As you know, much of what I do here is pattern recognition. My technique works because:

1) We are in a long-term, bull market in the precious metals.

2) The fundamentals are overwhelmingly positive and not changing anytime soon.

3) The metals are openly manipulated and capped by an increasingly ineffective Cartel of bullion banks.

When you combine these three elements, you get patterns of behavior that repeat and become predictable. Tonight, I found something else for you to consider as we enter the last 10 days of April.

Remember, "first notice" day for the May silver contract is April 29. This is the day by which any May contract holder that wishes to exercise his contract for 5000 ounces of physical silver must have on deposit in his account 100% of the purchase cost. Its kind of a "put up or shut up" day. By the 29th, most folks will have rolled their May contracts into the next delivery month of July. However, some will stand for delivery. The question is, how many? In November of last year, we were all aflutter that the Comex might break in December. As an example, please read Harvey's post from November 18, 2010. Note the price action, the volume and the open interest numbers:

http://harveyorgan.blogspot.com/2010/11/silver-remains-explosiveopen-interest.html

Obviously, The Comex won their game of "chicken" in December and the focus eventually turned to the next delivery month of March. After reaching a low at Turd's Bottom in late January, silver was rolling by mid-February. As another example, read Harvey's post from February 19, 2011. Again, note the price action, the volume and the open interest numbers:

http://harveyorgan.blogspot.com/2011/02/silver-explodesmiddle-east-problems.html

As we all know, after much chagrin and grinding of teeth, The Cartel managed to settle all of the March longs and now the focus has turned to May. As your final example, think about the recent price action in silver and read Harvey's latest for today, April 19, 2011:

http://harveyorgan.blogspot.com/2011/04/silver-within-inches-of-4400-at-comex.html

OK, so what's the point...besides the obvious fact that Harvey simply recycles his copy every 60-90 days?

The point is pattern! As we approach first notice day, the pattern seems to be the same. A rally in price from mid-month until about the 22nd. A Cartel-induced selloff for 2-3 days designed to "encourage" those considering standing for delivery to roll forward, instead. Then a rally into the end of the month.

Here, see for yourself:

There is simply no reason not to think that this pattern won't repeat again this month so be prepared. As you know, I am long May 43s, 44s and 45s. I plan to be out of them all by Thursday noon, at the latest. Then, I fully expect to buy a dip by the middle part of next week. I will ride my new purchase to the new highs that will come the first week of May.

That's it for tonight. Learn it, know it, live it and get ready for tomorrow and Thursday. TF out.

9:00 am EDT UPDATE:

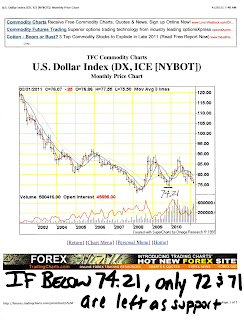

No funny pictures this time as this is getting serious. The US$ is in some deep doo-doo. Look at the action overnight:

The cascade stopped right at its current last line of defense of 74.21 cash. As you can see from the chart below, that level must be defended here.

IF 74 gives way, the POSX will quickly plummet toward its final support of 72 and then the intraday low of 70.81 set back in March of 2008. Below 70.81 lays a new world reserve currency system and all that entails. Therefore, expect all kinds of SPIN and MOPE over the next 36 hours. Fed hacks will be rolled out to give hawkish speeches. Politicians will sound conciliatory. One of the PIIGS will be brought front and center again. Whatever it takes to halt the slide and preserve the ponzi will be attempted. It won't work. Oh sure, maybe it'll work for a few days or weeks, but I think we are getting awfully close to a US$ meltdown and corresponding PM meltUP.

I'll let this sink in for a while and I'll be back with a new thread in about 90 minutes. TF

This comment has been removed by the author.

ReplyDeleteTurd, do you wear those 3D glasses to see those patterns?

ReplyDeleteGood work by you.

Isn't the COMEX/Globex closed this FR?

ReplyDeleteit's broken 44!

ReplyDeleteI've been thinking of buying June $45's... while hedging with Q's or SPY's and others on puts.

ReplyDeleteThanks Turd. That helps me to reassess where my stops are. I probably need to lower them a little.

ReplyDeleteIt's just a Turd thing - he keeps wanting this Friday to be open, but he means Thursday. Interestingly, this totally aligns with afrum's call which is based on the FOMC meeting and the Bernanke speech as well.

ReplyDeleteThank you for going back and comparing those, Turd - very interesting.

JoeKa - at the end of the last thread you suggested differently - can you explain your thinking please?

Re: Jim Rogers...

ReplyDeleteFirst, I am a HUGE fan/student.

Second, after reading the interview, how could anyone think that what he said is inconsistent with what 99% of us here say/think everybday?!?!?

I think people need to re-read the interview. I think what he basically said was sage advice and fits my strategy... Ride the lightning up, watch the dollar, watch other asset classes for what is hitting 30 year lows (e.g., real estate), and transfer metal (not all of it) there.

Trust me, Rogers is not Buffet... Rogers would be a friend of this board, but full of good warnings.

If you thought he was saying that we've got it all wrong here on this blog, go back and reread!!

This is from ZH story on options:

ReplyDeleteApril 21st, Holy Thursday: day before a holiday

April 22nd: Good Friday: CME Closed

April 23rd,Easter Saturday: Markets Closed

April 24th,Easter Sunday: Markets Closed

April 25th, Easter Monday: LME Closed (Largest Physical Bullion Exchange Worldwide)

April 26th, Tuesday: May Options Expiration CME

Last trading this week for Comex/Globex is Thursday night, NY time?

Good work Turd.... I am out tomorrow or on the open Thursday.

ReplyDeleteAt some point, does the cartel recognize that its schemes are being gamed by its enemies and alter its tactics accordingly? Placing us another degree removed from tangible reality, whereby the cartel bases its tactics on what it thinks we are thinking, and we base our investment timing and strategy on what we think the cartel thinks we are thinking?

ReplyDeleteOr does the cartel not give a shit who rides its coat tails to a few thousand or million, as long as the big boys get their billions?

Finnegan, I think the room for TBTB to zig when we zag is closing fast as math backs them into a corner. That won't stop them from outlawing math, but I think that happened with QE1.

ReplyDeleteFrom Daniel FCB:

ReplyDeleteWe're all Turd fans here, so here's the latest from another Turd fan, Jim Willie, entitled, "50 Factors Launching Gold."

http://news.goldseek.com/GoldenJackass/1303243200.php

atlee, kiwi, in the woods and other "friends of AGQ"....

ReplyDeleteWell, with Turd's post above, and given no change in his assessment prior to close on THURSDAY, that's my plan for AGQ.

Finnegan: We are but miniscule fish...plankton in the ocean of Cartel whales.

ReplyDeleteWe can game this pattern and absolutely no one will notice.

Turd you really need to set an alarm clock for Thursday. Memory lapse there and you're in the market for the weekend!

ReplyDeleteThanks for posting that up. Will make less traction for the trolls next week should the dip we've seen before roll in on time.

Btw, I fixed the Thursday-Friday thing. Just a brain cramp/habit of always thinking weeks end on Friday.

ReplyDeleteFinnegan,

ReplyDeleteRight now think of us as a few oxpeckers on the back of a big old bull buff. He know's we are there but isn't to bothered because we are feeding off his ticks. But when too many oxpeckers pile on it will get irritating for him. He will begin to thrash about a bit (and some of the oxpeckers will get thrown) until one day there are so many oxpeckers he eventually finds himslef bleeding to death and the only thing his thrashing about will accomplish is to deplete his already sparse energy reserves. Isn't it great to be an oxpecker??

Eric and anyone else LONG canned bacon.

ReplyDeleteSwap canned bacon for all the canned cheese you can find. Just opened my first can of cheese from my full case to celebrate busting $44/1500. Canned cheese is the bomb! Bacon is silver but cheese is gold....I'm holding till try pry my cold canned cheese out of my fingers.

Can't wait for tomorrow, Turd. Thanks for all the ways you look out for us. You're the best, I mean it!

I just realized something: When I open up that $1k account later this week, and use no leverage a 1 pip drop will cost me a dollar...So, if the spot price drop $1, I'm out and that kind of a swing is possible! Man, and I was thinking about using 10x-20x leverage! Are my calculations right or am I missing something?

ReplyDeleteWhat's the next big delivery month after May?

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteTime for a 'Feed the Turd' donation. btw, if you are new to this blog the donate button is located under the Crude chart.

ReplyDeleteMany, many thanks!!!!!!! (now I'm exclaiming like afrum!)

Black Hawk

ReplyDeleteHelp a buddy out here. Looking for a long term chart on the cheese-bacon ratio. Anyone?

TF, many are looking forward to your interview on the forum.

ReplyDeleteTake a look at how high gold ranks in the assets pyramid.

ReplyDeletehttp://lonerangersilver.wordpress.com/2011/04/17/john-exter%E2%80%99s-inverted-pyramid-of-assets/

Turd said:

ReplyDeleteEvery couple of weeks, I write something that I think is special, unique and actually adds value. I just did it again

I wholeheartedly agree. An excellent post.

@Walt

It was not made using visual basic, only google spreadsheets. It was very quick and simple as it is simply a reproduction of Jesse's made live.

Fed Ex says my canned bacon is coming tomorrow!!

ReplyDelete(doing the dance of joy)

Not a lot of time between Thursday and end of May Options Expiration on Tuesday.

ReplyDeleteI would probably end up waiting for the funds to be available and get skunked again.

Is this abnormal or not?or should I say significant.

ReplyDeleteHarvy Organs blog

Deposits to dealers inventory

Tue 19.....................................?

Mon 18 ....................................0

Fri 15 ....................................0

Thur14 ....................................0

Wed 13 ....................................0

Tues 12....................................0

Mon 11 ....................................0

Fri 8 .....................................0

Thur 7.....................................0

Wed 6.....................................0

Tues 5 ....................................0

Mon 4......................................0

Tues 3.....................................0

Mon 2......................................0

Thurs31....................................0

Total accumulative withdrawal of silver from the Dealers inventory this month.........701,400

""Now ladies and gentlemen: please pay note of this next piece of data...the confirmed volume at the silver comex yesterday came in at 185,250. In ounces, this is represented by 925 million oz or 132% of annual silver production. And the comex is not the biggest silver bourse which belongs to London England""

@Xty: it doesn't matter what I think. What the market is telling me is more important. I'm completely in agreement with TF and my investments are aligned majorily (is there such a word!?) with his analysis.

ReplyDeleteI just think this week is done in terms of major price action - and no I did not submit a week closing price target either so I don't qualify for totally cool Yellow hat to go with my green hair.

Either way I've got enough dry powder to exploit dips (small or otherwise) or if the market is telling me that today we will get an explosive price up. My core positions will benefit from that.

Again, I always defer to our master prognosticator TF, from whom I've learnt much.

Humbly yours,

JoeKa

Turd,

ReplyDeleteThanks again. It most certainly does add value.

I wonder, given that this would be the third time in a row, whether big money players would not also see the pattern, such that any dip would be more shallow due to traders jumping over each other to BTFD.

The AGQ friends - I'm holding a piece no matter what to test a plan and perhaps the cartel tries a change. If I get a dollar dip tomorrow I'll ease in and then out Thurs.

ReplyDeleteYou know, we are coming up with an awesome survival sandwich - I say trade 3/4ths of your bacon for cheese, take a small position in sprout seeds, and you are off to the races. The bread is more difficult. I understand that the US military has managed to make almost everything edible and non-perishable, except for bread. I have eaten an army meal, and truth be told, the 'bread' was inedible, even the dog wouldn't touch ut, but he loved the 'stew'. I could only stomach the instant coffee, and that was a stretch.

ReplyDelete"Finnegan: We are but miniscule fish...plankton in the ocean of Cartel whales.

ReplyDeleteWe can game this pattern and absolutely no one will notice."

Absolutely priceless!

Spot on analysis Turd, I believe your analysis to be exquisite. I have also come to this conclusion, the truth lies in the cycles!

ReplyDelete--

For any early birds, I will be on my friend's free speech radio show tomorrow morning at ~~7:05-8:00am EST (don't know how long it will go for).

We will be discussing gold/silver/us dollar/miners/etc.... He says we will have some callers, so if any of you have nothing better to do than have a conversation with us, feel free to drop by. My friend's show has featured Lindsey Williams before, and knows a lot about the gold/silver markets himself.

(streams on I-tunes)

http://wmbr.org/WMBR_live_128.m3u

Not really sure what it is going to be like, but should be fun.

Scott

Thanks for this Turd,

ReplyDeleteappreciate it will be looking to reload next week.

took some off the table during the globex run today and happy to sit on a nice gain till the next opportunity presents.

Great question Finnegan,

I believe we are well under radar at this stage for sure.

But Once I see a line to BUY metal at my local coin shop, instead of the line of folks I find Gleefully trading coins and silverware for a fist full of paper, that may be different, perhaps then the mass will be large enough to be detected?

Then what?

Who is Turd Ferguson?

ReplyDeleteI had to say it :)

Occam's Razor and the Precious Metal Markets

ReplyDeleteIn nine years of being 100% invested in this sector, I have never seen anything as blatant as the HUI action this week. How ANYONE watching this sector, particularly a gold/silver "expert", can give any other explanation of what we saw this week (and this year for that matter) other than government manipulation, is beyond me.

http://www.silverbearcafe.com/private/04.11/occam.html

This is an absolute must read for all who know the PM market is manipulated.

Joeka - not trying to give you a hard time - I really want to know - because I am going to ride this out, and you implied you thought next week would be a tear - and i agree. I don't think the usual drags on silver will have much effect. Not disagreeing with Turd's assessment, just think the dip won't be very significant.

ReplyDeleteOil, PMs, asian equities, carrytrade (AUDJPY) - everything moving up strongly. Asian market takes us to $1,500? Would be a pleasant surprise.

ReplyDeleteAnybody want to take a shot at Harvys numbers?

ReplyDeleteIm not sure what to make of it

Happy et al....

ReplyDeleteThat's why I told atlee originally that I'd probably leave 25% in over the weekend.

44.25 and rising. Gold beginning to show signs of life too.

ReplyDeletelooks like a blast off starting in silver and gold

ReplyDeleteXty I agree with you, I dont think the correction will be large .

ReplyDeleteS'funny. I had an Harvey Organ comment of my own waiting for a new forum.

ReplyDeleteEvening folks. Thanks for the new haunt Turd.

I checked out Harvey Organ's blog a little bit ago and I thought it interesting to note that the PSLV premium to NAV is 22.95% as of Monday.

Apparently the COMEX is late with their numbers the last few days.

Turdle GG - I think we are going there very soon - like in the next hour if not minutes.

ReplyDeleteerg - PSLV's premium is really amazing. Robert brought to life a cool spreadsheet that compares premiums, and I can't help but feel that PSLV represents the 'true' price of silver.

ReplyDelete@Xty: Hey none taken Xty! Absolutely, these so called 'dips' if they come must be bought. Which is why i trimmed my periphery profits bought on large contract sizes yesterday earlier this morning.

ReplyDeleteOf course if I held it til now, it would have been better. But profit is profit is profit. Plus I've cleared margin depth of +1000% to buy any 'dip' meaningfully - I trade XAGEUR and XAGUSD.

As it stands currently, the core positions are smiling now because of the current price action. Volumes again though, are low.

I am intrigued by TF's pattern of the selling next week. In my mind, I'm already apportioning the powder necessary to take advantage.

Man, this blog rocks!

HAVEFAITH,

ReplyDeleteIf you are still around.. thank you again for very kind words of encouragement.. I'm sure you and I would be great friends ;) ..Didn't mean to accuse you of making fun of anyone.. just couldn't believe you were talking (seriously) to me. ..lol.

Have to say about honesty & humility since you caused me to think about it more ..It's usually the people who have been the most arrogant and have fallen the hardest who will either be the most hardened or the most humble. I am just grateful for forgiveness, 2nd chances, and redemption!! !!

I'm still in the middle of the Leuren Moret video. Very scary stuff to think about and come to grips with. Thank you for sharing this because it needs to be considered.

ben13,

ReplyDeletethanks for the article "Occam's Razor and the Precious Metal Markets". If I had the chance to ask the author one question, it would be:

If the manipulators are so effective, why have they allowed gold and silver to rise so much over the last 10 years?

Turd,

ReplyDeleteThank you for the analysis. Question: What happens to the miners? Obviously, I have my homework to do with these dates and my miners.But will this pattern work for the miners as well? You speak for the options market. Many of us trade the miners. Any thoughts? I, and many of us, would appreciate your guidance here.

SSK

I'm wondering if this pattern has any effect on mining stocks. Although, given the direction of mining stocks lately I wouldn't be surprised if they continue down regardless of what happens with the spot price.

ReplyDeleteI'm digging this low $1490 to high $1490 ping-pong trading range. The buy and sell bells just keep going off on my computer.

ReplyDelete$ $

<

\_/

JoeKa - you said a mouthful with this sentence:

ReplyDelete"Of course if I held it til now, it would have been better." But you are wise - that is the greedy road to ruin not taken a million times before. Easy to be right with hindsight. And as you say, now you are loaded for bear. Trading/investing is odd because there really are a lot of 'correct' strategies.

Hi All,

ReplyDeleteIve been watching this blog and some of its counter parties for sometime. I'm just curious to know something....based on everything I have read here, is the general belief here that the dollar is to collpase into oblivion taking gold and silver coinage back into main stream use? If the end of the Keynesion experiment menas gold is going to finish at 10,000s of thousand dollars an ounce, is it not true to say just holding 20ozs or so will make a man relatively wealthy?

Jim WIllie has a new one out. "50 Factors Launching Gold"

ReplyDeletehttp://www.kitco.com/ind/willie/apr192011.html

if the dollar collapse significantly faster than it has i recent decades, what will the US govermnent do?

ReplyDeleteEric - OK, here's the deal.

ReplyDeleteCanned bacon, 12 (so sad) 9oz cans/case = $130

Canned cheese, 36 (wow!!) 7oz cans/case = $120

cost/oz (standard not troy) ratio = 1.2:.48, about 5:2 ??? How does this chese:bacon trade look long term? The fat's gonna be in the fire.

Bungsam2,

ReplyDeleteThe answer is "could be". (Maybe someone will give you a different answer.)

You should buy Mike Maloney's "Rich Dad's Advisors: Guide to Investing In Gold and Silver: Protect Your Financial Future" That will give you a more complete answer. It costs $10 or $15.

If you are asking that question, you should buy that book and read it ASAP.

Just a little tidbit post for fun:

ReplyDeleteJPM share price tonight $44.70

Silver price tonight $44.28

Bungsam2 - wealthier than a man with none.

ReplyDeleteArgh. Third attempt at making this post. Could've remembered the Ctrl-C on the second attempt...

ReplyDeleteSilver making 30+ yr highs every few hours, I am getting the heebie jeebies about not being able to buy physical fast enough. Still wedded to the idea of risk aversion thru dollar cost averaging, despite clear indications this is not appropriate in the current scenario.

I know Turd posted a piece about talking to relatives about PMs earlier: Absolute Advice For Relatives. But if anyone has success stories about convincing a hardheaded spouse (or becoming convinced oneself) about the fundamentals regarding PM, it would be much appreciated.

thanks for the "forecast", Turd. I'm hoping to buy another chunk of physical on any dip!

ReplyDeleteBy the way, your current "pattern" repeat coincides perfectly with what I'm seeing on the Bradley Siderograph! a weak are in terms of strength around the 27th-29th, give or take a day or two.

http://www.alpheefinance.com/

Hit the green "stock ratings" button on the left and read the "Help" link to find out how to work the pattern generator!!!

Alphee is old and has been sick. Release of the update of the separate updated module is up in the air at this point. I heard him speak years ago...he's really brilliant!

Anyone willing to trade a share of JPM for an oz of silver?

ReplyDeleteMe either!

In addition to my previous question, a family member just posed one that had me stumbling. I appreciate any advice or thoughts :)

ReplyDeleteOriginal question:

I just realized something: When I open up that $1k account later this week, and use no leverage a 1 pip drop will cost me a dollar...So, if the spot price drop $1, I'm out and that kind of a swing is possible! Man, and I was thinking about using 10x-20x leverage! Are my calculations right or am I missing something?

Second Question:

I understand the concept of a margin call, you lose your equite so the broker closes the position because at this point it's his money at play and you have no "ownership" unless you deposit to bring it up above the requirement.

But what happens when you don't use any leverage and say, to tie this to the example above, spot drops from $44 to $43, wipes out your $1k position (I'm not including fees,premiums,spreads) and your position is at $-1000 and balance at 0. Does that position get closed and you need to reload your account or because it's your money that you used, you can wait until spot returns above $43 bringing your account balance to positive territory.

Man, I wish I could feed the Turd AND the helpful folks here! I appreciate your help guys!

Thanks Turd.

ReplyDeleteAfter reading the ZH post, I got spooked about saying geared up over the holiday weekend.

http://www.zerohedge.com/article/options-risk-manipulation-and-may-silver-40-calls-fmx-connect-special-parts-1-and-2

I assume Part 3 is yet to come, but the conclusion is pretty obvious: it will be cheaper to drive spot prices down during the quiet times on Thursday night and Monday towards the massive pile of open calls at $40 which expire on Tuesday than to eat the cost of those calls being excercised.

CMEGroup.com right now shows open interest at $40 to be 4667, or 23.3 million oz... about $100 Million in losses for the writers of those calls. That is a lot of motivation to drive prices down.

You have just confirmed my desire to back off the leverage before the weekend, and come back Tuesday for the grand finale next Friday.

CD

ReplyDeleteIt's always easiest to get them interested (or at least not hostile) purely on the basis that the stuff is going UP. Everybody likes something that is going up. THEN, start in, a little bit at a time, on WHY it's going up.

When you have cup and handle formations forming in gold within the upward consolidation creeping to 1500, you will eventually trap the algos.

ReplyDeleteAll the gaps are being filled and there is a lot of bullishness going on... wow impressive to watch.

I am not an expert in TA, but checkmate seems close for gold. It is going to have to make up its mind... Wonder what kind of volume it would take to bust through 1500 though...

And for those fellow Turdites playing options, here is an elementary but useful tool (I used to make these in Excel): calculating call/put strike price pain points through a calculator. (h/t Theta Burn on ZH)

ReplyDelete@Xty: and I'm loaded (and still carrying) for Bull too! :)

ReplyDeleteUr right...there really are many 'correct' strategies.

Only the way of the market is the 'right' one.

Have a great night everyone and sweet dreams!

BlackHawk

ReplyDeleteI better lay in a case of cheese and do a little of my own DD ;)

I know it's a good problem to have, but the silver market makes me feel like a chump when I take profit at 125% gains only to see it go to 200% a few days later (talking options here). I'd be interested in hearing profit taking strategies from other options traders.

ReplyDeleteI had SLV May 37s a few weeks ago, at 50% profit I sold to buy June/July options while they still seemed cheap compared to what was coming. If I had held on I'd be up... 400%? Nuts.

Blackhawk, Eric-

ReplyDeleteI saw an ad that that my favorite canned bacon company has a new mobile phone app, they do free shipping on your first order.

You've heard of HAMPEX, right?

(sorry, couldn't resist... ;-)

Bungsam I'd say that the 200oz might not necessarily make one wealthy during the Keynsian collapse but rather maintain roughly the same buying power that 200oz can purchase today. You could buy the same amount of groceries after the collapse that it can buy today. ....at the very least IMHO.

ReplyDelete@Eric - thanks, will keep trying. Just not easy to explain a paradigm shift to someone whose idea of safe (and therefore advisable) investment is a) cash in bank or b) functional real estate. Buying a home to live in where I am is not feasible for me right now, can't afford/don't want to risk buying a rental property a continent away where I can't oversee/take care of it. Just getting more and more nervous about savings in fiat in bank account. FDIC insurance be damned, they take it a little each day not all at once...

ReplyDeleteWow. For the price of a case of canned bacon, you can get a pressure canner, parchment paper, jars, AND BACON.

ReplyDeleteThis is not a skill you want to try to learn when the pressure is on (sorry, pun). We're canning bacon this weekend (hat tip, Eric #1).

Also cheese is easy to make. Up your games.

This comment has been removed by the author.

ReplyDeleteOn a more serious note, I appreciate the insight on the coming silver roller coaster ride, but I may just stick it out with the AGQ I have...with the big jumps in value, a 2$ drop in silver does not seem like a huge deal... but it does make me think I'll wait to buy more until the big dip is done the middle of next week. Thanks Turd!

ReplyDeleteXaritas I don't know how long you've been trading but at some point trying to max it out turns into a burn. Talked to many in real life and they all have a story or two or....

ReplyDeleteFairly new myself and so happy to be booking good profit that I ignore what I miss and count what I get. Started off wanting to offset the devaluing dollar and beat the performance I've been used to. Way ahead on both counts.

Some excellent resources on this board and I hope you get closer to the 200% than the 125.

@F

ReplyDeleteI gave it a shot but I guess Turd deleted my response because it was there and then it was not.

I think I invoked the wrong argument for this site.

@Xaritas -- simple/stupid solution: sell 50% at 100% gain (your initial investment is covered) and let the rest ride with trailing stop to next (calculated) target. Pure gravy from there.

ReplyDeleteMore refined version is to break up into smaller chunks (sell 25% of position at 25% gain, another chunk at 50% and so on). This is just my vague recollection from other people's advice, but don't have a handy link to share right now.

Here's something I need to know. In my entire options trading career ..which goes alll the way back to March 30th :D ....I have wondered about this so thank you in advance whoever can get me thinking in the right direction on this.

ReplyDeleteBasically, I read where Turd will sell his silver calls by Thursday at noon. I also remember OldNavy talking about liquidating some SLV calls prior to the madness that will most likely be next week. I get why they are doing it.. taking profits off the table in advance of a beatdown in the metals price. What I want to know is why this is a better strategy than just leaving your calls alone and letting silver rebound. Everyone seems to be of the same mind that silver will probably get to $50 by summertime. I have ITM May SLV calls and I'm trying to figure out whether it's always better to take them down or ride out a dip and rebound. How do you decide? Wouldn't you make more money by leaving an ITM call alone to dip and then rebound? I of course can't buy back in to my May37 calls as cheaply.. ..but then I don't want to lose all of my profit either. I keep thinking about it one way and it makes sense to ride it out.. but then I can also see the other side of the equation too. So basically at this point I've thoroughly confused myself.

How do you decide when to hold and when to fold on these calls?

Bungsam2,

ReplyDeleteBy the way, you are asking the right questions and you are probably in the right place. But I don't know how much people can answer your questions here. Buy that Mike Maloney book. Also check out "why buy silver?" and "why buy gold?" on youtube.

Don't wait to do these things. Start buying some gold and silver quickly, even if it is just $100. (youtube "how to buy silver").

F said "Who is Turd Ferguson?"

ReplyDeleteROTFLMAO!

Does that make this Turds Gultch?

Meant to add.. ..So far all I've actually done is BUY calls.. ..Haven't actually SOLD any yet. ......The buying part is more comfortable to me for some reason. ..The selling part is making me nervous.

ReplyDelete...I guess shopping (spending money) comes too easily to me. I really need to get more comfortable actually making money.. ..I'm my own worst enemy. :D

"I AM TURDICUS!"

ReplyDeleteOkay, enough silliness, off to bed.....

Portland Community College, Oregon State, and Washington State are all offering canning courses this summer, if you want to learn to can more than just bacon.

ReplyDeleteCookie,

ReplyDeleteAre you saying that man can't live by bacon alone?

(Don't tell Eric)

Orko had a huge day today. Get yours before they are all gone. Either the shorts were covering or people here got on the train. Pardon my excitement but I've had ORKO for 3+ years and I'm having a Jesse Livemore moment.

ReplyDeleteOrko is bringing home the bacon.

Xaritas

ReplyDeleteYou've probably heard this a thousand times, but it's true: Bulls make money, bears make money, but pigs get slaughtered. In other words, EAT the bacon, don't BE the bacon! Oh, oh, I gotta stop now.

Seriously, let us know how that canning thing goes. Several on the blog will want to know.

Walt,

ReplyDeleteIt depends on the size of your position. With $1000, a 1000 oz position will wipe you out on a $1 drop in price. A 500 oz position will wipe you out with a $2 drop in price. If you only put $1000 in the account, I would try to take the smallest position possible, maybe 100 oz, and try to build it up from there.

This comment has been removed by the author.

ReplyDeleteHmmmm... another day of those damn PM miner blues...

ReplyDeleteNo sense cryin folks.... just ask BB... the thrill of 5% daily returns may be gone right now but they'll be back.

http://www.youtube.com/watch?v=lt2c9Iyq2UQ

You just gotta have faith....

http://www.youtube.com/watch?v=eZQyVUTcpM4

Sim

ReplyDeleteIf you are skipping ahead to paradigm shifts, you are getting way ahead of things and losing people. Keep it simple. Something like this:

Seen the price of gas lately? Yeah, me too. I'm earning squat on my savings account, not getting a raise, and I'm not keeping up at all.

Would be smart to just buy 500 gallons of gas right now and lock in the price. But how do I keep it? In my front hall closet? No. Would if I could, but I can't so I won't.

But you know silver has a pretty long history of going up when gas goes up, and down again when gas goes down. You can't store 500 gallons of gas, so how about a couple rolls of Eagles?

@Turd

ReplyDeleteI tried to offer an answer to F's question a second time and carefully rephrased my wording. The comment is briefly showing up before disappearing. Is it possible that this is the spam filter? Or are you deleting my comments? I am assuming not because you recently said:

You are welcome here. All opinions are welcome.

So if you have a chance can you remove my comment from the spam box.

@Ginger - I am the LAST person to take advice from on options, having lost copious amounts on 2 separate, completely avoidable instances. But perhaps the pain of someone else's misfortune may help you in being wise.

ReplyDeleteTHETA - unless the options is WAAY in the money (and perhaps even then), the time component erodes and chips away at the price a few cents a day. This adds up. Also, in my experience decay loss is always higher than the calculate theta in one' trading program.

Price volatility works double (or at least MORE) in the opposite direction of your option bet -- calls drop more on equivalent price drops than they rise on the same $ amount of price increase in the underlying.

CD - I have the same problem. If you book 'profits' in cash, and it sits in the bank at 1% and silver goes up 2 bucks - what kind of profits are those? Relates to Ginger's riding out the bump question - but Ginger you have to worry about time to expiry too, right? My solution to the case problem, partially, is to buy gold and silver funds. You can get out easily if you need your money, and while this market tears it seems pretty safe. Safer than plain cash.

ReplyDeletexaritas,

ReplyDeleteHere's another suggestion-sell a higher call for the price you paid for the 37 call, such as a 40. That way, you have your money back and you can still earn more as the spread widens closer to expiration.

@Ginger (pt 2)

ReplyDeletea) the price stays flat thru the weekend -- you lose the decay

b) price dips but corrects back by next Wednesday - you lose decay + don't gain back the FULL amount of the drop, even if SLV goes back to EXACTLY where it had been (or slightly higher).

You can look at this on high volatility days -- the same contract will hit a price on a new high. Great. Then underlying corrects back down, so call drops too. When the underlying goes back again through the same high reached previously -- presto, call is at least a few cents lower than when equity price pierced this level the first time.

Absorbing Jr.-since there is less than 1oz of gold per human on earth odds are value will be much higher when that is all there is.

ReplyDelete"It's becoming critical, Captain! We can't handle it!"

ReplyDeleteWalt,

ReplyDeleteI have a lot of experience trading on margin so starting with $1,000, you could buy $100,000 worth of position assuming 100:1 leverage. At current silver prices, you could buy a bit over 2,000 oz but would be walking the tightrope and would get taken out of your position with a small drop in price.

I lost it all a number of times but finally figured out how to make it work for me and I've done exceptionally well over the past few months. The big drops can be quite scary and costly but to do this successfully, you must not be greedy and have a lot of discipline.

Personally, I follow silver round the clock, (I have a day job too) and read a number of blogs and websites religiously in order to have the best feeling for what's around the corner. I'm not always right but have been right more than wrong for a while now and it's paid off handsomely.

Of course I've benefitted by the huge run we've had over the past few months but I began with silver around $10 and didn't start making a profit until it got to about $25, not including my physical.

If you have any questions, feel free to e-mail me at silverisking@aol.com.

Ah yes, the old break even point strategy. Early on I made a spreadsheet I could plug my opening position into to give me break even numbers. A few times I have stupidly sold my entire position but I've learned to break that habit. I was vague—my real concern is trying to figure out when you are blowing an opportunity to make larger gains in farther out calls by letting your near term options mature. Probably not a question anybody qualitatively other than by saying it comes with experience, so I guess I'll have to look into some of the quantitative theory.

ReplyDeleteEric,

I'll do a write up of our experience with ba-can and put it on my blog.

RObert Leroy

ReplyDeletei dont' think Turd is deleting anything. It's just a blogger glitch. Happens all the time. Keep trying.

@Eric - it's the same guy here (Google changed my profile name to my first name, then locked me out of the account for 'Suspicious activity' and required phone confirmation). She gets the inflation, she buys the groceries and clothes and gasoline. It's the trusting PMs, and specifically silver as a safe inflation hedge that is the stumbling block. Thanks for your thoughts, you are right in that keeping it simple and slow is definitely the winning approach.

ReplyDeleteBro D.,

ReplyDeleteVery cool, thanks.

Ginger,

If you bought around the same time I did you must be looking at pretty large gains as a percentage. At least sell enough to break even on the position and secure a small amount of profit.

@F

ReplyDeleteOk last try and this time very brief.

The dealer/registered inventory, if you are to believe the comex numbers has more than enough silver as of right now and therefore does not need more.

It is also possible that the lease rates are high enough to wait until the last portion of the delivery period to release silver. Lease rates can be found at kitco.

And there is the possibility of a genuine shortage.

Eric:

ReplyDeleteIs that DD your going to do Drunk and Disorderly To the Upside?

The inflation trade is on:

ReplyDeletehttp://www.finviz.com/futures.ashx

Anybody know anything about American gold eagles? I got a lady that is selling a 1/2 ounce AGE under spot. Seems too good to be true. Any ideas how to determine if it's fake? Gonna take a look at it tomorrow

ReplyDeleteCD

ReplyDeleteSince it's a "she" you're working on, one tack you might try is to relate it to jewelry. A lot of women might instinctively understand that good quality jewelry holds it's value. Why would that be? Hmmmm. Then, possibly jump from jewelry to gold and silver coins. A lot of coin shops double as jewlery stores too, so maybe go shopping?

Apologies to the ladies here. Sorry to stereotype, but....

Scottj88,

ReplyDeleteContinue to ride the inflationary wave:

inflationary wave

I follow this analyst and consistently he's been right

zz

ReplyDeletethat's a whole different t-shirt.

I see 1499

ReplyDelete1500

ReplyDelete1500.

ReplyDeleteGood night...

Tomorrow should be fun :)

Let's see if we can hold this! Exciting!

ReplyDeleteBlue Sky,

ReplyDeleteBeen in Orko since last year, with plenty of opportunities for multiple buys points while consolidating. I posted about OK.V here a couple of times, but no one seemed interested. With the clear breakout after a long consolidation, you guessed it, there's nothing but blue sky above! Still a buy on pullbacks below $3, if/when they are presented.

I will shut up now for a little while, but b4 I go, here is a non-TBTF bank offering 2.75% interest on your checking account ($25K max, $100 min) as long as you have 1 electronic transfer in per month and use debit card for 10 transactions (no amount minimum). This used to be 4% as recently as January, but I guess they can't swim against ZIRP forever, and the debit card fee structure underlying is changing. Still better than CDs out there (pun intended).

ReplyDeleteOK Thanks for giving it a shot, Im a little perplexed why they would settle in cash if they have so much silver available.

ReplyDeleteI'm no accountant , but it ain't adding up.

No Turd didn't delete your post it happens a lot on here.It a glitch that's all.

@ swamp fox, lol at least somebody got it !

What will happen to the miners stocks? Will they start chopping off fingers now that they are bleeding on the ground?

ReplyDelete@Ginger,

ReplyDeleteTo build on what CD said about Theta slowly killing the value of your option.

Yesterday's close:

SLV - 43.00

May 21, 2011 SLV 43 Call - 1.86 (32 days away)

June 18, 2011 SLV 43 Call - 2.54 (50 days away)

If the price of SLV does not change, those calls will lose an average of 5-6 cents per day until they expire (slower at first, and more as the expiration gets closer). That is 2-3% of the call's value every day you hold it that is lost to time.

If you think the price of SLV is not going up, or is likely to go down, it is better to sell the call now and wait for better signs to buy it back at a lower price.

Ginger

ReplyDeleteThat Theta gal sounds like a real bitch! Seriously though, when I was kicking this stuff around over the weekend, the horrendous time decay at the end was the reason I was saying I would only be comfortable with longer dated options.

Well, I saw my 1500, now it's gone, so I'll hit the hay.

Man can't live on bacon alone? Shun the nonbeliever!!!

Gold is 1499.90 would somebody go buy a fricking ounce a gold already! only 10 fiat cents off.

ReplyDeleteThanks for the warning, Turd.

ReplyDeleteSwitching from XAG to AUD or NZD tomorrow. Have to front run EE. Will buy the dip after the monkeys hammer PMs. Maybe 30 minutes before Globex closes on Thursday.

SilverisKing,

ReplyDeleteThank you very much for sharing your thoughts. I don't think I'm going to start off with 100:1. With that kind of leverage every 1 PIP would cost me around $2.26 so a 39 cent drop and I'm out. By the way I realized that my calculations were off because I thought that when I was buying, I was buying in $, turns out that it's the amount the COMMODITY you want to buy, not how much $ you want to spend. I'm up 67% in two days though so that's encouraging.

If I have any questions that I can't find answers to online or here, I will definately let you know.

Thank you again.

ScottJ88 will be interviewed on 88.1 FM WMBR MIT Student Radio Wednesday morning at 7am ET if anyone wants to listen in:

ReplyDeletehttp://wmbr.org/WMBR_live_128.m3u

$1500+ didn't hold (so far). My guess is we won't break it and hold it before Wed night / Thurs morning. (I'm staying long in my core gold/silver Comex paper in case I'm wrong).

ReplyDeleteTF, if you are so good, which I know you are, why don't you tell us when silver is going to correct? Obviously fundamentals are behind the current moves but technically that is another story. So here is your moment, lets see what you've got. LOL

ReplyDeleteTIA

Ginger,

ReplyDeleteI will try to answer your question with regard to selling options. Do you understand that options have a time value associated with them? When you are holding options with less than 30 days left to expiration, the value goes down as you approach expiration day. So, if you expect a correction in price it is better to get out with your profit and buy back in after the correction. You can't think in terms of "I can't get back in as low as my original price" because that trade is done and profits locked in. All you have to do is get back in at a price LOWER than what you sold at. If prices correct for 3-4 days next week, and require the following week to get back to where you were before the correction, then you've lost 2 weeks in time value and the options don't pay as generously. Book profits when you get a warning in advance which is as clear as Turd has issued.

""A rally in price from mid-month until about the 22nd. A Cartel-induced selloff for 2-3 days""

ReplyDelete@Bermuda B , do you want a specific hour?

I'm always learning valuable information from the astute contributors at Turd's Towne but - in my own humble opinion, of course - the true pricing of precious metals is mostly to be found on eBay...

ReplyDeleteWhere everyone always stands for delivery!

Ol' Michael

P.S. I swopped some Au for Ag at 68+ SGR but I'm simply holding tight for now...and keeping my eye out for swans.

Ginger,

ReplyDeleteIf you are uncertain, you should hedge your risk. Sell some (or all) and hold some is the best advice.

I don't necessarily agree with the utility of comparing to prior options expiration dates, but I do believe we have had a pretty incredible run here, and I think we are due for consolidation/correction either late this week or early next week. I will tell you what I am doing, but it is almost certainly not what you should do. I am holding May 36 calls at 240% profit, and I sold off 33% of that position today; I expect to sell another 33% before the weekend. I am holding May 38 calls at 110% profit, and I expect to sell 66% before the weekend. I am holding July 38 calls at 100% profit, today I sold 20% of that position, at most I would sell another 20% before the weekend (but likely won't given the other profits I have booked, and the longer term of the contract).

The gist of my strategy is that for shorter term options, volatility can be a killer. I am selling so that I recoup my initial investment and book some of my profits. I will let the rest of the May options ride through some degree of dips, but will probably get out if the contracts drop to the initial price I paid. If I get 100% out, I will not buy back into May options (I hate time decay). As timing dips is hard, I will just hold onto my July options unless SLV drops below $38 or the Fed, Bernanke, or CME change the rules. Barring game changes, I would be happy to purchase some June and July calls if SLV were to correct to around 41ish.

If silver doesn't drop next week, I regret taking some money off the table, but at this point, I think I have more to lose than I do to gain. Regardless of what silver does next week, my guess is that I will be able to buy back into this insane bull market and still make money long on SLV calls.

MHT

Bermuda, I can put you contact with someone who might be able to help you out. she is very good.

ReplyDeleteand made a fortune doing it . Her number is listed on the page .

http://www.youtube.com/watch?v=z6UTxKKhqfk

This comment has been removed by the author.

ReplyDeleterom Rob Kirby:

ReplyDeletehttp://news.goldseek.com/GoldSeek/1303221043.php

"The purpose of this paper is to illuminate the real purpose of the obscene size of derivatives books amongst the world’s largest financial institutions. Derivatives in strategic markets are controlled by governments through proxy banks and agencies using these instruments. By sheer volume, the trading in paper “tails” wag the physical “dogs”. When market volatility negatively impacts these large institutions they are given a pass by regulators and accounting protocols in the interest of national security and preservation of the status quo..."

Sumo here. The CFTC chair is a member of the PPT (http://en.wikipedia.org/wiki/Working_Group_on_Financial_Markets).

As current CFTC chair and PPT member, Gensler will never rein in big silver shorts.

My opinions are derived from being a physical only buyer. So when I buy, it's for keeps. I don't have the luxury of buy/sell/buy/sell especially when you factor in premiums. You all know what I'm talking about. I'm sure most have physical too.

ReplyDeleteBut I say all this to let you know I'm as bullish as you all are long term, but tread lightly when it comes to actually pulling the trigger on buys.

With that said, turn your attention to these GSR charts.

http://goldprice.org/gold-silver-ratio.html

In particular, the last 2 charts of 20 and 36 years. Note the rapid decline of the GSR into the low 30s of now. Now note what looks to be a line of support in this area back in the 1970s. If that was a stock chart, you might consider buying it for at least a dead cat bounce.

Now consider if the GSR is to bounce a little higher from here it will either be because silver trades flat and gold get disorderly to the upside, or both metals fall with silver leading the drop. Given that both metals are at highs, nominal or otherwise, and the GSR is hitting a 30 year low support area, I have to think cheaper prices are coming. Maybe it will last a few days, a few weeks or longer. Don't know. But like I said, I'm a cash buyer, not a trader so I try to pick my spots carefully.

Just throwing this out there and look forward to anyone who wants to comment, support or dismantle this.

(holy crap, is it 1am? bad time to call for a study session)

Prize Fighter,

ReplyDeleteI'll take a shot at you :)

I think 99% of stock traders would not be taking any notice of a line of support that is 40 years old!

By the way, we broke $1,500 again.

whee?

ReplyDeleteand it's a better break this time, as we've made it a full $1 through the barrier :)

ReplyDeleteWell, I could still be right, but it looks like I'm wrong. Unless we get a big raid (which we could) this look like we're on the way to $1521.

ReplyDeleteI'm easy. I'll take it with or without a raid. I'll take it tonight or next week.

Let's see how hungry Europe is for gold.

ReplyDeleteBased on the news, you'd think they'd be pretty hungry.

Turdle, good point! But does 30 year support make it less or more valid?? These macro lines take time and patience to play out.

ReplyDeleteI tend to jinx things around here whenever I post - LOL - and even get deleted sometimes by the Turd, but I haven't checked the silver prices until just now tonight. Looks like we are moving over $45 tomorrow to me, boys and girls. Best of luck to all. I'm in until $50, will re-evaluate at that point.

ReplyDeletePrize Fighter,

ReplyDeletei subscribe to the theory that the older the support (or resistance), the less relevant it is. The whole idea of support or resistance is that traders who bought or sold at such points are likely to use them as a reference point when considering a buy or sell in the future. How many traders from 40 years ago are still trading? I learnt most of my technical analysis from Stan Weinstein's famous book.

thx Turdle. Duly noted.

ReplyDeletePrize Fighter,

ReplyDeleteI should have added that the full name is Stan Weinstein's Secrets for Profiting in Bull and Bear Markets.

Weeeee indeed..

ReplyDeleteBTW. Word variation is : GATORD... is that just coincidence..? I shit you not.

I've been reading up on reviews for brokers and honestly, it seems like there are problems with all the major ones. That's really discouraging to hear that they take opposite positions against clients, demo account have different quotes sometimes from real quotes,etc.

ReplyDeletePailin and anyone else, especially if you are Canadian, that trades XAG and XAU, what has your experience been like with your brokers.

@Walt: Fxpro. Excellent. Based in Cyprus. Sounds dodgy but they are good. Fxpro.com

ReplyDeleteBut if ur Canadian there are probably other options.

Where's correction? What's going on?

ReplyDelete@Thanks for that one, Turd! Won't put my eye away from the screen on the 21st and 22nd ...

ReplyDeleteHere's our first real test of $1500 support. Let's see if she holds. That would be interesting.

ReplyDeleteThe trading volumes are so low it seems the market is moving along on fumes only. LOL

ReplyDeleteIn such conditions the EE or BoS can change anything at the drop of a hat!

the dollar is dropping like a turd in a snowbank

ReplyDeleteShit man! That POSX is stupid sick.

ReplyDelete10.30am ET - Potential Oil / Gold takedown, set your alarms!

ReplyDelete@ Ginger & others, thanking you muchly for your kindness

@Direct: Why will there be a takedown? Is there something I missed earlier?

ReplyDeleteOil inventories are due to be released, the past 2 times this happended, oil was taken down and the algo's sold off gold in sympathy, albeit temporarily

ReplyDelete@Direct: that's excellent heads-up! Thank you!

ReplyDeleteYippee...SALE TIME soon!!! :)

@ Joeka

ReplyDeleteof course there could be less oil than expected and the prices could zoom up. Erring on the side of caution as I'm now resolute to do, I'll lighten up my position and tighten the stops, hoping for a re-entry after any potential madness evaporates...

Powder dry. Ready to lock and load SIR! :)

ReplyDeleteGreat place to see the days potentially disruptive events:

ReplyDeletehttp://www.forexfactory.com/

you can set your time zone by clicking the clock at the top

Thank you. I nearly forgot about this website.

ReplyDeleteRegistered a long time ago but never really used it.

Will refer to it more now. :)

@Ginger

ReplyDeleteHere is something you should probably ponder:

"No one ever went broke taking profits."

EUR/USD heading for 1.45. Watch the POSX keep sliding

ReplyDeleteCiti Techs recommended a EUR/USD short last night and they sold short at 1.4290. Stop loss at 1.439.

Nice trade!

EUR/USD 1.4512

ReplyDeleteI know I shouldn't be shocked at how poorly the USDX is doing...but I can't help but be.

ReplyDeleteSad.

Ginger,

ReplyDeleteGreat Question to ponder and great answers from the group.

As someone who has seen tidy profits in options evaporate very quickly there is nothing I find more painful, I have learned to book em and be happy.

The time answers to your question above are really at the core here. And remember we are dealing with well manipulated market, so expecting anything rational is at my peril I figure.

the expression "Pigs get slaughtered" comes to mind at times like these.

I trade my calls and hold my core of physical ETFs, CEF PHYS and PSLV, no time decay no expiration, for the long haul. I even have those tucked away in a separate account so I am not tempted to get cute. Learned that lesson the hard way as well.

That way even though this morning I am looking at 44.54 and sold my calls into the 44.15 rally last evening "missing out" on more profits. I am happy with my 95% gains on this trading portion and happy to see the higher price adding up through my ETF holdings.

anyway if/when the EE makes a major beat back next week I will have dry powder and wait for General Turd give us the all clear and wave us ahead to buy another round of calls!

My 2cents

Thanks all,

Dmon

USDX 74.5

ReplyDeleteSilver has reached €1000,- per kilo!

ReplyDelete(bullionvault.com)

Come on you $POS just die! Die! Die! already!!! How high does gold need to go to get it to bust all time basement at 70? FUCK!

ReplyDeleteThat is one great post Mr.TF, thank you.

ReplyDeleteClosing in on $45/ounce!

Interesting thesis. I've been aching for a dip to increase my position. I last bought at 42,8 and hoped for 42, but didn't get it. I know silver is ultra bullish right now, but I didn't realize how much. They threw 50000 contracts at it in half an hour and didn't accomplish much.

ReplyDeleteBtw, absolutely monstrous volume, the 185k reading. Have we ever seen volume like that before? Even 100k days have been regarded as high volume lately.

Scott streaming on student radio now:

ReplyDeletehttp://wmbr.org/WMBR_live_128.m3u

Remember when Silver was having touble breaking $44??

ReplyDeleteMorning all! I see somebody was busy overnight!

ReplyDeleteLet's hope the miners wake up and notice the action as well. S&P futures are huge, so the golden combination of metals up and market up may happen today.

kiwiquest

ReplyDeleteCheck: HAMPEX app on my Crackberry ;)

Sold my option that expires tomorrow. over 230% gain, no-one ever went broke selling with profit !

ReplyDeleteGood Morning 1500! Wow - fell asleep to a beat-down, wake up to 1500 and 44.75 - wahoo.

ReplyDeleteScott, listened to I believe the latter half of the interview, well done! And nice shout to to TF & this blog!

ReplyDeleteturd happy

ReplyDeleteAnyone going to sell one third into strength today?

ReplyDelete...didn't think so.

Gold and silver want to go higher.

Get your physical while you can...

Wow. PO$X is a disaster and XAG is hit 44.75. That's plain scary all around. The BERNANK has to play to this publicly with hawkish comments next week post-FOMC, no matter what the truth of the closed door meeting is. PO$X is 36 cents away from possibly gapping down $2. Or bouncing back. Based on FOMC being next week, I see dead cat bounce there, albeit very briefly.

ReplyDeleteOh yes, good morning all. Here's my response to some of the overnight comments...

@Walt

I'm American and use Forex.com. There's no evidence they front-run my trades/positions, but their spread of .06 XAG contracts is pretty rich for them IMO, so maybe they don't need to goose it any extra? Otherwise, I use limit orders to grab lowball buys when I'm away from PC or sleeping and use market orders to buy/sell based on strength of movement ( relative volume) and time of day (EE raids). This means Forex and the world at large don't see me coming with a trade until I execute (or post targets in advance here :)

@e736e346-32cb-11e0-89fe-000bcdcb5194

re: "Remember when Silver was having trouble breaking $44??"

Um. Remember when XAG had trouble holding 37 :) :) :)

That was like 2 wks ago, right?

Sam, thanks for talking about a % gain.

ReplyDeleteI think folk on this blog should stick to this. As we are all in different economic and financial conditions I would like to see peole refrain from talking about dollar gains.

Expressing your gains in % terms achieves the same thing but may prevent those less fortuate from feeling bad if gains are expressed in dollar terms.

Turdle GG

ReplyDeleteI read Stan's book too. We must be fellows "of a certain age". Mostly though, I devoured everything Marty Zweig ever wrote.

Prize Fighter

ReplyDeleteYour points are well taken, but I think this time the fundamentals are different, and way better, for metals than at any time in that 36 year chart.

Holy moly batman usdx is 74.38. Confetti?

ReplyDeleteHey - what happened to gold on the one hour chart there are hours missing between 2:30 and 6ish? A gap to be filled no doubt but was there a halt to trading?

ReplyDeletere: Pailin's trading strategy for 04/20/2011

ReplyDeleteI'm holding very small core XAG position at present. I'll hold this until COMEX busts and numbers on a screen no longer matter. I am happy, very happy that we floated so high overnight. Right now, this position has margin coverage all the way down to XAG $10. I think I'm ok and will not get blown out of it :)

Otherwise I'm aggressively looking for speculative re-entry this morning to clear some quick Benrons (afrum!) before Thurs. close.

Stage 1 - will add at end of pre-COMEX open beatdown (approx. 8:30 am). Beatdown may not even happen today??

Stage 2 - will add more during beatdown pre-10:30 oil numbers (thanks Direct!)

Will hold those buys through day. Depending upon the volume action, may or may not hold specs overnight. Will definitely trim all non-core sometime tomorrow and be very dry for buying next week.

Showing a Netdania XAG high of 44.79. Would be nice to get at least a 20 cent discount off that when I buy :)

Watcher-

ReplyDeleteActually, I'm thinking if the miners in my trading account finally break into the green, I'll sell them off, hold the $ until next weeks mega-dip, back up the wheelbarrow (can't afford a truck yet.. ;-) load up with AGQ, and then sit there, fat, dumb, and happy, til it's time to sell before the big correction comes.

(But my word verification "SUCKUDG" gives me pause for thought..... :-0 )

@ e73

ReplyDeleteI agree about the % gains. It is also more helpful to consider daily and weekly moves in silver in terms of percent instead of dollars. A one-dollar drop today is about the same as a .50 drop last October. that helps me ride the roller coaster with a bit more enjoyment.

Good morning again friends! My goodness, the POSX...I have no words left.

ReplyDeleteLooking good Billy Ray.

ReplyDeleteGonna be a wild day.

Metals, energy, grains, and look at that POSX.

Are we rooting for the dollar to fail? I mean I find myself checking the price of silver constantly, looking at the dollar and thinking its toast. I'm not going to lie I get a little happy. But unfortunately, my happiness is resulting in others pain. I like to think of it as just being happy about making a wise decision, instead of rooting for failure. I mean, I started buying in 2009 at 18 forgot about it until february 2011, and bought like crazy. Since then I have made alot of money. But have I? or Has the dollar just become that worthless in less than 3 months? I hope we rebound and not go down the drain. But every day it's looking more and more like a global problem and eventually we all may have to start over.

ReplyDelete...and what Direct mentioned earlier...watch the Crude Oil inventories release later.

ReplyDeleteTurd,

ReplyDeleteWe got the $109 oil that you were looking for. Looking good, but then so is everything except POSX. I think almost the first time I've ever seen all green on the Equities screen and Commodities screen on the Bloomberg app on my phone (except for China, which was flat today).

I wonder what trick they'll try out this time to slow the descent of the dollar.

perhaps rooting is the wrong word. maybe betting against the dollar is more of what I meant

ReplyDelete