As the month of May draws to a close, just one more note on the premeditated massacre that took place between May 1st and May 17th.

Remember and never forget that the Comex is owned by the CME. A failure to deliver by the Comex would result in a failure and endless lawsuits against the CME.

By the end of April, it was clear to almost everyone actively paying attention that the Comex was failing. To this date, it is still failing. The total amount of available, deliverable silver stands at a record low of 31,000,000 ounces. This number is down from over 100,000,000 ounces just two years ago. In an effort to squelch demand and buy time, a deliberate and premeditated attack of Cartel selling and CME margin increases drove price down nearly 35% in 10 trading days.

Do not believe the nonsense that volatility caused the margin increases. This is not a chicken vs egg argument. The margin increases created the volatility. Period. End of story. The CME "used" the volatility they created to justify a total and unprecedented 5 margin increases in 9 days. Breathtakingly bold manipulation and, when contemplated from a distance, only offers further proof of the desperate situation in which the CME/Comex/Cartel finds itself. The CME's decision today to lower margins on equity futures contracts, despite contrary volatility evidence, proves once and for all their active role in managing our "markets".

http://www.zerohedge.com/article/and-scene-cme-lowers-es-sp-ym-margins

Therefore, we must resist the urge to be complacent and/or overconfident. Yes, The Truth is on our side and, as always, The Truth will win. However, the C/C/C has shown that they will not go down without a fight. Can margins be raised to 100%? Yes. Will they? Who knows? Maybe, and we must be prepared for that and any other eventuality.

In the end, as Santa says, your best option may just be to simply continue stacking your physical. Let traders such as myself guarantee an early grave for ourselves by stressing over the daily machinations. Believe me, you'll have just as much fun following the markets and watching to see if Ole Turd is right again even if you don't have any "skin in the game". Don't be afraid to simply buy physical on every 5% dip and avoid all the other nonsense. You'll be much happier, I can assure you.

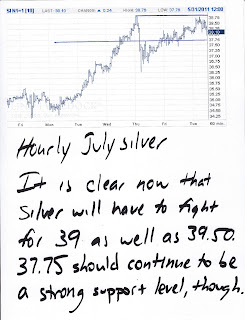

To that end, The Wicked Witch seems obsessed with keeping silver below $39. We've seen this behavior before and it usually ends badly for her. I'm convinced she will lose this battle, too. The fundos are stacked too high in our favor. Silver will soon trade through $39 and then $39.50. Before the month of June ends, I'm supremely confident that it will trade to $43, maybe even $45. Could I be wrong? Of course. Maybe margins will be raised to 200%. Who knows? But, in the short term, gold is strong, crude is up, the euro is rebounding and the dollar is rolling over. This is a recipe for silver strength, not weakness, so keep the faith and let's see what tomorrow brings. TF

Tuesday, May 31, 2011

Our Nascent Ascent

After the 3-day weekend, things are looking quite positive this morning. I know there were a lot of nervous moments back on Friday but those who hung in there have been rewarded today.

As we begin the week, let's start with the dollar. "Calvin" appears to have run his course and now it's just a matter of watching it bounce off of potential support areas. Nearly all bounce buying will be purely technical in nature because who, in their right mind, would be buying on the dollar's fundamentals? Seriously.

The PMs are getting, and will continue to get, a lot of help today from the crude pit. As we've been discussing for the past 10 days or so, once crude got past 101.50, it was going to be clear sailing to 105. Today's action proves that to be correct as I have a last of $103.10, up $2.50. The pace of buying will begin to slow above $104 and selling will emerge as we approach $105. I'd expect $105 to serve as rather significant resistance for a while as, beyond there, it's straight back to $109-110 and our esteemed and supremely qualified president has clearly stated his desire to keep prices down.

Gold continues to climb higher as it builds toward The Wicked Witch's hoped for double top. It made it's first foray into the 1540-45 area overnight and it will continue to ram into that area today. However, just like 1525, 1545 will fall, too, and we will head toward 1560. Beyond there, 1570 awaits and with it, all the firepower that The Cartel can muster in what will be a desperate attempt to paint a double top and convince their shills and disinformation agents to proclaim the long-term bull market in gold to be kaput.

Lastly, here is silver. As if on schedule, it is making its run to $39.50 as we close out the month of May and flip the calendar to June. I expect some tough sledding between 39 and 39.50 but, ultimately, the fundamentals will trump the technicals and silver will once again eclipse 40 and head higher. Our goal before the end of June is still somewhere around $43. Let's call it a range of $42.50-45.00, somewhere in there. Again, I would expect silver to reach that level sometime before "first notice" day of the July contract, which is June 30.

OK, that's it for now. Keep an eye on the headlines today as the Greek "situation" is just another step in the collapse of the Great Keynesian Experiment. Have a fun day! TF

1:00 EDT UPDATE:

Frankly, I'm a little disappointed in myself that I didn't see this coming today. Moving too fast, I guess, and I apologize.

After silver reached 38.85 on Thursday, the Cartel brutally beat it back 36.25. In rallying back, I should have realized that they would cap today near that 38.85 level. Bad Turd. Silver reach 38.77 and the monkeys were unleashed.

From here, let's look for an FUBM. Let's hope it is already underway. If not, another wave down should lead to the area of pretty stout support between 37.50 and 37.75. Either way, I still expect silver to re-group and test 39.50 very soon.

As we begin the week, let's start with the dollar. "Calvin" appears to have run his course and now it's just a matter of watching it bounce off of potential support areas. Nearly all bounce buying will be purely technical in nature because who, in their right mind, would be buying on the dollar's fundamentals? Seriously.

The PMs are getting, and will continue to get, a lot of help today from the crude pit. As we've been discussing for the past 10 days or so, once crude got past 101.50, it was going to be clear sailing to 105. Today's action proves that to be correct as I have a last of $103.10, up $2.50. The pace of buying will begin to slow above $104 and selling will emerge as we approach $105. I'd expect $105 to serve as rather significant resistance for a while as, beyond there, it's straight back to $109-110 and our esteemed and supremely qualified president has clearly stated his desire to keep prices down.

Gold continues to climb higher as it builds toward The Wicked Witch's hoped for double top. It made it's first foray into the 1540-45 area overnight and it will continue to ram into that area today. However, just like 1525, 1545 will fall, too, and we will head toward 1560. Beyond there, 1570 awaits and with it, all the firepower that The Cartel can muster in what will be a desperate attempt to paint a double top and convince their shills and disinformation agents to proclaim the long-term bull market in gold to be kaput.

Lastly, here is silver. As if on schedule, it is making its run to $39.50 as we close out the month of May and flip the calendar to June. I expect some tough sledding between 39 and 39.50 but, ultimately, the fundamentals will trump the technicals and silver will once again eclipse 40 and head higher. Our goal before the end of June is still somewhere around $43. Let's call it a range of $42.50-45.00, somewhere in there. Again, I would expect silver to reach that level sometime before "first notice" day of the July contract, which is June 30.

OK, that's it for now. Keep an eye on the headlines today as the Greek "situation" is just another step in the collapse of the Great Keynesian Experiment. Have a fun day! TF

1:00 EDT UPDATE:

Frankly, I'm a little disappointed in myself that I didn't see this coming today. Moving too fast, I guess, and I apologize.

After silver reached 38.85 on Thursday, the Cartel brutally beat it back 36.25. In rallying back, I should have realized that they would cap today near that 38.85 level. Bad Turd. Silver reach 38.77 and the monkeys were unleashed.

From here, let's look for an FUBM. Let's hope it is already underway. If not, another wave down should lead to the area of pretty stout support between 37.50 and 37.75. Either way, I still expect silver to re-group and test 39.50 very soon.

2:00 EDT UPDATE:

So far a very nice FUBM. This afternoon and evening, watch 38.60. Getting back UP through there should lead to a successful passing of 39 and then on to 39.50. Failing at 38.60 will lead silver back down to a retest of the 38-38.10 area.

Saturday, May 28, 2011

Saturday Charts and The Sunday Night Massacre Revisited

First of all, I've made it clear now that I believe everything from mid-April to mid-May was an orchestrated, manipulative event courtesy of our friends in the bullion banking cartel. I've summarized my feelings here and I stand my opinions and my projections.

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

Along these lines, I found found Ted Butler's consenting opinion via Harvey:

http://news.silverseek.com/SilverSeek/1306416249.php

Harvey also posted a letter to the CFTC from GATA member James McShirley. This is a must-read for those of you who have suspected that the daily price swings around LBMA fixes seem too consistent to be "natural".

And here are some quick, daily charts. My Lind site is down temporarily so I had to use futurestradingcharts. They don't give me much room to write so I will leave much of the interpretation to you. The POSX looks particularly bad and, if you're stocking up on beef, now is the time to do it!

I hope you have a safe and fun weekend. Please try to take a moment to remember all those who have died in the service of their country. TF

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

Along these lines, I found found Ted Butler's consenting opinion via Harvey:

http://news.silverseek.com/SilverSeek/1306416249.php

Harvey also posted a letter to the CFTC from GATA member James McShirley. This is a must-read for those of you who have suspected that the daily price swings around LBMA fixes seem too consistent to be "natural".

Here is a follow up letter sent by GATA member James McShirley to the CFTC:

Dear Sirs, Madams,

This is a follow-up to the letter I sent you last Friday, May 20th. I have subsequently compiled data for all of 2010 regarding the highly suspicious Comex gold trading. In particular, I have focused this time on the London AM and PM fixes. As you probably know the AM fix occurs at 10:30 AM London time, prior to Comex trading. The PM fix occurs at 3:00 PM London time, putting it squarely in the middle of Comex trading hours. Many gold watchers have for years noticed peculiar Comex selloffs into the London close, along with sudden weakness after the London market closes. To see the intensity of Comex selling statistically is rather stunning. Keep in mind this data occurred during a year when gold rose 26.7% y/y. As you will see gold prices rose almost entirely outside of Comex trading hours. The Comex "price discovery" was, and continues to be a one-way street lower. I reiterate that the short seller(s) in suspect are certainly well-funded, HFT savvy, and without care for true price discovery.

Total trading days 254

Trading days PM fix over 2% higher than AM fix ZERO

Trading days PM fix over 1% higher than AM fix 2

Trading days PM fix either lower, or no higher than $5 211 (83.1%)

It should be obvious to anybody with a trained eye for sleuthing that something is badly wrong here. I find it incredible that for all of 2010 only TWO out of 254 trading days resulted in a PM fix higher than 1%. There was an 83% chance of either a lower close, or very minimal gain. This is totally consistent with the trading patterns for the first 5 months of 2011. Since the beginning of 2010 gold has rallied 41.5% without a SINGLE PM fix above +2%, and only 7 above 1%. There is an obvious seller who wants ALL Comex trading days capped at 1%. This is illogical from a trading perspective, and defies all fundamentals, technicals, and news-driven events. I can't imagine a more obvious example of tape painting, and am again requesting you investigate Comex gold trading manipulation in addition to the silver investigation. I realize your tools for identifying manipulation are undoubtedly sophisticated, so you should have no problem modeling the odds of this happening in a free trading environment. It must be so many standard deviations off norm that you will give up counting zeros on the end. The advent of HFT systems has only accelerated the trend of manipulative trading by gold short sellers. Until the CFTC or anybody else decides to crack down I am confident this tape painting will not only continue, but worsen.

Any CFTC ruling (and crackdown) on concentrated short silver manipulation will likely put a chill into the gold manipulators as well. That doesn't mean however, that gold manipulators should be exonerated. The quickest, and only way to restore faith in the U.S. financial markets is to finally prove to investors that manipulators, including short sellers, will be held accountable. That, for many years now, has been nothing more than wishful thinking.

Sincerely,

James C. McShirley

This is a follow-up to the letter I sent you last Friday, May 20th. I have subsequently compiled data for all of 2010 regarding the highly suspicious Comex gold trading. In particular, I have focused this time on the London AM and PM fixes. As you probably know the AM fix occurs at 10:30 AM London time, prior to Comex trading. The PM fix occurs at 3:00 PM London time, putting it squarely in the middle of Comex trading hours. Many gold watchers have for years noticed peculiar Comex selloffs into the London close, along with sudden weakness after the London market closes. To see the intensity of Comex selling statistically is rather stunning. Keep in mind this data occurred during a year when gold rose 26.7% y/y. As you will see gold prices rose almost entirely outside of Comex trading hours. The Comex "price discovery" was, and continues to be a one-way street lower. I reiterate that the short seller(s) in suspect are certainly well-funded, HFT savvy, and without care for true price discovery.

Total trading days 254

Trading days PM fix over 2% higher than AM fix ZERO

Trading days PM fix over 1% higher than AM fix 2

Trading days PM fix either lower, or no higher than $5 211 (83.1%)

It should be obvious to anybody with a trained eye for sleuthing that something is badly wrong here. I find it incredible that for all of 2010 only TWO out of 254 trading days resulted in a PM fix higher than 1%. There was an 83% chance of either a lower close, or very minimal gain. This is totally consistent with the trading patterns for the first 5 months of 2011. Since the beginning of 2010 gold has rallied 41.5% without a SINGLE PM fix above +2%, and only 7 above 1%. There is an obvious seller who wants ALL Comex trading days capped at 1%. This is illogical from a trading perspective, and defies all fundamentals, technicals, and news-driven events. I can't imagine a more obvious example of tape painting, and am again requesting you investigate Comex gold trading manipulation in addition to the silver investigation. I realize your tools for identifying manipulation are undoubtedly sophisticated, so you should have no problem modeling the odds of this happening in a free trading environment. It must be so many standard deviations off norm that you will give up counting zeros on the end. The advent of HFT systems has only accelerated the trend of manipulative trading by gold short sellers. Until the CFTC or anybody else decides to crack down I am confident this tape painting will not only continue, but worsen.

Any CFTC ruling (and crackdown) on concentrated short silver manipulation will likely put a chill into the gold manipulators as well. That doesn't mean however, that gold manipulators should be exonerated. The quickest, and only way to restore faith in the U.S. financial markets is to finally prove to investors that manipulators, including short sellers, will be held accountable. That, for many years now, has been nothing more than wishful thinking.

Sincerely,

James C. McShirley

There is also this, straight to you from the desk of Santa:

Dear Friends, Long speculated upon in our community, the rock and the hard place has finally become a reality. An economy not accelerating at an accelerating rate is declining at an accelerating rate. The mirage of a recovery is getting harder and harder to MOPE about. It simply is not there. We are entering a declining phase that will not end in any kind of a soft landing. Stimulation monetarily, QE, and fiscal are like controlled substances in that the real high is on the first injection. After that, each additional stimulation of an economy must be multiples of the first stimulation in ever increasing size just in order to hold the line. QE3 is guaranteed unless the powers that be want to see a depression that will make the Great Depression look like kindergarten in the pain department. This week we saw a European Bank forced to sell their US mortgage derivatives and the loss was a shocker. These pieces of crap are not worth the digital bits they are written on. Smart money has not let this event pass their view, and know now how broke the US financial system really is. This event broke the camouflage of FASB's selling their souls out to politics by allowing the banks to value their mortgage derivatives at any price the bank wanted on the bank's cartoon balance sheets. The western balance sheets of their financial institutions are raging misstatements. The system is broke. This is why there is no recovery of merit but rather a statistical aberration, which was until recently only holding the line. Here we are at that place we have anticipated for the past 45 years knowing that all the games being played had to play out at that point where super stimulation had no effect and it became totally appreciated that even many trillions of printed money will only impact the currency and not business. The rock and the hard place is a time when the Western World is simply screwed. The risk of not stimulating is stagflation at a spiritual level. The risk of stimulating is stagflation at a spiritual level. The risk of doing nothing is both an economic and currency collapse of biblical proportions. This is what the three illustrations of the skier teach. Should the Fed lose control of this, which is predictable, then currency induced cost push inflation would take gold to Martin Armstrong's $12,500. The odds are 70/30 right now that hyperinflation occurs. That takes gold over $1650. If the odds shift then gold starts a run to balance the International Balance Sheet of the USA and will secure Martin Armstrong's target of $12,500. |

And here are some quick, daily charts. My Lind site is down temporarily so I had to use futurestradingcharts. They don't give me much room to write so I will leave much of the interpretation to you. The POSX looks particularly bad and, if you're stocking up on beef, now is the time to do it!

I hope you have a safe and fun weekend. Please try to take a moment to remember all those who have died in the service of their country. TF

Good Morning

Just a quick note to start your weekend.

When you have 10 minutes or so, please utilize the time to read this guest post from ZeroHedge.

http://www.zerohedge.com/article/guest-post-economic-death-spiral-has-been-triggered

We talk often here about the "end of the Great Keynesian Experiment" and its implications. The missive discusses how and why the "end" will come about. If I, The Turd, had the time, the mental tools and the talent to write something such as this, I would have done it. As it is, this Mr. Long has done it for me.

I'll check in later today with some weekly chart updates that all look very positive.

Have a great Saturday. TF

When you have 10 minutes or so, please utilize the time to read this guest post from ZeroHedge.

http://www.zerohedge.com/article/guest-post-economic-death-spiral-has-been-triggered

We talk often here about the "end of the Great Keynesian Experiment" and its implications. The missive discusses how and why the "end" will come about. If I, The Turd, had the time, the mental tools and the talent to write something such as this, I would have done it. As it is, this Mr. Long has done it for me.

I'll check in later today with some weekly chart updates that all look very positive.

Have a great Saturday. TF

Friday, May 27, 2011

Charting Friday

It's only 8:30 am EDT and I'm already behind schedule. Gonna be one of those days.

However, all signs point to a very good day in our precious PMs. Here are some charts for you to peruse as we head into the morning.

First up, the POSX. Uh-oh. I'm glad I'm not long this pig right now.

In the words immortal (paraphrased) words of Hootie and The Blowfish, "gold's the one I love the mo-o-ost but crude's not far behind".

Those two sure look similar again, don't they?

And silver is still working hard to repair all of the technical and psychological damage done over the past 4 weeks. However, I think it was last Friday when I told you it would approach 39.50 by late May and it's right on track for that so I guess we shouldn't be too disappointed.

Lastly, I've read in the comments that there is some concern regarding holding positions over the 3-day weekend. Recent pattern on 3-day weekends has been for a rally on the holiday, only to have The Wicked Witch immediately claw back the gains on Tuesday for a net effect of zero. No reason to expect different action this time around. Be not afraid.

Oh, and here's a link to that Hootie song simply because I know it's stick in your head now.

http://www.youtube.com/watch?v=1aVHLL5egRY

Have a great Friday!!! TF

p.s.

Lots of talk about "Linda Green" on ZH and in the comments here. If you haven't yet watched this, please take 15 minutes to do so. Really, really disturbing.

http://www.cbsnews.com/video/watch/?id=7361572n

However, all signs point to a very good day in our precious PMs. Here are some charts for you to peruse as we head into the morning.

First up, the POSX. Uh-oh. I'm glad I'm not long this pig right now.

In the words immortal (paraphrased) words of Hootie and The Blowfish, "gold's the one I love the mo-o-ost but crude's not far behind".

Those two sure look similar again, don't they?

And silver is still working hard to repair all of the technical and psychological damage done over the past 4 weeks. However, I think it was last Friday when I told you it would approach 39.50 by late May and it's right on track for that so I guess we shouldn't be too disappointed.

Lastly, I've read in the comments that there is some concern regarding holding positions over the 3-day weekend. Recent pattern on 3-day weekends has been for a rally on the holiday, only to have The Wicked Witch immediately claw back the gains on Tuesday for a net effect of zero. No reason to expect different action this time around. Be not afraid.

Oh, and here's a link to that Hootie song simply because I know it's stick in your head now.

http://www.youtube.com/watch?v=1aVHLL5egRY

Have a great Friday!!! TF

p.s.

Lots of talk about "Linda Green" on ZH and in the comments here. If you haven't yet watched this, please take 15 minutes to do so. Really, really disturbing.

http://www.cbsnews.com/video/watch/?id=7361572n

Thursday, May 26, 2011

The Small Businessman

Man-o-man. This small business stuff is fun but it can sure wear you out. On one hand, it's very cool to make all your own decisions and be responsible for getting things done. On the other, it's exhausting having to make all you own decisions and being the only one who will get things done. Thank you for your patience as this week is a very important one for Mrs F and she requires my attention. I promise that by next week we will return you to your regularly scheduled blogging.

A couple of things...

Having had 12+ hours of hindsight, I'm stunned now at the blatancy of the EE smackdown back at 5:00 am EDT. A brutal, $1.50+ bloodletting courtesy of your friends in The Cartel. From a distance, I was also surprised by my reaction to it. I used to get all strung out and pissed off over such things but now I'm just like, "whatever". It's such blatant criminality and manipulation but no seems to care so why should I? Seriously, the CFTC couldn't give a shit. The SEC looks the other way. Congress passes a law with position limits and the law is simply ignored. You don't like the law? Screw it! Who cares? Ignore it! That's how it works these days in The Land of The Free and the Home of The Brave.

A bunch of interesting "conversations" in the comments section of the previous thread. Please allow me to touch upon a few:

1) I don't know who this "Trinity" person is and, frankly, I don't care. If it comes back, that's perfectly fine with me. It can post whatever it likes so long as it stays within the bounds of decorum we all follow. Never forget that, in the end, this is my blog and I have final say on content. I'm also the one who ultimately gets to judge readers/commenters as either "helpful" or "douchebags". Trinity's initial comment here was deeply into "douchebag" territory and it was labeled as such. If it chooses to participate in the future, it has the opportunity to work to remove that label. Until then, the label sticks.

2) Greek default and euro weakness is not PM negative. Oh sure, maybe on a one-day basis the euro may fall, the POSX may rise and WOPR will sell some PM. However, we are now at the endgame of the fiat currency, keynesian experiment. The number of folks protecting themselves with PM is growing each day. Going forward, all dips will be bought. Maybe not the next day or the next week, but all dips will, most surely, be bought eventually. Count on it.

3) We all disagree from time to time but please try to keep the name-calling and profanity to a minimum. I will disable comments before I allow threads to become the cesspool of pettiness that plagues every other PM blog available today. Got it, you f***ing c**ks***ers? OK.

Now, here are some quick charts. The silver chart has almost completed its FUBM from this morning. It just needs to move now through 37.70 and then it will head back to 38. I've got a last of 37.68 so things are looking up!

I don't recall when but, sometime last week, I told you that gold would struggle to clear 1525 and then pull back to 1515 before mounting a successful, final charge through that level. Lo and behold, looky here! (If it wasn't me that was doing it, I'd swear that this Turd guy was either some kind of witch or a mole/plant of the Evil Empire. The frickin guy is almost kind of spooky sometimes.)

Lastly, the POSX is once again in danger of rolling over like the dog it is. This "calvin" bounce needs to continue higher...and soon...or it will restart it's death spiral and the hounds will be unleashed.

My buddy, Trader Dan, has a better picture and more complete analysis of it. You can find it here:

http://traderdannorcini.blogspot.com/2011/05/us-dollar-running-into-some-selling.html

He's such a nice guy, Trader Dan. Almost everyone else I know is a cynical, dour narcissist like me but not ole Dan. How he's able to remain so pleasant and cheery after all these years of commodity trading is beyond me. You should be sure to read his blog daily.

That's it. I have to head back over to wifey's new store to work on a few more details. Have a great overnight and let's see what tomorrow brings. Fridays before 3-day weekends are always extra exciting.

TF

A couple of things...

Having had 12+ hours of hindsight, I'm stunned now at the blatancy of the EE smackdown back at 5:00 am EDT. A brutal, $1.50+ bloodletting courtesy of your friends in The Cartel. From a distance, I was also surprised by my reaction to it. I used to get all strung out and pissed off over such things but now I'm just like, "whatever". It's such blatant criminality and manipulation but no seems to care so why should I? Seriously, the CFTC couldn't give a shit. The SEC looks the other way. Congress passes a law with position limits and the law is simply ignored. You don't like the law? Screw it! Who cares? Ignore it! That's how it works these days in The Land of The Free and the Home of The Brave.

A bunch of interesting "conversations" in the comments section of the previous thread. Please allow me to touch upon a few:

1) I don't know who this "Trinity" person is and, frankly, I don't care. If it comes back, that's perfectly fine with me. It can post whatever it likes so long as it stays within the bounds of decorum we all follow. Never forget that, in the end, this is my blog and I have final say on content. I'm also the one who ultimately gets to judge readers/commenters as either "helpful" or "douchebags". Trinity's initial comment here was deeply into "douchebag" territory and it was labeled as such. If it chooses to participate in the future, it has the opportunity to work to remove that label. Until then, the label sticks.

2) Greek default and euro weakness is not PM negative. Oh sure, maybe on a one-day basis the euro may fall, the POSX may rise and WOPR will sell some PM. However, we are now at the endgame of the fiat currency, keynesian experiment. The number of folks protecting themselves with PM is growing each day. Going forward, all dips will be bought. Maybe not the next day or the next week, but all dips will, most surely, be bought eventually. Count on it.

3) We all disagree from time to time but please try to keep the name-calling and profanity to a minimum. I will disable comments before I allow threads to become the cesspool of pettiness that plagues every other PM blog available today. Got it, you f***ing c**ks***ers? OK.

Now, here are some quick charts. The silver chart has almost completed its FUBM from this morning. It just needs to move now through 37.70 and then it will head back to 38. I've got a last of 37.68 so things are looking up!

I don't recall when but, sometime last week, I told you that gold would struggle to clear 1525 and then pull back to 1515 before mounting a successful, final charge through that level. Lo and behold, looky here! (If it wasn't me that was doing it, I'd swear that this Turd guy was either some kind of witch or a mole/plant of the Evil Empire. The frickin guy is almost kind of spooky sometimes.)

Lastly, the POSX is once again in danger of rolling over like the dog it is. This "calvin" bounce needs to continue higher...and soon...or it will restart it's death spiral and the hounds will be unleashed.

My buddy, Trader Dan, has a better picture and more complete analysis of it. You can find it here:

http://traderdannorcini.blogspot.com/2011/05/us-dollar-running-into-some-selling.html

He's such a nice guy, Trader Dan. Almost everyone else I know is a cynical, dour narcissist like me but not ole Dan. How he's able to remain so pleasant and cheery after all these years of commodity trading is beyond me. You should be sure to read his blog daily.

That's it. I have to head back over to wifey's new store to work on a few more details. Have a great overnight and let's see what tomorrow brings. Fridays before 3-day weekends are always extra exciting.

TF

Changing Sentiment

Of course you recall earlier this month when all rallies were sold. The PMs could never seem to get any upside traction because rallies were ultimately viewed simply as opportunities to sell at a higher price. These market "sentiments" are very powerful and often difficult to change.

Fortunately, over the past few days, sentiment has shifted back in our favor. Do you recall the big dips of last Thursday, last Friday and Monday? If not, here's a gold chart that can serve as a reminder:

Note the stark contrast to the action from earlier this month. Instead of piling on and driving lower, market participants are now once again looking for support levels that can be bought. We've jokingly referred to these chart formations as FUBMs as if all selloffs were brought about by The Wicked Witch herself, only to have Turdites everywhere rebuff her and rally the victim back above the level at which the assault began.

You can see a pretty, little FUBM forming on today's silver chart. After a waterfall decline that climaxed with $1.03 being taken out in 3 minutes, silver has reversed and is now well off its lows. Earlier this month, such a savage beating would have resulted in additional selling but not today. This is very important. IF we have truly rounded the corner and prevailing sentiment is now back to "buying dips", we can feel even more confident in our purchases and we can also resume aggressive dip buying for a while. Let's watch and see if today's FUBM is taken to completion as this will be a clue.

Unfortunately, that's it for now. Today will be a long day so I may not have another thread for you until later this afternoon. Keep the faith! TF

p.s. And these are for Art Lomax or anyone trading the DAG.

Fortunately, over the past few days, sentiment has shifted back in our favor. Do you recall the big dips of last Thursday, last Friday and Monday? If not, here's a gold chart that can serve as a reminder:

Note the stark contrast to the action from earlier this month. Instead of piling on and driving lower, market participants are now once again looking for support levels that can be bought. We've jokingly referred to these chart formations as FUBMs as if all selloffs were brought about by The Wicked Witch herself, only to have Turdites everywhere rebuff her and rally the victim back above the level at which the assault began.

You can see a pretty, little FUBM forming on today's silver chart. After a waterfall decline that climaxed with $1.03 being taken out in 3 minutes, silver has reversed and is now well off its lows. Earlier this month, such a savage beating would have resulted in additional selling but not today. This is very important. IF we have truly rounded the corner and prevailing sentiment is now back to "buying dips", we can feel even more confident in our purchases and we can also resume aggressive dip buying for a while. Let's watch and see if today's FUBM is taken to completion as this will be a clue.

Unfortunately, that's it for now. Today will be a long day so I may not have another thread for you until later this afternoon. Keep the faith! TF

p.s. And these are for Art Lomax or anyone trading the DAG.

Wednesday, May 25, 2011

The Silver Bullet

Truth be told, only readers of this site would have been confidently buying last week at $34 silver. It is my sincere hope that your faith in me has rewarded you with some nice gains over the past week. We took a lot of grief for the beating The Cartel mercilessly applied earlier this month but we kept our heads in the game and, with the creative use of a little white-out, came up with an actionable game plan.

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

Silver is now being quickly drawn toward $39.50. I'm a bit surprised at how quickly it is getting there as I didn't think it would approach that level until next week. Who knows, it may still wait until then to get there. However, as you can see on the chart below, there is nothing from a technical standpoint that stands in its way.

Gold continues to struggle with 1525 but copper is back above 410 and crude is at 101 so, provided extraneous events don't cause an unforeseen dollar rally overnight, silver should continue to climb toward our short-term goal.

Lastly, I've received several inquiries regarding my current option strategy in silver. In summary, it is this:

1) I bought 2 July $45 calls earlier this month, trying to "catch the knife". Oops.

2) I also bought 2 July $40 calls last week at the actual bottom. Hooray!

3) My stated goal for July silver is somewhere around $43.

4) This means I expect the July $45s to expire worthless.

5) I also expect resistance and a pullback once silver reaches above $39.

6) When silver reaches above $39, I plan to sell a total of 4 July $45s. These are the two I currently own plus two more. Selling 4 July $45s may bring in about $10,000 for my account.

7) I can sell the additional two $45s because I own (long) the two $40s.

8) This creates a "spread" whereby I am long the 40s but short the 45s.

9) This means that, once silver exceeds $45, I no longer make any money.

10) This trade is optimized IF silver closes right at $45.00 on option expiration day in late June.

11) My upside gain potential is now capped. I'll make the same amount of money now if silver closes upon expiration at 45.01, 55.01 or 65.01. It doesn't matter. The most I can make is:

$5000/point X 5 points X 2 contracts = $50,000 total

12) IF silver retreats and closes upon expiry below $40, all of my calls are worthless but I get to keep the $10,000 I received when selling the $45s.

13) IF silver closes upon expiry at $43, the $45s are worthless but the $40s are worth $15,000 each.

$5000/point X 3 points X 2 contracts = $30,000 total

I fear that I just made that about as clear as mud for most of you but I wanted to try.

Again, if you have detailed questions or if you have an interest in opening your own account, here's a link from last year that provides some help.

http://tfmetalsreport.blogspot.com/2010/12/opening-options-account.html

Thanks again for reading. TF

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

Silver is now being quickly drawn toward $39.50. I'm a bit surprised at how quickly it is getting there as I didn't think it would approach that level until next week. Who knows, it may still wait until then to get there. However, as you can see on the chart below, there is nothing from a technical standpoint that stands in its way.

Gold continues to struggle with 1525 but copper is back above 410 and crude is at 101 so, provided extraneous events don't cause an unforeseen dollar rally overnight, silver should continue to climb toward our short-term goal.

Lastly, I've received several inquiries regarding my current option strategy in silver. In summary, it is this:

1) I bought 2 July $45 calls earlier this month, trying to "catch the knife". Oops.

2) I also bought 2 July $40 calls last week at the actual bottom. Hooray!

3) My stated goal for July silver is somewhere around $43.

4) This means I expect the July $45s to expire worthless.

5) I also expect resistance and a pullback once silver reaches above $39.

6) When silver reaches above $39, I plan to sell a total of 4 July $45s. These are the two I currently own plus two more. Selling 4 July $45s may bring in about $10,000 for my account.

7) I can sell the additional two $45s because I own (long) the two $40s.

8) This creates a "spread" whereby I am long the 40s but short the 45s.

9) This means that, once silver exceeds $45, I no longer make any money.

10) This trade is optimized IF silver closes right at $45.00 on option expiration day in late June.

11) My upside gain potential is now capped. I'll make the same amount of money now if silver closes upon expiration at 45.01, 55.01 or 65.01. It doesn't matter. The most I can make is:

$5000/point X 5 points X 2 contracts = $50,000 total

12) IF silver retreats and closes upon expiry below $40, all of my calls are worthless but I get to keep the $10,000 I received when selling the $45s.

13) IF silver closes upon expiry at $43, the $45s are worthless but the $40s are worth $15,000 each.

$5000/point X 3 points X 2 contracts = $30,000 total

I fear that I just made that about as clear as mud for most of you but I wanted to try.

Again, if you have detailed questions or if you have an interest in opening your own account, here's a link from last year that provides some help.

http://tfmetalsreport.blogspot.com/2010/12/opening-options-account.html

Thanks again for reading. TF

The Empty Suits

I just wasted 5 minutes watching Bart Chilton on CNBS. Please allow me to summarize:

1) Politicians now want to delay imposing position limits until January of 2013.

2) Speculators cause prices of commodities to rise.

3) Volatility must be contained.

What an incredible farce this all is. Again, please allow me to summarize:

1) Politicians can't/won't control spending so money is printed and dollar collapses. Rather than accept blame, politicians deflect blame onto rascally, shadowy speculators.

2) Commodity markets, designed as a facility for producers to "forward" sell their products, cannot function without speculators. Just who do you think is buying when the producers are selling? Hmmm? It always takes "two to Tango".

3) Volatility must be contained. While we're at it, maybe Congress can vote to "contain" hurricanes and earthquakes, too. Ridiculous. The very nature of commodity markets is volatility. It cannot be removed or contained. You know it, I know it and they know it but that doesn't mean it's not a good talking point when you're trying to deflect attention from yourself.

The U.S. economy remains stagnant, even after all of the trillions spent purportedly to "stimulate" it. This is complete nonsense and SPIN, too. The Fed has printed and spent trillions in following their dual mandate: prop up the balance sheets of their primary dealers and provide funding for a cash-starved federal government. This will continue, for a while it may not be as overt as POMO but continue it will. As tax revenues continue to decline, where will nearly-bankrupt states and municipalities find cash? With interest rates this low, where will treasury auctions find buyers? No, the printing/creation of dollars will simply continue, whether you see it or not.

This leads us, of course, to gold. Individuals and central banks around the world are increasing their reserves. Why? It is store of value and recognized currency since the dawn of time. Investors are increasingly returning to silver as monetary "insurance", as well. This will continue. No amount of politician or bureaucrat double-speak will change these underlying fundamentals. If you have not already purchased physical metal, the question is why? If currently own metal, the question is why not buy more? If you're truly worried about the price you pay in fiat, keep reading this site and we will guide your way. Likely, the only "financial system" you know is the one that is dead and gone and not coming back. You must prepare for what is to come, the shape and scope of which even I am unsure. Keep educating yourself, however, and you will survive. Learn, trust your instincts and have faith in yourself and you will prosper.

Have a great day! TF

Noon EDT UPDATE:

Led by the ever-resilient crude and surging copper (back above 410), the metals are driving away now from their resistance at 1525 and 36.50. As mentioned above gold looks clear all the way to 1540 or 1545. Silver may meet with some resistance near 38 but that won't keep it now from trading back up to the major 39.50 resistance level. Watch crude closely as a move through 101.50 will set it on a course toward 105 and this will help the metals cause in the coming days, as well.

Just a quick word about the passing of Mark Haines. I've criticized him often mainly because his on-air arrogance often rubbed me the wrong way. He was even worthy of his own turdism "FOAD". However, I was personally interviewed by him on 2 or 3 occasions and I never found him to be hostile or unprofessional. In the end, he seemed like a very nice man and I am sorry to hear of his untimely demise.

1) Politicians now want to delay imposing position limits until January of 2013.

2) Speculators cause prices of commodities to rise.

3) Volatility must be contained.

What an incredible farce this all is. Again, please allow me to summarize:

1) Politicians can't/won't control spending so money is printed and dollar collapses. Rather than accept blame, politicians deflect blame onto rascally, shadowy speculators.

2) Commodity markets, designed as a facility for producers to "forward" sell their products, cannot function without speculators. Just who do you think is buying when the producers are selling? Hmmm? It always takes "two to Tango".

3) Volatility must be contained. While we're at it, maybe Congress can vote to "contain" hurricanes and earthquakes, too. Ridiculous. The very nature of commodity markets is volatility. It cannot be removed or contained. You know it, I know it and they know it but that doesn't mean it's not a good talking point when you're trying to deflect attention from yourself.

The U.S. economy remains stagnant, even after all of the trillions spent purportedly to "stimulate" it. This is complete nonsense and SPIN, too. The Fed has printed and spent trillions in following their dual mandate: prop up the balance sheets of their primary dealers and provide funding for a cash-starved federal government. This will continue, for a while it may not be as overt as POMO but continue it will. As tax revenues continue to decline, where will nearly-bankrupt states and municipalities find cash? With interest rates this low, where will treasury auctions find buyers? No, the printing/creation of dollars will simply continue, whether you see it or not.

This leads us, of course, to gold. Individuals and central banks around the world are increasing their reserves. Why? It is store of value and recognized currency since the dawn of time. Investors are increasingly returning to silver as monetary "insurance", as well. This will continue. No amount of politician or bureaucrat double-speak will change these underlying fundamentals. If you have not already purchased physical metal, the question is why? If currently own metal, the question is why not buy more? If you're truly worried about the price you pay in fiat, keep reading this site and we will guide your way. Likely, the only "financial system" you know is the one that is dead and gone and not coming back. You must prepare for what is to come, the shape and scope of which even I am unsure. Keep educating yourself, however, and you will survive. Learn, trust your instincts and have faith in yourself and you will prosper.

Have a great day! TF

Noon EDT UPDATE:

Led by the ever-resilient crude and surging copper (back above 410), the metals are driving away now from their resistance at 1525 and 36.50. As mentioned above gold looks clear all the way to 1540 or 1545. Silver may meet with some resistance near 38 but that won't keep it now from trading back up to the major 39.50 resistance level. Watch crude closely as a move through 101.50 will set it on a course toward 105 and this will help the metals cause in the coming days, as well.

Just a quick word about the passing of Mark Haines. I've criticized him often mainly because his on-air arrogance often rubbed me the wrong way. He was even worthy of his own turdism "FOAD". However, I was personally interviewed by him on 2 or 3 occasions and I never found him to be hostile or unprofessional. In the end, he seemed like a very nice man and I am sorry to hear of his untimely demise.

Tuesday, May 24, 2011

A Really Good Day

How are you feeling about Turd's #2 now? So far, so good, huh?

Having reached our critical resistance points, both metals rest this evening in important positions. Gold has made it to 1525, even reaching as high as 1529 before being beaten back. We really want it to hold on now. Not that it can't give some back but we don't want to see it move below 1515. Look for it to continue to base overnight around the 1525 level. Maybe as soon as tomorrow, it can make a second assault on 1525-30 and burst through once and for all. Above there, it should only encounter minimal resistance as it heads toward 1545.

Silver is much the same. The Cartel would love to contain it under 36.50 and they may very well succeed as I wouldn't be at all surprised to see it dip back down toward 35.80-36.20 overnight. The buying interest seems significant, however (hello again, BoS?), and it looks like the next trip up near 36.50 will be the one to drive it through. You can clearly see on the chart that very little resistance is indicated between 36.50 and 39.50, other than a little at 38. Let's sit back and see where this takes us over the next 24-48 hours. It should be very interesting.

Unfortunately, that's all the time I have. Sorry. Mrs F's 2nd yogurt store is opening later this week and things are a bit crazy. Thanks for your patience.

For now relax, smile and be happy. We survived the most brutal assault The Cartel has ever amassed and now things are rebounding almost exactly as planned. Truth is winning once again! TF

p.s. It's time for another "Hat Contest"! Please use this thread to enter your guess for the date and exact time (New York time) that silver prints $40.00 again. Contest closes when I start a new thread tomorrow morning. Good luck!!!

Having reached our critical resistance points, both metals rest this evening in important positions. Gold has made it to 1525, even reaching as high as 1529 before being beaten back. We really want it to hold on now. Not that it can't give some back but we don't want to see it move below 1515. Look for it to continue to base overnight around the 1525 level. Maybe as soon as tomorrow, it can make a second assault on 1525-30 and burst through once and for all. Above there, it should only encounter minimal resistance as it heads toward 1545.

Silver is much the same. The Cartel would love to contain it under 36.50 and they may very well succeed as I wouldn't be at all surprised to see it dip back down toward 35.80-36.20 overnight. The buying interest seems significant, however (hello again, BoS?), and it looks like the next trip up near 36.50 will be the one to drive it through. You can clearly see on the chart that very little resistance is indicated between 36.50 and 39.50, other than a little at 38. Let's sit back and see where this takes us over the next 24-48 hours. It should be very interesting.

Unfortunately, that's all the time I have. Sorry. Mrs F's 2nd yogurt store is opening later this week and things are a bit crazy. Thanks for your patience.

For now relax, smile and be happy. We survived the most brutal assault The Cartel has ever amassed and now things are rebounding almost exactly as planned. Truth is winning once again! TF

p.s. It's time for another "Hat Contest"! Please use this thread to enter your guess for the date and exact time (New York time) that silver prints $40.00 again. Contest closes when I start a new thread tomorrow morning. Good luck!!!

Turnaround Tuesday

In a reversal that, once again, leaves The Turd shaking his head, today is the polar opposite of yesterday. Everything that WOPR was discarding yesterday is being repurchased today. It's enough to make you crazy if you let it. This is why, here in Turd's World, we believe in the primary trend and try to buy long-term options only. Trying to outguess the whims of the algos or anticipate Fed-speak MOPE will either bankrupt you or put you in the Nut House...or both.

On the bright side, most everything continues to improve from a technical standpoint. First, take a look at gold. The trendline from Turd's Bottom back in January is still very much intact and it is looking to keep churning higher. As mentioned repeatedly, 1525 is your first hurdle. Through there, gold can move quickly toward 1540 and 1550.

Overnight, silver broke out of the pennant I drew for you late yesterday. The battle at $36 now begins. If you need a refresher on the challenges of that number, read this:

http://tfmetalsreport.blogspot.com/2011/03/clinging-to-36.html

And this:

http://tfmetalsreport.blogspot.com/2011/03/curious-case-of-36.html

Add to that the peaks at $36.50 which you see below and you've got the basis for a gargantuan struggle. Additionally, there is very little to contain silver between 36.50 and 39 so we can all expect quite a fight to keep it below $36.50. Despite the action overnight, I still expect that it will take multiple attempts over several days to finally get $36.50 to fall. If we can pull it off by the end of the week, I'll be very happy. Silver will be right on schedule to go tackle 39.50 by early June and then roll toward 42 or 43 by mid to late June. In case you've forgotten, this was your "roadmap":

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

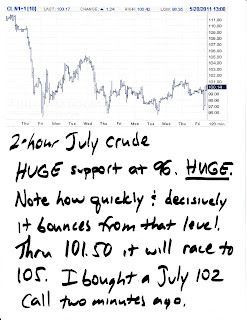

I got all excited about crude late Friday only to have it beaten back sharply before I could even have a cup of coffee on Monday. Well, it looks better today. $96 has held again and, sometime soon, encouraged longs are going to feel confident that their downside is limited so they will aggressively plunge back into this market. A move UP through the trendline will be your first clue. A close above $101.50 will be next and then crude will rush toward $105.

Lastly, physical metal continues to be scarce so I beg you to NOT sell your precious "insurance". If you are worried about falling prices and volatility then, by all means, call up a broker and buy some put options in order to hedge your position. Here's a link to help you with that:

http://tfmetalsreport.blogspot.com/2010/12/opening-options-account.html

I've received several emails lately, mostly from European Turdites, concerning the safety and availability of gold in Swiss accounts. I don't know a lot about that as I'm just a simpleton here in Anytown, USA, but where there is smoke, there is often fire.

http://www.businessinsider.com/jim-rickards-take-gold-out-of-the-bank-2010-12

http://www.shtfplan.com/precious-metals/precious-metals-storage-scam-sorry-delivery-is-not-

possible_04192011

Delays are getting longer and multi-million dollar lawsuits are piling up. If you wait to physically deliver your metal or if you blindly trust in your custodian, I fear you may deeply regret your procrastination.

Physical is physical and paper is paper.

Have a great day. Let's see if we can add to these gains. TF

On the bright side, most everything continues to improve from a technical standpoint. First, take a look at gold. The trendline from Turd's Bottom back in January is still very much intact and it is looking to keep churning higher. As mentioned repeatedly, 1525 is your first hurdle. Through there, gold can move quickly toward 1540 and 1550.

Overnight, silver broke out of the pennant I drew for you late yesterday. The battle at $36 now begins. If you need a refresher on the challenges of that number, read this:

http://tfmetalsreport.blogspot.com/2011/03/clinging-to-36.html

And this:

http://tfmetalsreport.blogspot.com/2011/03/curious-case-of-36.html

Add to that the peaks at $36.50 which you see below and you've got the basis for a gargantuan struggle. Additionally, there is very little to contain silver between 36.50 and 39 so we can all expect quite a fight to keep it below $36.50. Despite the action overnight, I still expect that it will take multiple attempts over several days to finally get $36.50 to fall. If we can pull it off by the end of the week, I'll be very happy. Silver will be right on schedule to go tackle 39.50 by early June and then roll toward 42 or 43 by mid to late June. In case you've forgotten, this was your "roadmap":

http://tfmetalsreport.blogspot.com/2011/05/its-finally-over-now-what.html

I got all excited about crude late Friday only to have it beaten back sharply before I could even have a cup of coffee on Monday. Well, it looks better today. $96 has held again and, sometime soon, encouraged longs are going to feel confident that their downside is limited so they will aggressively plunge back into this market. A move UP through the trendline will be your first clue. A close above $101.50 will be next and then crude will rush toward $105.

Lastly, physical metal continues to be scarce so I beg you to NOT sell your precious "insurance". If you are worried about falling prices and volatility then, by all means, call up a broker and buy some put options in order to hedge your position. Here's a link to help you with that:

http://tfmetalsreport.blogspot.com/2010/12/opening-options-account.html

I've received several emails lately, mostly from European Turdites, concerning the safety and availability of gold in Swiss accounts. I don't know a lot about that as I'm just a simpleton here in Anytown, USA, but where there is smoke, there is often fire.

http://www.businessinsider.com/jim-rickards-take-gold-out-of-the-bank-2010-12

http://www.shtfplan.com/precious-metals/precious-metals-storage-scam-sorry-delivery-is-not-

possible_04192011

Delays are getting longer and multi-million dollar lawsuits are piling up. If you wait to physically deliver your metal or if you blindly trust in your custodian, I fear you may deeply regret your procrastination.

Physical is physical and paper is paper.

Have a great day. Let's see if we can add to these gains. TF

Monday, May 23, 2011

Surviving Monday

Well I don't know about you but I, for one, am glad to have this day behind us. Ever since The Sunday Night Silver Massacre, Mondays have made me very nervous. Things certainly didn't look too rosy this morning with the euro getting crushed, the dollar rallying and WOPR in charge. Fortunately and as hoped, humans reclaimed the market and the metals trended higher virtually all day with both putting rather impressive mini-FUBMs on their intraday charts. With this day behind us, we can begin to look forward toward the rest of this week.

Here's a 2-hour gold chart. It looks very good. You've got the spike down to a panic low of 1462 about 15 days ago. A snapback rally was followed by seven trading days of a beautiful looking base between 1475 and 1515. It now appears to be breaking higher and ready to take its first stab at 1525. Because that level is so technically significant, I have a hard time imagining that it will break through in its first attempt. Maybe some "news" will help it but I think it's more likely to fail at 1525 and then take a day or two to regroup between there and 1515. Then, after that pause, the next attempt at 1525 should carry enough momentum to blast through and send gold on a trajectory to take on 1545.

Silver continues to get its act together but doesn't seem quite ready yet to move as strongly higher as gold. Again, the technical and psychological damage done to the silver market was great and it's going to take a while for enough convicted money to return to move things substantially higher. Nevertheless, the open interest and the CoT report leads us to believe that there should now be more buyers than sellers in the silver market and this alone will help silver firm up and drift higher in the coming days. Where gold has 1525 to conquer, silver has 36.50 so silver clearly has a lot of work to do to catch up.

One last thing, Gonzalo Lira has decided to convert his site to a subscription service. Here's the announcement:

http://gonzalolira.blogspot.com/2011/05/money-in-blogging.html

Given the current, unprecedented economic conditions, those attempting to manage significant portfolios should give his service a look.

Have a great day and evening. More sometime soon. TF

p.s. As you've probably heard, the city of Joplin, Missouri was devastated by a tornado yesterday. They are desperately in need of water and basic supplies. If you can help in any way, here is a link you can follow:

http://www.uwheartmo.org/

You can also donate through the local chapter of the Red Cross:

http://www.redcross-ozarks.org/donate/

If you've ever wondered what it's like to be caught in such an event, watch and listen to this:

http://www.youtube.com/watch?v=cQnvxJZucds

Very sad and tragic.

Here's a 2-hour gold chart. It looks very good. You've got the spike down to a panic low of 1462 about 15 days ago. A snapback rally was followed by seven trading days of a beautiful looking base between 1475 and 1515. It now appears to be breaking higher and ready to take its first stab at 1525. Because that level is so technically significant, I have a hard time imagining that it will break through in its first attempt. Maybe some "news" will help it but I think it's more likely to fail at 1525 and then take a day or two to regroup between there and 1515. Then, after that pause, the next attempt at 1525 should carry enough momentum to blast through and send gold on a trajectory to take on 1545.

Silver continues to get its act together but doesn't seem quite ready yet to move as strongly higher as gold. Again, the technical and psychological damage done to the silver market was great and it's going to take a while for enough convicted money to return to move things substantially higher. Nevertheless, the open interest and the CoT report leads us to believe that there should now be more buyers than sellers in the silver market and this alone will help silver firm up and drift higher in the coming days. Where gold has 1525 to conquer, silver has 36.50 so silver clearly has a lot of work to do to catch up.

One last thing, Gonzalo Lira has decided to convert his site to a subscription service. Here's the announcement:

http://gonzalolira.blogspot.com/2011/05/money-in-blogging.html

Given the current, unprecedented economic conditions, those attempting to manage significant portfolios should give his service a look.

Have a great day and evening. More sometime soon. TF

p.s. As you've probably heard, the city of Joplin, Missouri was devastated by a tornado yesterday. They are desperately in need of water and basic supplies. If you can help in any way, here is a link you can follow:

http://www.uwheartmo.org/

You can also donate through the local chapter of the Red Cross:

http://www.redcross-ozarks.org/donate/

If you've ever wondered what it's like to be caught in such an event, watch and listen to this:

http://www.youtube.com/watch?v=cQnvxJZucds

Very sad and tragic.

Beware WOPR

You know, sometimes the charts can only take your so far. You shut down on Friday and all of the charts look great. Go back and look at my post from Friday afternoon. I was really excited to get back to work on Monday. Then, here comes the old PIIG boogeyman out of the closet and down goes everything. If you know what you're looking for, there are definitely times when the charts can predict the future. Unfortunately, in an era when computer algorithms can be tripped and swayed by simply managing the headlines, you've got to learn to take your lumps and be patient. Today is such a day.

I guess if there's a fundamental "rationale" for today's trade it's this: The global currency structure is going to be dramatically changing. The economic disruption caused by this will be significant. Therefore, sell commodities such as copper and crude but buy gold as a "safe haven" asset. Sounds nice, doesn't it. Sounds perfectly rational. Too bad that's not what's going on. Instead, mindless computers which have been programmed to "buy X and sell Y" at the push of a button are in charge and moving markets. As an example, last evening the grains were all UP about 10 cents on supply and weather concerns...real fundamentals. But that doesn't matter to WOPR. Nope. WOPR see rising dollar. WOPR sell everything.

For today, let's see if humans intervene and begin buying back what the computers sold. IF there is genuine (non-artificial) intelligence in the trade today, established support levels will hold once again and the commodities should turn. Crude looks very firm at 96. DrC should be well-bid between 393-395 and silver should not trade below 34.

Eventually, perhaps even in the not too distant future, today's euro is going to be replaced with a new "Nordic" euro. Then the East Asian nations will all combine to sponsor their own, regional trading currency and the dollar will be left for dead. WHEN this happens, gold and silver will be much, much higher in price than they are today. That doesn't matter much to WOPR, though. WOPR only knows today and, today, WOPR is selling.

More after the close. TF

I guess if there's a fundamental "rationale" for today's trade it's this: The global currency structure is going to be dramatically changing. The economic disruption caused by this will be significant. Therefore, sell commodities such as copper and crude but buy gold as a "safe haven" asset. Sounds nice, doesn't it. Sounds perfectly rational. Too bad that's not what's going on. Instead, mindless computers which have been programmed to "buy X and sell Y" at the push of a button are in charge and moving markets. As an example, last evening the grains were all UP about 10 cents on supply and weather concerns...real fundamentals. But that doesn't matter to WOPR. Nope. WOPR see rising dollar. WOPR sell everything.

For today, let's see if humans intervene and begin buying back what the computers sold. IF there is genuine (non-artificial) intelligence in the trade today, established support levels will hold once again and the commodities should turn. Crude looks very firm at 96. DrC should be well-bid between 393-395 and silver should not trade below 34.

Eventually, perhaps even in the not too distant future, today's euro is going to be replaced with a new "Nordic" euro. Then the East Asian nations will all combine to sponsor their own, regional trading currency and the dollar will be left for dead. WHEN this happens, gold and silver will be much, much higher in price than they are today. That doesn't matter much to WOPR, though. WOPR only knows today and, today, WOPR is selling.

More after the close. TF

Sunday, May 22, 2011

Not Raptured

In looking over the comments from the previous post, I'm not surprised to find that many of our regular contributors are also still here on earth this morning. But seriously, if you are one of those lunatics who blew their entire life savings betting on the end of the world yesterday, what are doing today? I mean, today can't just be another day for you. Are you pissed? Are you hopeful that maybe The Grand Poobah was just off by a couple of days and now today is the day? Maybe tomorrow? Like Art Cashin says: "You never want to go around predicting the end of the world because you're only going to be right once". That's some sage advice right there.

Along those lines, the PM world did not end last week, either, as some would have led you to believe. I'm extremely confident that "Turd's #2" is now set and in. Now we just need to move away from our bases and it looks to me like that is going to happen this week. Here are some hastily drawn weekly charts for you to consider. First up, the POSX. The trend is clearly down. After breaking support at 74, it immediately popped back up. It will now certainly head lower and test 74 again. IF 74 holds, then maybe we can start thinking that the dollar has stabilized but not until then.

Here's a weekly CRB. Note that following the big drop, it has since stabilized and is now heading back up. I'm looking for this to reach back above 660 this week.

Gold looks great and, after a higher close last week, looks ready to move higher still. Like we discussed Friday, I expect a run toward 1525 then a pullback toward 1515 before running higher again toward 1540-45 by the end of the month or early June.

And here is silver which has three, consecutive weekly closes almost right at $35. I find that very interesting and I look for it to close UP this week. Maybe all the way back up toward the 37-38 area.

IF it does, then we'll go tackle the 39-40 area the first week of June.

That's it. Time's up. I hear our overnight guests stirring upstairs so I'd better go make some more coffee. They're going to need it after the night we had last night ;)

Have a great Sunday. I'll try to check in this evening after everything opens. TF

Along those lines, the PM world did not end last week, either, as some would have led you to believe. I'm extremely confident that "Turd's #2" is now set and in. Now we just need to move away from our bases and it looks to me like that is going to happen this week. Here are some hastily drawn weekly charts for you to consider. First up, the POSX. The trend is clearly down. After breaking support at 74, it immediately popped back up. It will now certainly head lower and test 74 again. IF 74 holds, then maybe we can start thinking that the dollar has stabilized but not until then.

Here's a weekly CRB. Note that following the big drop, it has since stabilized and is now heading back up. I'm looking for this to reach back above 660 this week.

And here is silver which has three, consecutive weekly closes almost right at $35. I find that very interesting and I look for it to close UP this week. Maybe all the way back up toward the 37-38 area.

IF it does, then we'll go tackle the 39-40 area the first week of June.

That's it. Time's up. I hear our overnight guests stirring upstairs so I'd better go make some more coffee. They're going to need it after the night we had last night ;)

Have a great Sunday. I'll try to check in this evening after everything opens. TF

Friday, May 20, 2011

Friday Wrap-Up

OK, admit it now. How many of you, at 10:00 EDT and gold at 1488 thought ole Turd was plum crazy with his "1515 by later today or Monday" statement? How many of you were ready to give up on Turd's Bottom #2, also? Faith. We must have faith. The truth is on our side and the truth always wins. (The most notable exceptions being "I did not have sexual relations with that woman" and the OJ trial.)

As we look to wrap up this really wild and significant week, let's begin with a summary of my trading today.

I sold: 2 of my 4 July $7.50 corn calls and my 2 June $1500 gold calls.

I bought: 1 August $1550 gold call, 1 July $40 silver call and 1 July $102 crude call.

For charts, let's start with our two nominations for best supporting actor: copper and crude.

Ole DrC looks great. On this 12-hour chart, you can clearly see a reverse head-and-shoulder bottom. Copper then closed the week above the critical 410 level that had acted as support and then resistance. Closing back above 410 returns it to the support category and copper is now poised to run back toward 420-25. Longtime Turdwatchers know that a recovering copper price will certainly add resilience and excitement to the bid for the PMs.

Now take a look at crude. At this point, it looks like the only thing that can drive crude below 96 would be if those lunatics that are predicting the 2nd Coming for tomorrow are proven correct. Outside of that, the 96 level looks to be about as strong of chart support as your ever going to see. Note that you don't just have rounding bottoms at 96, either. You have sharp, quick reversals off of that level, particularly today. I printed this chart and immediately called Lind-Waldock and bought that July $102 call I mentioned above. It clearly looks like it will go thru 101.50 early next week and, from there, it should move rapidly back to 105.

Gold is still proving to be the champ in the PM arena. For now, silver is still to psychologically damaged to mount a major, sustainable advance. Give it another week or so. Gold, though, looks terrific! $1515 may continue to offer resistance into early next week but, once it falls, gold will scoot toward $1525. It will likely pause there and re-group for a day or two between 1525 and 1515. However, it should then resume its recovery and trade toward 1540-45 by the end of this month.

Lastly, here is silver. The fact that it turned on a dime this morning near $34 and that it couldn't muster additional downside momentum is just another clue that the bottom of this manufactured "correction" is now in. It, too, will dilly-dally and fiddle around a while longer between 34.50 and 36.50 but, once it clears 36.50, shorts will be forced to cover while new buyers rush in. It will spring from 36.50 toward 39 in very short order. I expect this to also happen by the end of May.

Well, that's it. I hope you all have a relaxing and wonderful weekend.

Thanks again for making this the absolute best PM blog on the face of the earth! TF

p.s. A nice, tidy little stack of these came via Fedex today. I was able to purchase them directly out of the PayPal account you into which you all have donated money. I own some GPL stock, too. What a deal!!

As we look to wrap up this really wild and significant week, let's begin with a summary of my trading today.

I sold: 2 of my 4 July $7.50 corn calls and my 2 June $1500 gold calls.

I bought: 1 August $1550 gold call, 1 July $40 silver call and 1 July $102 crude call.

For charts, let's start with our two nominations for best supporting actor: copper and crude.

Ole DrC looks great. On this 12-hour chart, you can clearly see a reverse head-and-shoulder bottom. Copper then closed the week above the critical 410 level that had acted as support and then resistance. Closing back above 410 returns it to the support category and copper is now poised to run back toward 420-25. Longtime Turdwatchers know that a recovering copper price will certainly add resilience and excitement to the bid for the PMs.

Now take a look at crude. At this point, it looks like the only thing that can drive crude below 96 would be if those lunatics that are predicting the 2nd Coming for tomorrow are proven correct. Outside of that, the 96 level looks to be about as strong of chart support as your ever going to see. Note that you don't just have rounding bottoms at 96, either. You have sharp, quick reversals off of that level, particularly today. I printed this chart and immediately called Lind-Waldock and bought that July $102 call I mentioned above. It clearly looks like it will go thru 101.50 early next week and, from there, it should move rapidly back to 105.

Gold is still proving to be the champ in the PM arena. For now, silver is still to psychologically damaged to mount a major, sustainable advance. Give it another week or so. Gold, though, looks terrific! $1515 may continue to offer resistance into early next week but, once it falls, gold will scoot toward $1525. It will likely pause there and re-group for a day or two between 1525 and 1515. However, it should then resume its recovery and trade toward 1540-45 by the end of this month.

Lastly, here is silver. The fact that it turned on a dime this morning near $34 and that it couldn't muster additional downside momentum is just another clue that the bottom of this manufactured "correction" is now in. It, too, will dilly-dally and fiddle around a while longer between 34.50 and 36.50 but, once it clears 36.50, shorts will be forced to cover while new buyers rush in. It will spring from 36.50 toward 39 in very short order. I expect this to also happen by the end of May.

Well, that's it. I hope you all have a relaxing and wonderful weekend.

Thanks again for making this the absolute best PM blog on the face of the earth! TF

p.s. A nice, tidy little stack of these came via Fedex today. I was able to purchase them directly out of the PayPal account you into which you all have donated money. I own some GPL stock, too. What a deal!!

Subscribe to:

Comments (Atom)