the january 25 lows .

ReplyDeleteThe emotional test for investors is to be patient,dont fear that you'll miss out by not buying now. Choose a price that is comfortable and desirable to you and keep doing all the technical analysis to see if things are heading that way,in elliott waves, and fibs and s/r levels,etc... and never go all in on a single buy. scale in .

This soaring surge up was impressive and the plunging power of the raiders is equally impressive. I'm calling it a draw and sitting on the sidelines for a few days maybe. and sticking to my plan of wait and see how far down it can go before I buy more.

@bobsmith5 - agree 100%.

ReplyDeleteI will buy more Silver near 32.20, 31.60, and 30.50 should we reach those levels...I suspect not.

yes, Bobsmith5 ,I support your thoughts .

ReplyDeleteI think the Chinese help them do this so they can come back in and buy at a better price with their worthless fiat dollars. Probably a condition the Chinese impose to keep them from dumping their ever so cheapening dollar reserves. I should get quite interesting when NY opens at 8:15 AM NY time.

ReplyDeleteDown almost 5% from the high, Guess BM is doing all she can to survive although offering more silver to buyers who stand for delivery will only compound the situation. Guess it all depends if the longs stand up for delivery then......

ReplyDeleteCounter attack in progress - this all hinges on whether the OI is high enough... - That was probably the most vicious attack ive seen, and in the dead of night US time..

ReplyDeleteLets see if this breakout can be sustained..

Whoooosh!

ReplyDeleteholy beatdowns it's like the entire weekend never happened - That $2 gain in the past two days was wiped out in 8 hours. Whoever said that he has pictures of Blythe sweating: sorry, it looks like she's fully in control here. Max Pain for all the MAR 35 call holders too (looks like there are many). What happens this week is anyone's guess but dam i can't wait to find out!

ReplyDeleteDid you really think it would be that easy?

ReplyDeleteYou boys really have no idea what your up against.

B

yes Blythe we do: Mutually Assured Destruction: if you can't win then nobody can and you'll take down the entire frikin bank with you if you have to. brilliant

ReplyDeletebuy buy buy :)))

ReplyDeleteDid BM sell off copper and attack silver at the same time? If so, this is probably the last line of defense for JPM and the silver shorts. It will be interesting to see how effective this tactic will be.

ReplyDeleteAfter a run up like that there was bound to be some profit taking. No need for paranoia to explain the price action.

ReplyDeleteBuying opportunity

This is way way more than profit taking Miked

ReplyDeleteI agree, but seemed to be recovering after the London A.M. fix, at least for now??????

ReplyDeleteThis is what I mean by Patience.

ReplyDeleteIts a heavyweight fight between JPM and China, (yes,china shorting to buy back with worthless dollars ) and the chessgame is far from checkmate. Lots of things to examine now. Looking at how this volatility affects the mining stocks...which ones look stronger in the face of all this... I'll be curious to see how PHYS and PSLV moved during all this time,and tomorrow and the next several days. along with the phony usdollar movement. all a curious game in the grand casino.

I like Great panther listed on the big exchange now but want to see if it corrects to some price more appealing than 3 dollars.

same with all the others.

Its hard to think of buying SLW now when it was just 28 a while ago.

just like all the others.but look at BVN...what a soaring rise and plunging fall. or IVN.... so volatile. they seem some of them, like bubble stocks overpopular and extra volatile.

I like the more steady ones like AZK and SVM myself.

There can be a checkmate only when there is no physical around, there is no other way to bring the EE down.

ReplyDeleteI just brought 1000 OZ & Plan to buy more if prices will fall further.

In a few months I will be happy about it!!!

Buy Physical only

Looks like Silver is ready to make a stab at moving up thru the $33 resistance

ReplyDeleteJust bought! Here kitty, kitty!

ReplyDeleteBobsmith, we have only retraced 50% of the last upleg since we broke to a new high. It's really nothing abnormal.

ReplyDeleteIf anything I would say the big drops were a long squeeze as traders who bought at the top with too much leverage were forced out.

Reading through the comments, no one seems to have given the Turd his props for calling the overnight action almost perfectly.

ReplyDeleteHere's to the Turd

Now let's see if he is right yet again and we see them (WB?) rally into the open.

It is very much like watching a chess match or a prize fight, isn't it?

Reverse Head & Shoulders forming on 4hr chart now...unless/until it morphs into something else...lol Neckline ~$33 Watch for the break up..

ReplyDeleteeveryday price goes down, 1 more opportunity to buy while the price remains at these levels. For those readers who don't have metal, both gold/silver, purchase some and convince your friends & family to do so as well and diversify their portfolio. They will thank you one day.

ReplyDeleteHey this is urgent!

ReplyDeleteit seems for me here in germany www.kitco.com is down, apmex.com is down and goldprice.org is down, can anyone confirm quick please ??!?!

Not so Unky. I see them fine

ReplyDeleteunky,

ReplyDeletechecked all 3 sites and could reach them.

hmmm i was just wondering, because on top of this blog here it doesnt show the kitco charts as well, now kitco seems to work again also but apmex.com i cannot load the website still. well, maybe just my providers problem here, i guess

ReplyDelete@unky

ReplyDeleteThe best way to find that out is here:-

http://www.downforeveryoneorjustme.com/

Unky,

ReplyDeleteany chance teh German government are leaving the euro, and launching a new gold-backed Mark?

Could explain the inability to get a gold price!

The line in the "movie" about going all in and selling everything possible has turned out to be rather prescient, wouldn't you say?

ReplyDeleteWhat happens in the next hour Turd?

ReplyDeleteHaha, just bought 100,000 JP Morgan PUT Warrants at $35..... Got Til June 17 for them to CRASH!

ReplyDeleteLoving your work Hillsie.

ReplyDeleteIf you paid with a JPMC credit card, you are my ultimate hero!

Took a punt on the FTSE at 5000 too....Bring it all down! ;-)

ReplyDeleteBlythe isn't even logged into her bloomberg now, she might not be even coming in after the raping she saw on emails from London yesterday...

ReplyDeleteDon't worry guys, just buy this dip, as noted above the fact that its gotten raided this early is clearly a move by her London based slaves to have the longs wake up in NYC only to see Silver down vs being up strongly earlier and close out there positions.... Don't fall for it, just BTFD!

The Strippers are buying

ReplyDeleteI have an update posted for you. I'll have another one in about an hour or so.

ReplyDeleteHey guys and gals. I'm new to the board....just bought 500 oz today. what is FUBM?

ReplyDeleteTurdle GG, thanks for posting that!

ReplyDelete